I was asked whether the market still has the risk for a sizable correction and if yes, for what reasons as the panic due to the short squeeze has passed already.

What this indicator is saying about investors' complacency (by SentimenTrader)

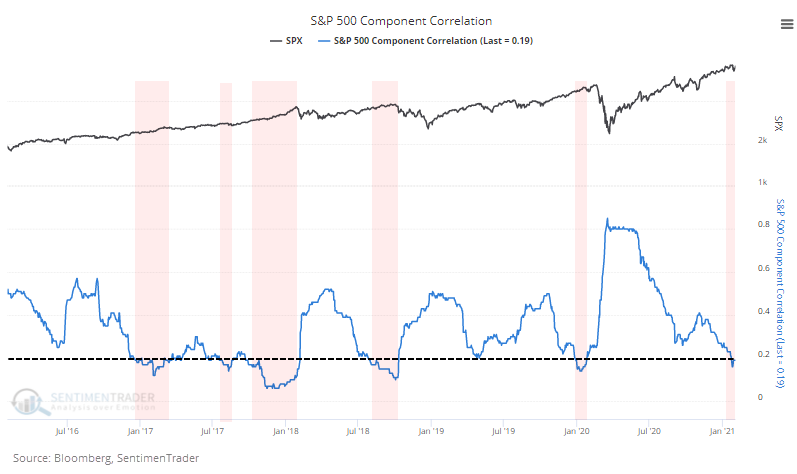

It's a truism of markets, lasting decades if not centuries, that when investors panic, they sell everything together. When they're comfortable, they buy and sell securities on their individual merits.

That's why we see correlations among stocks and other assets rise during times of anxiety and fall during periods of complacency. This is notable now because the correlation among stocks in the S&P 500 has plunged to the lowest level in over a year.

Correlations have gyrated in a wider range in recent years, so we can transform the data series above into a z-score. This compares the current reading to the average over the past year and adjusts for the standard deviation among those readings. This measure dropped below -1.5 in late January and has stayed right around that level.

When the S&P 500 has been at or near a high and the correlation z-score drops below -1.5, the index has had some trouble holding its momentum.

PS:

I have registered as 深山老林 at SafeChat (SC) (You need to download the SafeChat app first) and have set up a new SC chat group. I'm gradually shifting our major social media interactions to SC instead of WC. If you'd like to join my group, sign up a free SC account easily and search for me and connect me as friends. For friends sharing similar conservatism views, let's come together to form a better chatting group that won't be constantly disturbed and harassed by the insane radical censorship!

No comments:

Post a Comment