It is amazing to see the big dichotomy between the retail investors vs smart investors in viewing the risk of this roaring market. While it seems there is nothing that can stop the uptrend for the market, quietly the smart money is dumping. You may want to see that happened back in early 2020 regarding the divergence just before the epic Feb/Mar selloff. And now the divergence is even more pronounced! Simply unbelievable to me!😵

Per SentimenTrader:

Last month, there was a remarkable jump in the most speculative corners of the market, including leveraged vehicles like options and margin trading, and lottery ticket shares in the form of penny stocks.

The roaming horde of speculators found that niche in December, with more than 1 trillion shares traded. It picked up even more in January and has rocketed even higher so far in February.

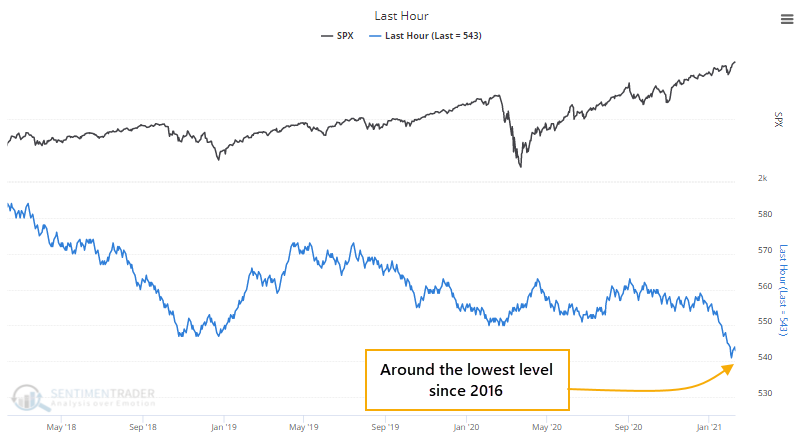

At the same time, all this speculative volume is coming in, the "smart money" seems to be selling. That's based on the admittedly tenuous idea that sophisticated investors wait until the near close of the day to trade. And lately, the last hour has been consistently negative.

Below is a cumulative advance/decline line of last-hour activity that we update daily. If the S&P 500 rises during the last hour, then this indicator adds 1 to its running total; if the S&P sees selling to end the day, then the indicator subtracts 1. We've seen so much last-hour selling lately that this has been hovering near its lowest level since 2016.

Going back more than 25 years, we've never seen so many days with this measure near its lows while the S&P is near its highs.

No comments:

Post a Comment