LEGAL DISCLAIMER Please note everything discussed at this site is a personal opinion of the author and may contain errors or omissions. NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT. It would be your sole responsibility for actions you undertake as a consequence of any analysis, opinion or advertisement on this site.

Total Pageviews

Saturday, May 29, 2021

Bitcoin uses too much energy?

Friday, May 28, 2021

Wisdoms from investing legend

Happy Memory Day!

Share this interview with investing legend Stanley Druckenmiller, who has never had a down year in more than four decades of investing and once compounded at more than 30% annually over 30 years. Here's an overview of the topics he covers:

- What makes a great investor

- How he makes an investment decision

- Whether we are in another tech bubble

- What career advice he has for 20-year-olds

- What he thinks of crypto (bitcoin, ethereum, and dogecoin)

- Which Big Tech firm will be the first to reach a $5 trillion valuation

Here's Druckenmiller on the implications of the "incredible wave of digital transformation":

From 1995 to 2000, you had an incredible wave while the Internet was being built. What you have now is this incredible wave of digital transformation, particularly moving onto the cloud.

I used to say two to three years ago in some interviews that we're in the bottom of the first or second inning in terms of digital transformation. And this is a 10-year runway.

Well, COVID sort of jumped you from the bottom half of the first inning to the sixth inning. I think [Shopify (SHOP) CEO Tobi Lütke] said we went from 2019 to 2030 [in terms of e-commerce sales] in one year.

I think the difference now is if you haven't moved to the cloud, you're dead because who you're competing against, they can just beat you because the technology is so important.

So, now, full disclosure, I didn't see what was coming in 2000. But I [have a difficult time coming up] with a scenario that this digital transformation thing is going to collapse and these SaaS [Software-as-a-Service] companies are going to go away.

The biggest problem you have now is the overall bubble and asset prices. The good news is if we had this conversation two months ago, the good [SaaS stocks] were like 45 times to 50 times sales. Not earnings but sales. They're down to – there's a range – I'd say now 10 times to 25 times sales for the good ones.

So, if the problem is price and – in my opinion – that is the problem: a lot of that has been wrung out. And I think if you hold these names for three to four years, they could easily grow into their valuations.

On which stock might reach a $5 trillion valuation first:

So, before I give my first guess: I have no idea.

If you put a gun to my head or we're going to Vegas:

No. 1 would be Amazon.

No. 2 would be Microsoft.

Google could have a big pop, ironically, if the government breaks them up because their core search business is literally the best business I've ever seen.

But they keep trying all this experimental stuff that challenges shareholder value. But those guys are so rich. They're more interested in changing the world right now and good for them.

On making concentrated, high-conviction bets:

When I've looked at all the investors [that] have very large reputations – Warren Buffett, Carl Icahn, George Soros – they all only have one thing in common.

And it's the exact opposite of what they teach in a business school. It is to make large, concentrated bets where they have a lot of conviction.

They're not buying 35 or 40 names and diversifying.

I don't know whether you remember that Icahn a few years ago put $5 billion into Apple. I don't think he was worth more than $10 billion when he did that.

[In 1992] when I went in to tell Soros that I was going to short 100% of the fund in the British pound against the Deutschmark, he looked at me with great disdain.

He thought the story was good enough that I should be doing 200%, because it was sort of a once-in-a-generation opportunity.

So, [these investors] concentrate their holdings. This is very counterintuitive.

In my thinking, [concentrating your bets] decreases your overall risk because where you tend to be in trouble is if you have 35 or 40 names.

If you start paying attention to one. If you have a big, massive position, it has your attention.

My favorite quote of all time is maybe Mark Twain: "Put all your eggs in one basket and watch the basket carefully."

I tend to think that's what great investors do.

On knowing when to sell and using stop losses:

The other thing to me [that makes a good investor] is you have to know how and when to take a loss. I've been in business since 1976 as a money manager.

I've never used the stop loss. Not once. It's the dumbest concept I've ever heard. [If a stock goes down 15%] I'm automatically out.

But I've also never hung onto a security if the reason I bought it has changed. That's when you need to sell.

If I buy X security for A, B, C, and D reasons, and those reasons are no longer valid, [I sell].

Whether I have a loss or a gain, that stock doesn't know whether you have a loss or a gain.

You know, it is not important. Your ego is not what this is about. What this is about is you're making money.

So, if I have a thesis and it doesn't bear out – which happens often with me, I'm often wrong – just get out and move on.

Because I said earlier: if you're using the most disciplined approach, you can find something else. There's no reason to hang on to any security where you don't have great conviction.

On why he changed his mind and bought bitcoin for the first time:

Fast-forward: I never owned it from like $50 to $17,000. I felt like a moron. Then it goes back down to $3,000 again.

Then a couple of things happened.

So, solution in search of a problem. I found the problem: When we did the CARES act and [U.S. Federal Reserve] Chairman [Jerome] Powell started crossing all sorts of red lines in terms of what the Fed would do and wouldn't do.

The problem was Jay Powell and the world's central bankers going nuts and making fiat money even more questionable than it already had been when I used to own gold.

Then the second thing that happened is I got a call [from billionaire hedge fund manager] Paul Jones and he says, "Do you know that when bitcoin went from $17,000 to $3,000, that 86% of the people [who] owned it at $17,000, never sold it?"

Well, this was huge in my mind. So here's something with a finite supply and 86% of the owners are religious zealots. I mean, who the hell holds something through $17,000 to $3,000? And it turns out none of them – the 86% – sold it. Add that to this new central bank craziness phenomenon.

[A few years pass] and it goes up to $6,000 in the middle of the last spring.

I got to buying some just because these kids on the West Coast are already worth more than I am, and they're going to be making a lot more money than me in the future. For some reason, they're looking at this thing the way I've always looked at gold, which is a store of value if I don't trust fiat currencies.

Then the thing that Paul told me [about the 86%]. Then, the fact that it's been around 13 years. It has become a brand, right? So it's funny. I tried to buy $100 million of bitcoin at a price of $6,200. It took me two weeks to buy $20 million. I bought it all around $6,500, I think.

And I said, "This is ridiculous."

You know, it takes me two weeks [to buy $20 million]. I can buy that much gold in 2 seconds.

So like an idiot, I stopped buying it. The next thing I knew, [bitcoin] is trading at $36,000.

I took my costs and then some out of it and I still own some of it. My heart's never been in it. I'm a 68-year-old dinosaur, but once it started moving and these institutions started upping it, I could see the old elephant trying to get through the keyhole and [it] can't fit through in time.

I own this company called Palantir and I see it announced that it's going to start accepting bitcoin and they may invest it. That's happening all over the place.

And you know, this thing is never going to have more than 21m [units]. It's a fixed supply.

On career advice for 20-year-olds:

The No. 1 necessary condition would be something I was passionate about.

Particularly in the [investing] business, the people [who] love it like me are so addicted to it and so intellectually stimulated by it.

If you're not passionate about it and only in it for the money, you have no chance of competing with these people.

They're going to outwork and out-execute you.

If you're American – and this isn't true for everyone – but you're probably going to spend 60 to 70 hours a week working. If you don't love it, you're going to blow all that time?

That's not going to be great for your happiness quotient.

I was just lucky. I followed my passion. My mother-in-law says I'm an idiot savant, and I wouldn't be good at anything else.

I would do this job for $50,000 a year. I really would. I just, I just love it.

And I hate to see young people get trapped in something.

Thursday, May 27, 2021

If you want Bitcoin rewards credit card

Wednesday, May 26, 2021

Hyperinflation is coming...

Monday, May 24, 2021

Turbulence ahead

There is likely some turbulence coming in the weeks ahead and if it indeed materializes, its impact can be quite broad!

I'm talking about the king of currency, the US dollar. US$ has a rough path in the past two months, after touching a recent high around 93 back in Apr. Since then it has lost about 3% in about 6 weeks. Sounds like nothing, right? Well, in the currency world, this is a lot of move, especially for a major currency like US$ in such a short time period. But right now, US$ is showing a short term bottoming sign based on its TA. The last time the dollar chart showed a similar setup was at the start of the year. The buck rallied about 2% over the next month. We may very likely see a similar kind of rally for the US$ in the next few weeks. If it does, guess what its rally will lead to? You can bet the stock market will not fare too well for a strengthening dollar but more impact will likely be felt in gold, silver, and many commodities! I bet commodities in general will have a tough few weeks ahead.

Having said that, a short-term bounce in the dollar won't change its longer-term trajectory. The bigger picture remains bearish. The Dollar Index is likely to be much lower several months from now. But for the near term, I'm betting for a bearish trend for gold/silver.

Friday, May 21, 2021

Play with volatility

Thursday, May 20, 2021

CDC's scandal secrete

By Jeff Brown

Earlier this month, the Centers for Disease Control and Prevention (CDC) provided guidance on investigating and reporting COVID-19 vaccine breakthrough cases.

A breakthrough case is when someone is fully vaccinated but still contracts COVID-19. It isn't expected to happen a lot. But as the vaccines are not 100% effective, there will be rare cases of this happening.

And the definition of a breakthrough case is if someone is confirmed to have COVID-19 two weeks (14 days) or more after having completed their vaccination.

This is where things get really interesting.

The way that the CDC determines if someone is a breakthrough case is by using a PCR test. These are the very same tests that have been used throughout the pandemic.

But hidden within the CDC guidance is something truly extraordinary. It contradicts the guidance that was used throughout the pandemic from March of last year until early this year.

For breakthrough cases, the CDC specifies a cycle threshold setting of 28 or less.

As a reminder, the cycle threshold is a setting related to how much the RNA from a specimen is amplified as a way to determine if the virus is live and infectious, or simply dead fragments from a previous infection.

Pre-COVID-19, scientific research had shown that cycle thresholds of 26–27 provided a useful indication of a virus being live and potentially infectious. Therefore, the latest guidance for breakthrough cases makes a lot of sense. 28 or less is based on past scientific research.

What's incredible is that throughout the pandemic, PCR tests were used at a cycle threshold of 40. That's more than a million times amplified from what the CDC is guiding for breakthrough cases.

At a cycle threshold of 40, the number of false positives can be in the 60–90% range. That's because it will detect dead fragments of RNA from infections that occurred weeks or even months ago.

Yet this data was used to feed the fear and panic around the explosion in new cases. And it was also used to determine data on COVID-19-related deaths.

This dramatic swing in guidance is not a nuance. It couldn't be more material. The science behind PCR tests and cycle threshold settings was well-documented prior to the outbreak of COVID-19.

Why did the CDC ignore best practices during the pandemic? Why would the CDC determine if someone was "positive" for COVID-19 using settings that simply wouldn't give accurate results?

And why is the CDC now reverting to accurate and appropriate PCR settings for breakthrough cases?

Imagine how different our lives would have been had the CDC stuck with the scientific research and used the same guidance that it is using now for breakthrough cases?

The charts for COVID-19 new cases, hospitalizations, and mortalities would have looked completely different that what we see today. They would have been a fraction of what we witnessed over the last 15 months.

As I wrote earlier during the pandemic, this is a scandal of epic proportions.

Doggy can ride the waves

This week we have witnessed a bloodbath for cryptos and the "People's coin", the doggy coin (Dogecoin) got a haircut and lost value by nearly 50%. There is certainly some panic selling but if you ask me, what's to worry about? The Doggy has an expert skill to ride the rough waves!!😄😜

Image source: People

Now seriously, if you know anything about the history of cryptos, volatility is just part of daily life for it!

Let's use Bitcoin as an example. In its last bull run back in 2016-17, it had experienced at least 6 times of crashes by 30% or more....

So don't sweat a bit if you are serious about Bitcoin. There is a very long way to go to its top.

Having said that, I do feel we are seeing a temporary top for now and we may be entering a consolidating period that may last for months, if not years, in a wide range. I don't feel we will see a breakout to the upside through the recent high of $64000 any time soon. For one reason, there are still too many people eagerly waiting to catch the falling knife. This is usually not the bottoming sentiment. I hope to see widespread outcries and desperation and no one is interested in buying it or even talking about it, then the ultimate bottom is formed. We are far from it!!

Wednesday, May 19, 2021

Welfare for the Rich

Welfare for the Rich

By John Stossel

Congress passed the $2.2 trillion Heroes Act.

House Democrats said it gives money to "governments who desperately need funds."

But it also gives lots of money to people who don't need funds.

Maryland, which even The Washington Post admits is "flush with cash," got enough extra money to pass a budget that "hands bonuses to every state worker."

Even Atherton, California, where the median home price is $6 million, got Heroes Act money.

"There was no means test!" complains Lisa Conyers, author of Welfare for the Rich, in my latest video.

Omni Hotels & Resorts received $68 million in loans. Major airlines got $25 billion in loans from the CARES Act.

"Who wouldn't like to play Santa Claus?" asks Conyers. "Who wouldn't like to just be able to give everybody some money?"

Welfare for the rich didn't start with coronavirus relief bills. Politicians have done it for years, and a pandemic didn't stop them.

Nevada politicians gave Oakland Raiders owner Mark Davis $750 million for a new stadium. A stadium designer says Davis insisted on the very best, including natural grass on a field that "moves in and out of the building in one piece."

Cool. But why didn't Davis pay for it himself?

"I'm not a billionaire," he said.

But he is... The team is valued at more than $3 billion, and Davis and his mom co-own 47% of it.

Politicians screw taxpayers to build stadiums for lots of rich people.

Minnesota gave the Minnesota Vikings $348 million for their new stadium. Santa Clara, California, gave the San Francisco 49ers $114 million, plus $850 million in loans. Team co-owner Denise York and her family are worth $3.5 billion, says Forbes. She ought to fund her own stadium.

"The taxpayers often vote for this stuff," I say to Conyers, "so they must like it."

"They're promised there's going to be all these jobs," she replies, "not only at the stadium but at the hotels that are going to rise up around the stadium."

Politicians always promise that public investment will return more in benefits to taxpayers. But it's not true...

A study by the Federal Reserve Bank of Kansas City found new stadiums bring in about $40 million in jobs and tax benefits, much less than the $188 million that taxpayers pay.

Handouts to other corporations fare no better.

Ohio politicians gave General Motors millions in tax credits to keep its Lordstown plant open. GM then closed the plant. Politicians let GM keep a third of the money.

Wisconsin gave nearly $3 billion in tax breaks to Foxconn because it promised to create 13,000 jobs. Now the company promises to create only 1,454.

"If you look at the cost of each job, it was a million dollars," Conyers points out.

Actually, it was more than a million.

Politicians often justify this corporate welfare by saying, "We didn't give cash, just tax breaks."

But "If some big company is in that town and they are not paying property tax, that means every other taxpayer is covering for them," Conyers points out. "(F)ire departments still have to be paid for. Police departments still have to be paid for. Schools still have to be paid for!"

Then there's the farm subsidy scam.

Both Republicans and Democrats eagerly give your money to agribusiness, even though farmers are now richer than the average American.

The politicians claim the handouts are not a payoff for political contributions but to "make sure there's enough food to go around," since "farmers have no control over price fluctuations and the weather."

But that's absurd. Other businesses adjust to price fluctuations and weather. America doesn't subsidize fruit and vegetable farmers – yet we have plenty of fruits and vegetables.

The politicians claim they want to help "small family farms," but they give 90% of the subsidies to the biggest farms.

Such welfare for the rich persists because, years ago, politicians voted for a handout, and once they start giving your money away, they never stop.

"I'm an American taxpayer," says Conyers. "I don't understand why money is leaving my pocket and going into the pocket of somebody who is wealthy."

Me either.

Green light for now....

Thursday, May 13, 2021

A bubble is still inflated....

This was the note I sent to my chat groups yesterday: "The past few days have been very brutal to bulls but I think it has come to the end of this run of correction. I bet tomorrow we may see a reversal. Right now I think the best speculation is to short volatility."

Well the market indeed rebounded strongly today. Timing-wise I'm lucky but I think the market has a habit to trick people, especially when the TV talking heads are quickly changing their moods from extremely bearish to very bullish. I think the market will cool off, maybe even retest the Wednesday low around 4050. If that level holds then we will see a more sustainable rally. Let's see how it goes. 😜

Now today's topic. Are we in a bubble? Where it all depends on how to define a bubble. According to Investopedia:

"A bubble is a market cycle that is characterized by the rapid escalation of market value, particularly in the price of assets. Typically, what creates a bubble is a surge in asset prices driven by exuberant market behavior. During a bubble, assets typically trade at a price that greatly exceeds the asset's intrinsic value. Rather, the price does not align with the fundamentals of the asset."

And looking at the historical chart below about the epic bubbles in the past, it definitely looks like we are already deep in a bubble. The question is when it is going to burst. Again, it is not if but just when a bubble will erupt as history has demonstrated its fate again and again!

Having said that, "If everyone sees it, is it still a bubble?" As a "contrarian" investor, it is usually when "everyone" is talking about an event; it doesn't happen.

As Mark Hulbert noted recently, "everyone" is worrying about a "bubble" in the stock market. To wit:

"To appreciate how widespread current concern about a bubble is, consider the accompanying chart of data from Google Trends. It plots the relative frequency of Google searches based on the term 'stock market bubble.' Notice that this frequency has recently jumped to a far-higher level than at any other point over the last five years."

You see, the past few days of just a few percentage points of mini crash has already scared many into panic. This is not what we should see for a major bubble being burst. We haven't seen sufficiently high euphoria that fools people into insanity without any fear whatsoever. As such, I think we are just in the process of blowing up the bubble to its extreme state. And we are still yet to see the final Melt-Up phase showing up. Probably we are still quite a few months away from the ultimate top of the bubble. Here is the advice: Don't predict, but be prepared!

Wednesday, May 12, 2021

FED: Wealth Killer

Yes, as we pointed out last week, the Fed has turned investors – both public and private – into active shooters.

In the private sector, they're wasting their ammunition firing away at the Doge... NFTs... SPACs... Tesla... MicroStrategy... GameStop... celebrity sneakers, and other attractive nuisances.

And in the public sector, they're spending trillions on "investments" that are nothing more than boondoggles, bamboozles, and bribes.

Together, they're whacking real investment in real businesses that satisfy real customers and add real wealth to the society.

And here, we offer a single sentence to explain the decline and fall of civilizations: The more time, energy, and resources you spend on things that don't matter, the less you have available for those that do.

So when the Robinhood traders are chasing after the Doge, they're not learning electrical engineering, building houses, or investing in companies that add useful products and services.

Likewise, when the feds announce new programs to redirect $4 trillion down their favorite rabbit holes, they're going to waste a big part of the nation's wealth.

And if trigger-happy "investors" get word of any slowdown in money-printing... public or private... they'll go on a rampage.

Legendary investor Stanley Druckenmiller and his colleague Christian Broda, in this op-ed in yesterday's WSJ, The Fed Is Playing With Fire, called on the Federal Reserve to tighten monetary policy and raise interest rates. Excerpt:

With Covid uncertainty receding fast, and several quarters deep into the strongest recovery from any postwar recession, the Federal Reserve's guidance continues to be the most accommodative on record, by a mile. Keeping emergency settings after the emergency has passed carries bigger risks for the Fed than missing its inflation target by a few decimal points. It's time for a change.

The American economy is back to prerecession levels of gross domestic product and the unemployment rate has recovered 70% of the initial pandemic hit in only six months, four times as fast as in a typical recession.

Normally at this stage of a recovery, the Fed would be planning its first rate hike. This time the Fed is telling markets that the first hike will happen in 32 months, two and a half years later than normal. In addition, the Fed continues to buy $40 billion a month in mortgages even as housing is clearly running out of supply. And the central bank still isn't even thinking about ending $120 billion a month of bond purchases.

Not only is the recovery happening at record speed, excesses of fiscal policy are already visible. Consumers are spending like never before, construction is booming, and labor shortages are ubiquitous, thanks to direct government transfers. Two-thirds of all relief checks were sent after the vaccines were proved effective and the recovery was accelerating. Opportunistic politicians didn't let the pandemic go to waste. Especially after the Trump years, Congress has decided to satisfy its long list of unmet desires.

Isn't the Fed's independence supposed to act as a counterbalance to these political whims?

The emergency conditions are behind us. Inflation is already at historical averages. Serious economists soundly rejected price controls 40 years ago. Yet the Fed regularly distorts the most important price of all – long-term interest rates. This behavior is risky, for both the economy at large and the Fed itself.

Monday, May 10, 2021

Why is Etherum so valuable?

By now I guess you all know Bitcoin regardless if you hold it or not, unless you are from Mars😜. The utility for Bitcoin is very similar to gold, store of value due to its unique nature with limited quantity available and more and more adoption of it globally. Sure there are still high profile people like Buffett, Munger or Yellen etc denying the reality either intentionally or naively due to ignorance of the centurial innovation! Having said that, apart from its monetary utility, there is virtually no other functionality for Bitcoin. That's why you see a lot of other cryptos that have been invented for various utilities. The most famous and well-established one is of course Ethereum. While Ethereum can also be used as money with the feature of store of value, it has evolved into a platform that supports billions of dollars' worth of economic activity.Two major trends are driving this surge of activity: DeFi (decentralized finance) and NFTs (non-fungible tokens). These trends are the core reason for Ethereum's impressive rally and are key catalysts that will propel the Ethereum price to $10,000 and beyond. Of course, I'm not talking about the short term trend but in the long run.

The most important addition was to make the Ethereum network itself programmable. It basically means the Ethereum network can operate as a giant global computer. In particular, it means Ethereum can execute "smart contracts." These are similar to real-world contracts, except the conditions are written in software. The contract executes when the conditions set forth in the contract, using data from a trusted online source called an oracle. This seemingly simple idea is the foundation of almost everything that has been built on the Ethereum platform. More than anything else, it's what makes Ethereum valuable. If you still have a hard time to understand what it means, just think about the Ethereum platform as the Window operation system, on which various applications have been developed that have become the foundation for the morden Internet economy!

"What really changed everything was smart contracts," billionaire investor Mark Cuban said on March 25. "Smart contracts came along, and that created DeFi and NFTs. That's what changed the game. That's what got me excited. That's why it's a lot like the Internet." Cuban made his fortune by selling an Internet-based company he co-founded, Broadcast.com, to Yahoo in 1999.

Over the past year, money has poured into projects built on Ethereum, particularly DeFi. DeFi is a term that describes the use of smart contracts, decentralized exchanges, and special-purpose tokens people are using to perform financial transactions such as borrowing and lending. According to CoinGecko, the total value of financial services associated with DeFi has grown to $140 billion. That may not sound like much compared to the tens of trillions of dollars of value in the global banking system, but DeFi is growing at an exponential rate. The DeFi "market cap" is up more than 550% in 2021 alone. One year ago, it sat at just $3.2 billion, which means the value of DeFi has skyrocketed 4,275% over the past 12 months.

Ethereum's other growth engine, NFTs, has seen a similar rise – most of it concentrated in activity this year. According to the website NonFungible, the value of NFT sales on the Ethereum network rocketed from $94 million in the last quarter of 2020 to $2 billion in the first quarter of 2021. Fueled by NFTs and DeFi, the total value of all transactions on the Ethereum platform was $1.5 trillion in the first quarter – a sum higher than the seven previous quarters combined.

I think these are the reasons why we are seeing some trend divergence between Bitcoin, which is a bit struggling at the moment, vs Ethereum which is making new highs more and more. Don't get me wrong to think that its price will only go up from here. I think the sentiment for it is a bit euphoric and too high. This is often a contrary indicator, suggesting a sizable correction is doomed to come sooner or later. But the point here is that Ethereum has a fantastic long term trend. If you are fortunate enough to have already bought it, especially at a low price, then just keep it and forget about it! It may turn out to be a fortunate for you in a few years from now!!💪😜

Saturday, May 8, 2021

Dying Currencies: A Living Omen

If America thinks the dollar will always be the world's reserve currency and keeps pushing the limits of monetary policies, Daniel reminds us again to look at the U.K.

The British pound lost its top spot as the world's reserve currency nearly a century ago... If we keep spending and borrowing recklessly, the dollar could suffer the same fate.

The Fed and Washington should warn against the siren calls of Modern Monetary Theory, thinking they can print and borrow endlessly. There is, in fact, an end. If you look at the history of money, nearly all empires crumbled because of a monetary disaster... We're looking at you, Rome.

And you needn't be a top player to destroy the purchasing power of your currency... Venezuela, Argentina, Iran, Turkey, Spain, Greece, Portugal, and Italy (before the euro) – all of them did and do what the U.S. is doing now. Prices change by the hour in parts of Latin America...

Furthermore, if we suffer death-by-printing at our own hands, China's there waiting to pounce (as always). The Red Dragon's cementing relationships with African, European, and Latin economies right now, waiting for the American financial system to stumble and hoping for a reality where their money makes the world go round.

The elections of 2022 and 2024 will be critical in the U.S. deciding on America going European or the States sticking to its capitalistic roots.

We need to keep addressing our irresponsible financial policies, folks. We're getting caught up in petty culture wars as our economy is on the verge of imploding. Empires and societies longer-lasting than our own have fallen in similarly dire fiscal circumstances... Just look at a map of Europe to remember the fallen giants.

As a country, we want to avoid this end. As an investor, you want to pick stocks that rise with inflation. In short, fiat currencies are in trouble, and assets like gold and bitcoin have rarely looked better.

If we're not careful, you might have to pay for that next Starbucks Venti with digital yuan.

Trish Regan

Friday, May 7, 2021

The Street darlings are faltering

The ARK Innovation Fund (ARKK) was the Street darlings in the last couple of years and had been vigorously chased up. It soared 150% in 2020... thanks to the performance of Tesla (its largest position, at 10% of the ETF's assets) and stay-at-home stocks like Zoom Video Communications (ZM), Roku (ROKU), and Teladoc Health (TDOC) in its top 10 holdings. But its good time came to the end in Feb this year: after ARKK reached its all time highs in mid Feb, it now trades roughly 31% below its 52-week high due to the poor performance of Tesla and other top 10 holdings. Has it done its job on the slope down? Probably not yet!

As shown below, it has just broken down from the triangle wedge as well as pierced through its 200 DMA long term support line. Its 50 DMA is trending down, poised for a death cross. All these poor TA setups are coming up during the seasonally bearish months. I doubt ARKK will simply bounce back and recover from the loss. We may see another 20% haircut before the final bottom is seen.

Thursday, May 6, 2021

What dose the American Families Plan really mean...

Privacy Destroyed

But then some middle-aged bald fella comes and kicks some sleepy shins. Wake up, he says, it's all a ruse.

You probably didn't catch it - the media was too busy touting all the freebies the president pitched - but the American Families Plan that Biden announced last week had a very sinister aspect to it.

Privacy wonks should freak.

It's why Yellen is out in front of the news this week, acting as if she's just now learning that millions of Americans take advantage of the thousands of loopholes buried in the tax code.

If she really is "shocked" by the news, perhaps she's not the right person for the job.

But we know a well-orchestrated act when we see one. And this is one of the best.

It should be. What's been proposed will have ramifications for generations.

Get this... the president and his troops want to force banks to report "aggregate account outflows and inflows."

It's a way to ensure we're all paying what we're supposed to be paying.

That's huge.

It means your bank won't send the IRS just a 1099 detailing the interest you earned in a year. Oh no... it will send details on everything that goes in and out of your account.

Uncle Sam will know what is in your account, how much you spent and how much you transferred here and there.

If Uncle Sam doesn't like what he sees, the suits will come knocking.

Give a graduation gift to your grandson... you'd better hope you reported it the right way.

Help a child out with a down payment on a home? Sure, it's your money... but you're allowed to gift only so much of it in a lifetime.

Deposit cash from the sale of an old boat... you'd better hope the numbers match up.

It's no wonder Biden wants to "invest" $80 billion into the IRS and its audit army. He knows that for every buck he puts into the tax machine, it will pull $10 into the government's coffers.

It's the next best thing to printing money.

The future is clear.

Washington is broke. It has gotten itself into a pickle. It can't slow spending. It won't cut back. And it's going to have a heck of a time passing any of the recently proposed tax hikes.

But it will find a way to get its money.

Whether it does it by slashing your privacy or taking the cash right out of your paycheck... taxes are on the rise.

Don't worry, though... most folks will likely never even hear about any of it.

Be well,

Andy

Wednesday, May 5, 2021

Will History Repeat Itself?

by Graham Summers

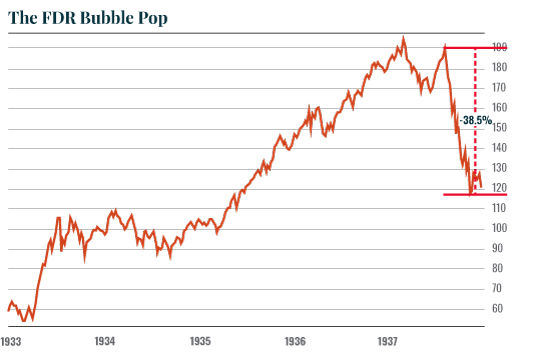

The last two times that inflation ignited as a result of government stimulus/ money printing were during Franklin Delano Roosevelt's New Deal in 1933 and Lyndon B. Johnson's Great Society plans in 1964.

FDR's government stimulus plans occurred in two stages. The first was launched soon after his 1933 inauguration. That ignited a four-month stock market rally. After that, stocks rolled over until FDR introduced new, greater spending programs.

That second round of spending programs triggered a bull market that lasted over two years until inflation reached a boiling point and the Fed was forced to tighten. Stocks promptly crashed roughly 40%.

Bottomline: during the massive government spending programs of FDR, the stock market boomed until inflation was so out of control the Fed was forced to hike rates.

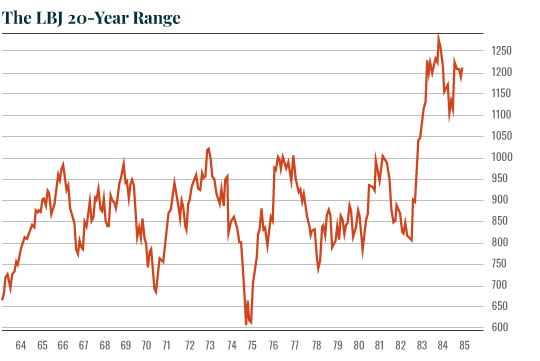

A similar pattern played out during LBJ's Great Society plan in 1964: stocks initially erupted higher on greater spending from 1964 to 1966. They then peaked as inflation entered the financial system and effectively traded sideways for the better part of the next two decades.

So here again we see that stocks love the initial burst in government spending. But the subsequent inflation soon erases those gains.

Food for thought as the Biden administration seeks to mimic FDR and LBJ.

Time tested rules of investing and trading

Although we are likely still in the market Melt-Up phase for the near future, we are approaching fast the next bear market cycle that will be doomed to come after the Melp-Up bubble is burst. It is just when, not if, the time will come. With this in mind, the following investing/trading rules that have been tested times and again are worth noting.

The Rules 1-10

- Common sense is not so common.

- Greed often overcomes common sense.

- Greed kills.

- Fear and greed are stronger than long-term resolve.

- There is no vaccine for being overleveraged.

- When you combine ignorance and leverage – you usually get some pretty scary results.

- Operate only in your area of competence.

- There is always more than one cockroach.

- Stocks have a gravitational pull higher – over long periods of time equities will rise in value.

- Long investing generates wealth.

The Rules 11-20

- Short selling protects wealth.

- Be patient and learn how to sit on your hands.

- Try to get a little smarter every day and read as much as humanly possible – an investment in knowledge pays the best dividends.

- Investors sometimes think too little and calculate too much.

- Read and reread Security Analysis (1934) by Graham and Dodd – it is the most important book on investing ever published.

- History is a great teacher.

- History rhymes.

- What we have learned from history is that we haven't learned from history.

- Investment wisdom is always 20/20 when viewed in the rearview mirror.

- Avoid "first-level thinking" and embrace "second-level thinking."

The Rules 21-30

- Think for yourself – those who can make you believe absurdities can make you commit atrocities.

- In investing, that what is comfortable – especially at the beginning – is most often not exceedingly profitable at the end.

- Avoid the odor of "group stink" – mimicking the herd and the crowd's folly invite mediocrity.

- The more often a stupidity is repeated, the more it gets the appearance of wisdom.

- Always have more questions than answers.

- To be a successful investor you must have accounting/finance knowledge, you must work hard and you have to be keenly competitive.

- The stock market is filled with individuals who know the price of everything but the value of nothing.

- Directional call buying, when consumed as a steady appetite, is a "mug's game" and is often a path to the poorhouse.

- Never buy the stock of a company whose CEO wears more jewelry than your mother, wife, girlfriend or sister.

- Avoid "the noise."

Rules 31-40

- Directional call buying, when consumed as a steady appetite, is a "mug's game" and is often a path to the poorhouse.

- Never buy the stock of a company whose CEO wears more jewelry than your mother, wife, girlfriend or sister.

- Avoid "the noise."

- Reversion to the mean is a strong market influence.

- On markets and individual equities… when you reach "station success," get off!

- Low stock prices are the ally of the rational buyer – high stock prices are the enemy of the rational buyer.

- Being right or wrong is not as important as how much you make when you are right and how much you lose when you are wrong.

- Too much of a good thing can be wonderful – look for compelling ideas and when you have conviction go ahead and overweight "bigly."

- New paradigms are a rare occurrence.

- Pride goes before fall.

Rules 41-50

- Consider opposing investment views and cultivate curiosity.

- Maintain a healthy level of skepticism as you never know when the Cossacks might be approaching.

- Though doubt is uncomfortable, certainty is ridiculous and sometimes dangerous.

- When investing and trading, never let your mind dwell on personal problems and always control your emotions.

- 'Rate of change' is the most important statistic in investing.

- In evaluating the attractiveness of a company always consider upside reward vs. downside risk and 'margin of safety.'

- Don't stray from your investing and trading methodologies and timeframes.

- "Know" what you own.

- Immediately sell a stock on the announcement or discovery of an accounting irregularity.

- Always follow the cash (flow).

- When new ways of earnings are developed – like EBITDA (and before stock-based compensation) – substitute them with the word… "bullshit."

2-Bonus Rules

- Favor pouring over balance sheets and income statements than spending time on Twitter and r/wallstreetbets.

- Always pay attention to what David Tepper and Stanley Druckenmiller are thinking/doing. (Trade/invest against them, at your own risk).

Two most popular questions answered about cryptos

At the annual shareholders meeting in the passing weekend, the vice chairman of Berkshire Hathaway, Charlie Munger, lashed out at Bitcoin again and called it disgusting. I guess I cannot expect too much from a nearly 100 years old man, who is very wise in investing but oftentimes very dumb about new technology and innovations. Just google to see what he said about the Internet back in the early 90s. Something similar to the effect that the Internet just made people feel good but wouldn't have utility and anything good for society at all!

Anyway, after laughing at the ignorance, I think the two questions below are the most asked ones and I have seen the good answers to them. So just share with you. Of course, if you agree with Munger, just pass it.

But let me first share some interesting utility of the joke coin, Dogecoin that I just saw:

We saw that this week when Major League Baseball began selling tickets for Dogecoin (DOGE).The Oakland A's Completes First Ever Dogecoin Transaction

Yesterday, the Oakland A's announced they are selling two-seat pods for 100 Dogecoin (DOGE).

President Dave Kaval tweeted about it, take a look:

***********************************************************************

Won't the government just outlaw crypto?

This is perhaps the No. 1 question I get.

It could. But it won't.

To be frank, the government can outlaw anything it wants. It's certainly tried. But it seems to be ever so slowly learning its lesson that prohibition of things the people want is a bad idea.

So far, several countries have tried to pinch crypto usage, and they've failed. In fact, the only thing they've seemed to do is push demand higher and raise prices even further.

But here's what most folks who ask that question fail to consider...

Very few cryptos are actually working to replace the dollar. The very best coins have real-life functions. They create ways to swap critical data. They allow machines to talk to each other. And they keep contracts honest and unchangeable.

The government has no need or intent to outlaw such useful things.

In my off-centered opinion, it will ban books before it bans crypto. But keep that to yourself... We don't want to give it any ideas.

Aren't cryptos just like buying tulips during the tulip mania?

Nope. At least not with the good cryptos.

The tulip mania was complex - much more complex than how folks talk about it today. But it was largely caused by derivative contracts and the leverage that comes with them.

With many of the contracts, nothing physical was backing them. They'd trade hands, and few folks ever took delivery. The tulips were merely the symbol behind the speculation. The real speculation was finding a fella to sell your contracts to.

If anything, it was more like the 2008 housing mess than what we're seeing with cryptos.

Again, good cryptos are actually backed by some utilitarian purpose. They're doing something and have some intrinsic value. Those are the ones you want, and there are plenty of them.

Stick to those... and don't let unfounded comparisons keep you out of a strong moneymaking opportunity.

By Andy Syder

Monday, May 3, 2021

拜登在撒谎!加税就是冲中产阶级来的

日前,美国媒体《华盛顿检察官》发表社论文章,抨击拜登企图用虚假的话语欺骗大众,让人们相信他的加税计划是针对富人阶层的。然而,拜登措施真正打击的目标却是广大的中产阶级。拜登自己很清楚的知道这一点,但他却一再用谎言为自己的行动找借口。

文章说,拜登一次又一次地坚持称,他只会对年收入超过40万美元的人加税。但他从来都不是那个意思。他只是希望如果他藏的够深,那么中产阶级和新闻媒体就不会注意到加税。

事实上,拜登一直有针对中产阶级的税收增加计划,以支付自己的大量自由资金花费和联邦政府的大规模扩张。尽管如此,拜登仍试图隐藏它们。

提高公司税率就是一个很好的例子。美国国会及前总统川普通过《减税和就业法案》,使美国公司税率下降到了具有全球竞争力的21%,与富裕国家的平均水平相当。拜登却希望将其提高到28%,并对大公司的账面收入征收至少15%的税,从而禁止了许多税收抵免。

加上美国的州所得税,拜登让大多数美国公司面临着所有经济合作与发展组织和G-7国家当中的最高的税率。

而实际上,企业并不支付税款,他们只是负责收集税收。向公司征税就是向人征税,而这些人就是客户、股东和雇员。

税务基金会Tax Foundation估计,拜登的公司加税措施将削减159,000个工作岗位、平均降低0.7%的工资,那将伤害最底层的五分之一工人,他们的税后收入将减少1.45%。同时,价格可能会上涨,而退休账户里的钱比其它情况要少。

这实际上就是对中产阶级的加税。中产阶级才是钱袋子所在。在欧洲和美国,中产阶级家庭比富裕家庭更多。如果拜登想为自己的计划付帐,或者想遏制他向经济注入数万亿美元所带来的通货膨胀的影响,那么他就要敲中产阶级的竹杠。