Well, the whole market has been misled by the Washington political show today. Traders thought a deal was almost done and would come to fruition tonight. So some sort of euphoria was prevailing towards the end of the trading. But exactly at one minute before 4 pm when the market was closed for 2012, the news was broken out that no deal would be made today but there was no time for people to dump stocks. I think a revenge will hit the market on Jan 2, 2013, the first day of trading in 2013 and let's be ready for the a severe sell off in 48 hours, unless some sort of miracle occurs that they strike a deal on Jan 1, 2013. But I'm almost sure now that a deal will come very soon, if not by Jan 2, to revert the fiscal cliff. So to me a market crash is likely a good buying opportunity. We will see.

Happy New Year!

LEGAL DISCLAIMER Please note everything discussed at this site is a personal opinion of the author and may contain errors or omissions. NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT. It would be your sole responsibility for actions you undertake as a consequence of any analysis, opinion or advertisement on this site.

Total Pageviews

Monday, December 31, 2012

Sunday, December 30, 2012

An out of box way to ride the aging megatrend

What is the sure thing in one's life? Not many but one thing is sure for everyone, that is, everyone will eventually die, unfortunately. I guess with this question you can guess what I'm going to talk about regarding the aging trend. No question that the world is facing a very significant megatrend that the population is becoming more and more aging, especially in the developed world including the US. Of course there are many companies involved in serving the elderly population but what I'm talking today is something not many people will think about in terms of investment, the funeral service industry. Well, let's face it. If the population is aging and the baby boomers in the US have mostly come to the elderly age range (over 65 years), it is inevitable that more and more people will come to the end of the life; in turn the funeral services will be demanded more and more. Actually death in America is a $15 billion a year industry, which includes funeral homes, crematoriums, and cemeteries. The average cost of a funeral is about $8000. Around 2.5 million people die every year in the US. That's why it is wise to also include some good death companies' stocks in your portfolio if you want to ride the aging megatrend.

Hillenbrand, Inc. (HI) is a global diversified industrial company that makes and sells premium business-to-business products and services for a wide variety of industries. But its leading products are funeral related products and it is the leader in the North America in this industry. HI sells 45% of caskets in the US, which amounts to 800,000 of the 1.8 million caskets sold in the US each year.

In addition to this, the company sells cremation containers and urns. All of Hillenbrand’s funeral products are sold under their Batesville Casket Company brand, which was founded in 1906.

HI at $22 is reasonably priced with a PE at 13. It is apparently at its uptrend, which I believe will continue. After all, death will occur regardless in what economic situations, good or bad. I'm especially more interested in its good dividend yield at around 3.5%. I have already added it into my portfolio and may add more if the overall market corrects to bring it down as well.

Hillenbrand, Inc. (HI) is a global diversified industrial company that makes and sells premium business-to-business products and services for a wide variety of industries. But its leading products are funeral related products and it is the leader in the North America in this industry. HI sells 45% of caskets in the US, which amounts to 800,000 of the 1.8 million caskets sold in the US each year.

In addition to this, the company sells cremation containers and urns. All of Hillenbrand’s funeral products are sold under their Batesville Casket Company brand, which was founded in 1906.

HI at $22 is reasonably priced with a PE at 13. It is apparently at its uptrend, which I believe will continue. After all, death will occur regardless in what economic situations, good or bad. I'm especially more interested in its good dividend yield at around 3.5%. I have already added it into my portfolio and may add more if the overall market corrects to bring it down as well.

Saturday, December 29, 2012

My "crystal ball" for the last day of 2012

Well, it has been a very volatile week before the final year end. Overall the market has been under quite some pressure due to no action from Washington for the fiscal cliff. While I don't have a crystal ball for what may happen on Monday, I do have some gut feelings about what could happen. It again all depends on how the saga in Washington will play out. If a deal is announced before the end of the trading in the last day of the year, then the market will likely shot up dramatically, a kind of relief rally. But more likely I think there is no deal announced when the market is closed, and we could see some significant plunge of stocks. This will serve as a warning sign for the politicians, who will then reach a deal before the mid night of Dec 31, 2012. If this is the scenario, then Jan 2, 2013 will meet you with a huge rally. Anyway, no one can tell you for sure what will happen. It is anyone's guess at the moment. Personally I hope some sort of market crash will come, which will give me a better chance to buy what I like.

Friday, December 21, 2012

S&P plunged 1% today

What a timing! It was almost that the market was whispering at my ear last evening that it was going to go down sharply today. Just kidding. Well, this is exactly something I have been thinking and expecting: extreme volatility in the last week of the year. Barring anything dramatic happening over the weekend, I think next Monday will be a bouncing back day for the markets, followed by more volatility after the Christmas break. If you would like to speculate, this is the best time for day traders and you may be able to make quick profits within hours if you are nimble enough and of course also right at the direction of your trading. I happened to take a day off today and in the early afternoon I took a shot with a small trade for Microsoft when it was sold off hard. Well, by closing, my position had come up 50% already. Not a shabby trade in any sense that just took a few hours. But always be aware that this is rather risky trading and don't bet too much with your money.

Thursday, December 20, 2012

How may the market behave the last week of 2012?

About 3 weeks ago, I said to expect a year end rally. Well, we have definitely got the rally. If it were a normal time, I'd think this rally may simply go ahead without much interruption into the new year. But this is not a normal time. With the ongoing Washington drama playing out regarding the so-called fiscal cliff, the market is very much like a schizophrenic patient, which can be up and down with a heart beat. But until now, the market is amazingly holding up well in the very unstable time period. What I'm thinking may likely play out is that the deal may not come till the very last minute, just like last time the two parties' fight for the budget ceiling. If this comes true, very likely the market will plunge significantly next week, the last few days before the year end. This drastic drop of the stock market may become a warning sign for the Washington politicians, who will then be under a huge pressure to finally get the deal done. In other words, I still think the fiscal cliff deal will still be made but at the expense of a significant market correction. However, this kind of correction may be a great buying opportunity.

Just a quick word about gold. It has plunged for a few days quite dramatically. Now it has broken through its 200 day moving average around $1650. This usually mean further decline will ensue. I think it may come down to around $1600 and if it does, it will be a great buying opportunity. I'm excited for this kind of opportunity.

By the way, we are moving this weekend. So likely I won't have time to write anything over the weekend. Wish you all a very Merry Christmas!

Just a quick word about gold. It has plunged for a few days quite dramatically. Now it has broken through its 200 day moving average around $1650. This usually mean further decline will ensue. I think it may come down to around $1600 and if it does, it will be a great buying opportunity. I'm excited for this kind of opportunity.

By the way, we are moving this weekend. So likely I won't have time to write anything over the weekend. Wish you all a very Merry Christmas!

Tuesday, December 18, 2012

Bite APPLE again

I was definitely too early to jump for Apple (AAPL). I started to establish my AAPL positions when it plunged from $700 to $600. A bad timing! When AAPL was over $700, everyone was excited about it and talking about $1000 Apple. You could hardly find any analyst who was bearish about AAPL. Now, AAPL is flirting with $500 per share; it dropped below $500 briefly yesterday. Suddenly you can hardly find any analyst who is bullish about AAPL. People are simply running away from it. What a few short months can change of everyone’s opinion. I’m just amazed!

I don’t know if this is the bottom for AAPL or not and I’ll certainly not be surprised if AAPL continues to decline for a while. But let’s face it. AAPL is fundamentally cheap in terms of its valuation (P/E is just 11 times its past year earnings for such a great company) and AAPL has a huge pile of cash (over $100 B) in hands. Although AAPL is facing more and more competitions, I don’t think AAPL is suddenly losing its edge over its competitors. At some point, value investors will step in to pick up AAPL. I’m starting to craft my plan to get into AAPL again by forcing others to pay me while I’m waiting for buying AAPL at $400. I just cannot believe no one will be interested in AAPL if it indeed plunges to $400, another 20% drop from the current price. Of course, I’m not predicting AAPL will go to $400, but just a worst case scenario for myself that I will have to buy AAPL at that low level if the Apple world is totally crashed.

I don’t know if this is the bottom for AAPL or not and I’ll certainly not be surprised if AAPL continues to decline for a while. But let’s face it. AAPL is fundamentally cheap in terms of its valuation (P/E is just 11 times its past year earnings for such a great company) and AAPL has a huge pile of cash (over $100 B) in hands. Although AAPL is facing more and more competitions, I don’t think AAPL is suddenly losing its edge over its competitors. At some point, value investors will step in to pick up AAPL. I’m starting to craft my plan to get into AAPL again by forcing others to pay me while I’m waiting for buying AAPL at $400. I just cannot believe no one will be interested in AAPL if it indeed plunges to $400, another 20% drop from the current price. Of course, I’m not predicting AAPL will go to $400, but just a worst case scenario for myself that I will have to buy AAPL at that low level if the Apple world is totally crashed.

Monday, December 17, 2012

Is it time to bet for Japanese stocks?

Japanese yen lost ground but the Japanese stock market jumped 2% higher overnight. Why? Because the liberty party led by Abe won the election although widely expected. So why it is so special with his win? Because Abe’s plan is to double Japan's inflation goal from 1 to 2% and to provide unlimited easing in order to try and stimulate economic growth. In a plain word, he is going to print unlimited money to try to dig Japan out of the deflational hole, an economic nightmare for Japan for the past 20 years, so-call Japan’s lost 2 decades. So will money-printing really promote growth? Not a chance in the long run; otherwise every county can simply print money to prosperity. But this is usually a great opportunity for traders to expect high stock prices in the short run. After all, Japanese stocks have lost ground for 2 decades and valuation wise, they are very cheap now. Any stimulus will likely have a positive impact on stock prices for a while.

For aggressive traders, EZJ, a leverage ETF, may be a way to play with this uptrend. However, I probably won’t jump into it right away. It has been in a range bound in $48-56 in the past half a year. If indeed the Japanese stocks are immediately going up with the prospect, EZJ should break upwards through $56. If that happens, there is much better chance that it will go up further with more momentum. Otherwise, it may first drop a bit towards its low boundary at $48, which should be a strong support. Buying at that price will give you a much better chance to be profitable.

For long-term players, a Japanese SmallCap dividend ETF, DFJ, will be a much safer bet. It is cheap (P/E at 12), in an uptrend, and paying good dividends at 4.0%. I don’t think there is much risk for this one.

For aggressive traders, EZJ, a leverage ETF, may be a way to play with this uptrend. However, I probably won’t jump into it right away. It has been in a range bound in $48-56 in the past half a year. If indeed the Japanese stocks are immediately going up with the prospect, EZJ should break upwards through $56. If that happens, there is much better chance that it will go up further with more momentum. Otherwise, it may first drop a bit towards its low boundary at $48, which should be a strong support. Buying at that price will give you a much better chance to be profitable.

For long-term players, a Japanese SmallCap dividend ETF, DFJ, will be a much safer bet. It is cheap (P/E at 12), in an uptrend, and paying good dividends at 4.0%. I don’t think there is much risk for this one.

Friday, December 14, 2012

Berkshire Hathaway is still cheap

Everyone in the investment world knows Warren Buffett, the most successful investor of all time. His company, Berkshire Hathaway (BRK-A & BRK-B), is traded at $134,000 per its A share and its B share is 1/1500 of it at $89 per share. Do you believe if I say BRK is still very much undervalued at this huge unit price? Indeed, it is still very cheap, believe or not. It is estimated that BRK is roughly 25-30% discounted against its intrinsic value. No one knows its value better than Buffett. He certainly sees the great value of his own company at this cheap price, so he is aggressively buying his own company stocks. In 2011, Buffett announced that he would buy BRK up to 110% of its book value. Just a couple days ago, he raised his buying price to 120% of its book value. This basically puts a floor for the BRK price, since Buffett will buy and therefore support the stock price if it drops below its book value. At the moment, BRK's book value is $112,000 for A shares, or $74for B shares. So its share price is right at around 1.2 times its book value. So you should expect that BRK share price would not drop too much below this level with Buffett's buyback power behind the curtain.

Examining the BRK long term chart suggests some pattern of its price movement. Excluding the exceptional turmoil times of the past 15 years (2000 & 2009), BRK has been quite stable: it is generally around certain level for a few years and then this level is broken through and raised. BRK-B was narrowly traded at around $50 roughly in 2001-2003, then at $60 between 2004-2006, and recently at $80 in 2009 till early 2012. This reflects its increasing book value translated into its increasing share price. Looks like at the moment BRK is again breaking through its range now, which should mean a higher price of Berkshire Hathaway in the next few years.

Examining the BRK long term chart suggests some pattern of its price movement. Excluding the exceptional turmoil times of the past 15 years (2000 & 2009), BRK has been quite stable: it is generally around certain level for a few years and then this level is broken through and raised. BRK-B was narrowly traded at around $50 roughly in 2001-2003, then at $60 between 2004-2006, and recently at $80 in 2009 till early 2012. This reflects its increasing book value translated into its increasing share price. Looks like at the moment BRK is again breaking through its range now, which should mean a higher price of Berkshire Hathaway in the next few years.

Thursday, December 13, 2012

Why plunging Freeport hasn't shaken me out

Two weeks ago, I talked about the coming shortage of copper and 2 companies which you might consider to buy to ride the uptrend. Indeed the copper's price is going up and one company, VALE, is also going up along with. However, the other stock, Freeport-McMoRan's (NYSE: FCX), has surprised the market by announcing to acquire McMoRan Exploration and Plains Exploration with a $9 Billion price tag. FCX is the world largest producer of copper. It owns a 90% stake in the gigantic Grasberg mining complex in Indonesia. Grasberg is the world's largest copper and gold mine. However, apparently FCX also wants to re-enter the energy sector. The markets did not like what FCX was doing and punished FCX by knocking about 20% off FCX's share price on the day FCX announced the acquisition.

I have got some positions with FCX for a while. With a 20% hair cut, one may consider that I have probably been shaken out of the FCX position. Nope! While my paper gain has indeed come down quite a bit, I'm still significantly in the money with a 46% paper profit. That's the beauty of using the so-called naked put option technique to long a stock. I don't need to be exactly right about the stock price. What I'm doing with this position (as shown below) is that I will be making money as long as FCX does not drop below $23. At the moment, FCX is trading hands at about $31. I still think FCX is a great company with very valuable assets. It may not be performing well in the near term, but I'm quite confident about its long term values. If it further declines significantly below $30, I will consider to add more of it to my portfolio.

|

3.05 |

-0.07 |

-2.24% |

$105.00 |

-15 |

$5.75 |

$4,030.49 |

+46.62% |

Saturday, December 8, 2012

Bioprinting human tissues

You may have heard the 3D printing technology, which can print everything from wrenches to aircraft parts. Have you heard bioprinting, which uses cells to "print" human tissues?

Organovo Holdings (ONVO) is just such a company, which develops three-dimensional (3D) bioprinting technology for creating functional human tissues on demand for research and medical applications. The company’s 3D NovoGen bioprinting technology works across various tissue and cell types, and allows for the placement of cells in desired pattern. It offers NovoGen MMX Bioprinter, a commercial hardware and software bioprinter platform to create tissues for bioprinting research and development. For example, Organovo can grow heart tissue and makes it to beat like a real heart. Eventually I think human organs can be "printed" for transplantation purposes. You can imagine what kind of the market it can be if doctors can print organs whenever there is a demand for transplant.

ONVO is kind of stock with a huge potential but it will certainly be very volatile! It may jump several times within a few weeks but may burst equally fast. See the chart below. It seems at the bottom at the moment. If you have the gut for its volatility, this may be the time to consider to get in.

Organovo Holdings (ONVO) is just such a company, which develops three-dimensional (3D) bioprinting technology for creating functional human tissues on demand for research and medical applications. The company’s 3D NovoGen bioprinting technology works across various tissue and cell types, and allows for the placement of cells in desired pattern. It offers NovoGen MMX Bioprinter, a commercial hardware and software bioprinter platform to create tissues for bioprinting research and development. For example, Organovo can grow heart tissue and makes it to beat like a real heart. Eventually I think human organs can be "printed" for transplantation purposes. You can imagine what kind of the market it can be if doctors can print organs whenever there is a demand for transplant.

ONVO is kind of stock with a huge potential but it will certainly be very volatile! It may jump several times within a few weeks but may burst equally fast. See the chart below. It seems at the bottom at the moment. If you have the gut for its volatility, this may be the time to consider to get in.

Saturday, December 1, 2012

Shortage of copper supply is coming

While the Chinese markets are struggling, believe or not the Chinese economy is showing signs of recovering. Per Bloomberg report, copper supply shortages will extend into

the first half of next year as an accelerating Chinese economy more than

doubles the pace of growth in global consumption even as mines extract a

record amount of metal. Given 41% of the world's copper is consumed by China, it will mean more demand should be expected. The problem is that demand will outpace supply by 316,000

metric tons in the first six months, more than all copper in London

Metal Exchange warehouses, before a surplus emerges in the second half. Production has lagged behind consumption since

2010, according to the International Copper Study Group. The metal may

average $8,300 a ton in the second quarter, 5.1 percent more than now

and the most in a year, according to the median of 21 analyst and trader

estimates compiled by Bloomberg. More stimulus has been announced or planned in the US, Europe & Japan will further deepen the supply shortage.

So how to ride this uptrend? You may consider Freeport-McMoRan Copper & Gold Inc. (FCX),

the biggest copper producer. It is expected a 44 percent gain in

net income next year. It is also estimated that its share price may jump by 30% next year. You may also consider Vale S.A. (VALE), which is the largest producer of basic metals in Brazil and a significant portion of its metals is copper. Its price action appears to be bottoming. The shortage of supply of copper may fire VALE's stock price. Friday, November 30, 2012

If you like gambling, buy this gaming giant

I was a bit bullish about the Chinese stock markets and thought it would have bottomed a few weeks ago. Too early a call. As I said, if the Shanghai Composite Index could not hold the 2000 level, then more decline was ahead. The Shanghai index is around 1980, a clear bearish sign for the Chinese markets. But this may not be bad if you are looking for bargain stocks related to China. Wynn Resorts (WYNN) is one of them.

While Wynn is an American giant gaming company, it derives nearly 75% of its revenue from Macau (the Las Vegas of China). Well, it is facing a lot of headwinds lately due to concerns over an economic slowdown in China. Its share price has been slammed & declined over 15% in the past few weeks. Well, not everyone is so bearish about Wynn. JPMorgan, the investment bank, has just issued an analysis report, which sounds quite bullish on Wynn. Here is the excerpt from JP's report published in Barron's:

In other words, the intrinsic value of Wynn has been largely underestimated. If people start to realize that, then Wynn's share price will go up accordingly. Per JP, Wynn should have a price of $133 instead of $112 (the current share price).

While Wynn is an American giant gaming company, it derives nearly 75% of its revenue from Macau (the Las Vegas of China). Well, it is facing a lot of headwinds lately due to concerns over an economic slowdown in China. Its share price has been slammed & declined over 15% in the past few weeks. Well, not everyone is so bearish about Wynn. JPMorgan, the investment bank, has just issued an analysis report, which sounds quite bullish on Wynn. Here is the excerpt from JP's report published in Barron's:

| At current levels for each stock, what is implied in Wynn 's (ticker: WYNN) market cap, once backing out its interest in Wynn Macau, is a negative value (though, admittedly, it's a modest negative value). Wynn's stake in Wynn Macau is $10.957 billion, while its (Wynn's) market cap is $10.923 billion, giving no value for its Macau royalty stream and Las Vegas Strip earnings before interest, taxes, depreciation and amortization (Ebitda), and certainly not a ton of value for its Cotai project [in Macau]. |

In other words, the intrinsic value of Wynn has been largely underestimated. If people start to realize that, then Wynn's share price will go up accordingly. Per JP, Wynn should have a price of $133 instead of $112 (the current share price).

Monday, November 26, 2012

Get ready for a year end rally

Following the market sharp plunge on Nov 7, I advised to get out of short positions. I guess this was a good call as the market has jumped quite significantly back in the past two weeks or so. The market is a bit overbought at the moment in a very short term and I won't be surprised to see it drop 10-20 points (S&P) in the next few days. But then the year end rally should finally kick in. I expect the market may go up 5-10% towards the year-end and the bullishness may well go into the first quarter of 2013. So if you also believe this trend, take the market decline in the next day or two as the buying opportunity. If you are aggressive enough, you may even play with this upward trend by buying some leverage ETFs, e.g. SSO or TNA. Of course, for any speculative plays as such, please also mindful of the risk involved.

Saturday, November 24, 2012

Be the landlord of the US government

Government Properties Income Trust (GOV) is a REIT (Real Estate Income Trust). To be qualified as a REIT, the company must pay 90% of its earning to the shareholders so that it can avoid paying the corporate tax. The shareholders will have to pay their income tax for the dividend they received. So this actually avoids the double taxation, which is generally the case for all other companies. That's why REITs usually pay a much higher dividend yield. GOV is currently paying 7.5% dividend for your money invested. You cannot get anything even close for your money in the bank. There are tons of REITs out there. What makes GOV outstanding among them is the nature of its core business: 94% of its annualized rental income is paid by the U.S. Government, 10 state governments and the United Nations. In other words, if you buy GOV, you are virtually the landlord of the US government. GOV has dozens of federal or local governments renting its properties. The top 5 renters are:US Customs & Immigration Service (10%), Internal Revenue Service (9%), Federal Bureau of Investigation (5%), Department of Justice (5%), and Department of Agriculture (4%). Will you be worried that the US governments such as IRS will lack of money to pay your rents? Not a chance. That's why I think this is a super safe deal to become the landlord of the US government. I have definitely added GOV into my retirement portfolio for long-term investment!

Sunday, November 18, 2012

Catch the shopping fever now

What is the best shopping season in the US? I guess it is a no-brainer question: the 4th quarter of a year. The Black Friday after the Thanksgiving Day, followed by the Cyber Monday that is the online shopping day after the Black Friday, and then followed by the X'mas seasonal shopping craziness, becomes the most euphorigenic period for the retailer business. People don't care if they have job, have money, or have debt, they just want to spend. They have credit cards anyway, right? Of course, this is not the topic I'm interested in. As an investor, what I want to know is which company may be best positioned to catch this seasonal shopping frenzy. I think I have found one for your consideration.

For sure you can consider Google or Yahoo since they are the overlords in the online advertising business. But I don't think this kind of seasonality will have too much impact on their stock price given their scale. I'm more interested in a much smaller company, for which a good season could mean a lot for its earnings. I think ValueClick (VCLK) is such a stock. By name, I guess you can easily understand that VCLK is an online advertiser. I'm not interested in its long term performance as it is a tough business in competing with Google or Yahoo. However, if you simply buy the stock for this special season, you may be rewarded handsomely. Look at its chart from 2001 up to now. Do you notice that VCLK tends to go up around the year end and drop in the first quarter? I think we can play with this seasonality game by buying VCLK now (before Thanksgiving) and hold it through the 1Q and then sell it in early Apr 2013 before its earning report. There is a good chance that we may see something like 20-30% appreciation of the stock price. If you know how to play with call options, the risk can be much lower with a much greater profit margin.

For sure you can consider Google or Yahoo since they are the overlords in the online advertising business. But I don't think this kind of seasonality will have too much impact on their stock price given their scale. I'm more interested in a much smaller company, for which a good season could mean a lot for its earnings. I think ValueClick (VCLK) is such a stock. By name, I guess you can easily understand that VCLK is an online advertiser. I'm not interested in its long term performance as it is a tough business in competing with Google or Yahoo. However, if you simply buy the stock for this special season, you may be rewarded handsomely. Look at its chart from 2001 up to now. Do you notice that VCLK tends to go up around the year end and drop in the first quarter? I think we can play with this seasonality game by buying VCLK now (before Thanksgiving) and hold it through the 1Q and then sell it in early Apr 2013 before its earning report. There is a good chance that we may see something like 20-30% appreciation of the stock price. If you know how to play with call options, the risk can be much lower with a much greater profit margin.

Saturday, November 17, 2012

Buy Intel for your retirement

If you have bought Yahoo as I suggested when it was traded at around $15 only 2 months ago, you should be happy now. At $17 at the moment, Yahoo has appreciated by 13% in 2 month, in a market which has declined by about 10%. More importantly, Yahoo has broken out its long trading upper range for over a year around $16. This is very important, which technically often means a much big advance is lying ahead for Yahoo. I won't be surprised to see it go over $25 within a year.

If you were convinced and bought Yahoo when I talked about it, then I think you should also consider to buy Intel (INTC) for the similar reason, that is, its great valuation. I know Intel for many people is a very boring stock, especially those who are looking for a quick win. I agree that Intel will likely not go up 100% in a short period of time. People are also thinking Intel is a dying company, given that it dominates the PC chip market with a 80% market share but the PC industry seems in a descending trend. While PC is not an exciting industry anymore, it won't go away for a long long time. We are still heavily relying on our PC for our work and daily life. You can safely bet that Intel will continue to earn a huge amount of money from the PC chip sector for years. The strategic problem Intel has is that it did not foresee the mega new trend of the mobile industry early enough and it has been greatly lagging behind in the game. But Intel has realized that now and is catching up. I think it is just a matter of time. In addition, Intel is also the main player in the severe sector. So I'm still very much interested in Intel, primarily due to its enormous intrinsic value at this very depressed price around $20. Its P/E ratio is only 8.8, a ridiculously cheap value for such a great company gushing out a huge pile of cash. I'm more interested in its 4.5% dividend yield, which you can bet will continue and increase. I definitely agree that you should not buy Intel for a quick money but I strongly recommend that you should consider Intel for your retirement portfolio with dividend reinvestment. Overtime, you will be very happy that you make this decision today. This is what I'm doing now and I simply add more if Intel continues to go down, although I don't believe it will go down too much further from here.

If you were convinced and bought Yahoo when I talked about it, then I think you should also consider to buy Intel (INTC) for the similar reason, that is, its great valuation. I know Intel for many people is a very boring stock, especially those who are looking for a quick win. I agree that Intel will likely not go up 100% in a short period of time. People are also thinking Intel is a dying company, given that it dominates the PC chip market with a 80% market share but the PC industry seems in a descending trend. While PC is not an exciting industry anymore, it won't go away for a long long time. We are still heavily relying on our PC for our work and daily life. You can safely bet that Intel will continue to earn a huge amount of money from the PC chip sector for years. The strategic problem Intel has is that it did not foresee the mega new trend of the mobile industry early enough and it has been greatly lagging behind in the game. But Intel has realized that now and is catching up. I think it is just a matter of time. In addition, Intel is also the main player in the severe sector. So I'm still very much interested in Intel, primarily due to its enormous intrinsic value at this very depressed price around $20. Its P/E ratio is only 8.8, a ridiculously cheap value for such a great company gushing out a huge pile of cash. I'm more interested in its 4.5% dividend yield, which you can bet will continue and increase. I definitely agree that you should not buy Intel for a quick money but I strongly recommend that you should consider Intel for your retirement portfolio with dividend reinvestment. Overtime, you will be very happy that you make this decision today. This is what I'm doing now and I simply add more if Intel continues to go down, although I don't believe it will go down too much further from here.

Sunday, November 11, 2012

Home depot is too much ahead of itself

I thought Home Depot (HD) was a good buy a year ago when it was trading around $40. I called it a diamond in the rough. Since that call, HD has advanced 50% up with its current price at around $60. This is a great gain by any standard. If you indeed bought HD, you may consider to sell it now by taking your good profit. Why? Because I think HD has gone way too much ahead of itself. People have got too excited about it by ignoring its valuation. When you buy something, you don't want to pay too much, regardless how good that thing is, do you? Look at two charts of HD below.

The first one is a historical price chart for HD. You may notice that the current HD price has reached the same level as it was in early 2000, the highest in its whole history. You must know that this was the time of the peak of the whole stock market in its huge bubble before bursting and crashing. This chart also presents an important technical warning sign: the double top. Unless HD can further go up, which I highly doubt, the double top often signals the downward turning point for a stock. I think this will likely happen for HD.

The following chart shows the momentum indicator (MACD) (the bottom part). While the stock price is moving up, MACD is showing a downward trend, a divergent trend often indicating that the current trend is weak and will likely turn to the opposite direction. In addition, HD's P/E ratio is 21, way too expensive for it. It is also too high away from its 200 day moving average (the green line). Taken all the signals together, I'm hearing a loud warning siren. Not only will I get out of HD as soon as possible, I will also be willing to short it via put options, if you know how to do it.

The first one is a historical price chart for HD. You may notice that the current HD price has reached the same level as it was in early 2000, the highest in its whole history. You must know that this was the time of the peak of the whole stock market in its huge bubble before bursting and crashing. This chart also presents an important technical warning sign: the double top. Unless HD can further go up, which I highly doubt, the double top often signals the downward turning point for a stock. I think this will likely happen for HD.

The following chart shows the momentum indicator (MACD) (the bottom part). While the stock price is moving up, MACD is showing a downward trend, a divergent trend often indicating that the current trend is weak and will likely turn to the opposite direction. In addition, HD's P/E ratio is 21, way too expensive for it. It is also too high away from its 200 day moving average (the green line). Taken all the signals together, I'm hearing a loud warning siren. Not only will I get out of HD as soon as possible, I will also be willing to short it via put options, if you know how to do it.

Saturday, November 10, 2012

Buy mortgage REITs when there is panic selling

No doubt so called "investors" are running away from mortgage REIT stocks these days such as Annaly (NLY) or the like. I smell blood on the street now with panic selling. I have been really waiting for such a day to come and my little patience has paid off, in a big way!

I talked about NLY several times and latest one was in Feb this year (see here). A similar panic selling was also ongoing at that time and I advised people to buy. My advice stays the same this time that this is a great opportunity to buy NLY, which is yielding over 13%, or even better, American Capital Agency Corp (AGNC), which is yielding a salivating rate of over 16%. So what has caused such a panic for NLY and AGNC to have dropped over 15% in the past 2 weeks? Nothing extraordinary actually. The reason is QE3. Since the main effect of QE3 is to suppress the mortgage rate, this has caused a reduction of the interest rate spread, the key factor for mortgage REIT companies to earn money. This in turn has led such companies to miss earning estimates and reduce the dividend payout. It is understandable that such a poor earning and reduced dividends should lead to lower stock prices but when there is panic selling and their prices have been over corrected, then it becomes a great opportunity. At the current price around $15 for NLY and $30 for AGNC, they are trading hands below their book values (90% discount for NLY and 95% for AGNC). Over years, whenever they were below their book values, brave investors got a great deal by locking in their high dividend yield as well as a potential of substantial capital gains. A win win situation I don't want to miss.

Of course, always mind your position size, as it could be volatile and may stay in this depressed level for some time.

I talked about NLY several times and latest one was in Feb this year (see here). A similar panic selling was also ongoing at that time and I advised people to buy. My advice stays the same this time that this is a great opportunity to buy NLY, which is yielding over 13%, or even better, American Capital Agency Corp (AGNC), which is yielding a salivating rate of over 16%. So what has caused such a panic for NLY and AGNC to have dropped over 15% in the past 2 weeks? Nothing extraordinary actually. The reason is QE3. Since the main effect of QE3 is to suppress the mortgage rate, this has caused a reduction of the interest rate spread, the key factor for mortgage REIT companies to earn money. This in turn has led such companies to miss earning estimates and reduce the dividend payout. It is understandable that such a poor earning and reduced dividends should lead to lower stock prices but when there is panic selling and their prices have been over corrected, then it becomes a great opportunity. At the current price around $15 for NLY and $30 for AGNC, they are trading hands below their book values (90% discount for NLY and 95% for AGNC). Over years, whenever they were below their book values, brave investors got a great deal by locking in their high dividend yield as well as a potential of substantial capital gains. A win win situation I don't want to miss.

Of course, always mind your position size, as it could be volatile and may stay in this depressed level for some time.

Wednesday, November 7, 2012

Sharpest stock plunging in 5 years

Well, the stock market indeed had a free fall immediately after the election. Dow Jones plunged over 300 points and S&P 500 over 30 points, the sharpest daily drop since 2009. Although the president election did not repeat the struggling show in 2000 with prolonged uncertainty, people apparently still worried about the upcoming battle on fiscal cliff. It won't be pretty! Expect more uncertainty to come. But believe or not, the chance is high that the stock market may start to advance from this level and end up with a year end rally. However, the road won't be smooth but bumpy and volatile.

If you bought some short positions in the past few days as I suggested, pat yourself on the back to enjoy it but I'd take the profit off the table.

If you bought some short positions in the past few days as I suggested, pat yourself on the back to enjoy it but I'd take the profit off the table.

Monday, November 5, 2012

A potential high volatility post-election

Just a very quick note about what could happen after tomorrow's presidential election. You may remember what happened in 2000 following the voting day with the Bush/Gore election. The result could not be determined for weeks due to election "recount". And the market was very nervous with high volatility and plunging of stock markets.

With a new voting system introduced in Ohio recently, this fiasco could happen again that at least for 10 days the country will not know who wins. You can read this news here yourself. If this indeed materializes, likely the stock market will not respond well and volatility will likely shot up substantially. One way to hedge against this potential high volatility is to buy some VXX call options or simply buy SDS which will go up for a plunging S&P 500 index.

With a new voting system introduced in Ohio recently, this fiasco could happen again that at least for 10 days the country will not know who wins. You can read this news here yourself. If this indeed materializes, likely the stock market will not respond well and volatility will likely shot up substantially. One way to hedge against this potential high volatility is to buy some VXX call options or simply buy SDS which will go up for a plunging S&P 500 index.

Sunday, November 4, 2012

Coal has likely bottomed

I talked about coal in April, which was apparently too early. But the rationale I laid out then are still valid. I don't believe coal is dead and will not pick up again in demand. Actually the recent economic data from China start to look promising again, which will further support the increasing demand of coal. I have seen news that the coal prices in the past month have finally jumped high and there are many indicators suggesting the demand for coal is truly picking up. Looking at the chart below. You may notice the ETF for coal (KOL) has been range bounded between 22 to 26 in the past half year, a very clear bottoming range. If KOL can break through 26 and hold, I will be very confident that the new bull run for KOL has finally come. If so, I will be interested in the coal companies such as BTU or ACI.

Saturday, November 3, 2012

Buy gold in the Euro term

I hope all the friends are safe and sound without problems by now. After a few days of no power and Internet, we are finally back to normal. But still it is difficult to find gas locally here.

The Apple stock got hit quite hard last few days. I guess I was too early again. But for Apple I'm not a trader; rather a long-term investor. As long as its value is good, I'm fine to be a bit earlier. I will buy more if it drops further. Actually by the way I'm buying Apple I will not lose a penny until it drops to $500. At $576 at the moment, I don't think it will get to that level but I could be wrong of course.

As I predicted, gold is indeed coming down as well. With a $37 decline yesterday to $1678, gold is very close to its 200 day moving average at around $1650-1660 area. As I said, this is a strong support level and I think is a good entry point. However, I have learned over years that I should never be too confident about what I believe in. While I believe gold is likely bounce back from this support level, there is always a chance that it may not hold up there and may further go down. Whenever possible, I want to set up a position in such a way that my loss could be minimized. So what is the strategy to hedge against this possible short-term over correction for gold?

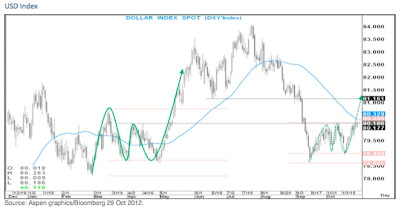

About 2 months ago in Sep, I said US$ was likely bottomed and would appreciate. See below that this is exactly what has happened. The US$ index has been range-bounded roughly between 79.0 -80.1 in the past 2 months. But it appears it has just broken through the upper bound. This will likely push US$ up to 81-84. I think this is one major reason why gold has declined so much lately, because a strong US$ will push down gold price at least in a short-term. Eventually though, gold will not be bounded by the US$ and will continue to go up substantially in its huge bull run, since gold has become more and more a currency, not a metal.

So when US$ goes up, what is the next obvious victim? I hope you can guess: yes, it is Euro. I think Euro has run its upward course already by now. Likely it will start to decline from the current level of $1.29. I won't be surprised to see Euro plunge to below $1.20 this time. I have talked about EUO many times in the past, which is a 2 x leverage ETF against Euro. In other words, when Euro drops 1%, EUO should go up 2%. You may notice interestingly below that EUO was also range bounded between 19-20 in the past 2 months and has just broken through the upper bound over 20 now. If indeed US$ appreciates in the next few months, Euro will decline and EUO will go up in parallel.

If you buy gold and at the same time short Euro (e.g. by buying EUO), you essentially buy your gold in the Euro term. If gold goes down due to a stronger US$, EUO will go up due to a weaker Euro to offset your loss in gold, a perfect hedge to me. But be aware, this is just a concept to let you know how to hedge your gold for a potential over correction. As we discussed before, I don't like to simply buy EUO due to the headache in tax filing for it, since EUO is structured as a partnership fund. I'd either buy EUO call options or buy FXE (a direct Euro fund) put options. For those who don't know options, maybe simply use the dollar averaging technique to buy some gold at its current level and buy more if it further drops. In the long run, I firmly believe you will be doing very well. My gut feeling tells me that this is likely the last chance to buy gold at such cheap levels for a long long time. So whatever the levels this correction will bring down gold and silver to, to me it is a great opportunity to buy more cheaper gold and silver. Don't miss it!

The Apple stock got hit quite hard last few days. I guess I was too early again. But for Apple I'm not a trader; rather a long-term investor. As long as its value is good, I'm fine to be a bit earlier. I will buy more if it drops further. Actually by the way I'm buying Apple I will not lose a penny until it drops to $500. At $576 at the moment, I don't think it will get to that level but I could be wrong of course.

As I predicted, gold is indeed coming down as well. With a $37 decline yesterday to $1678, gold is very close to its 200 day moving average at around $1650-1660 area. As I said, this is a strong support level and I think is a good entry point. However, I have learned over years that I should never be too confident about what I believe in. While I believe gold is likely bounce back from this support level, there is always a chance that it may not hold up there and may further go down. Whenever possible, I want to set up a position in such a way that my loss could be minimized. So what is the strategy to hedge against this possible short-term over correction for gold?

About 2 months ago in Sep, I said US$ was likely bottomed and would appreciate. See below that this is exactly what has happened. The US$ index has been range-bounded roughly between 79.0 -80.1 in the past 2 months. But it appears it has just broken through the upper bound. This will likely push US$ up to 81-84. I think this is one major reason why gold has declined so much lately, because a strong US$ will push down gold price at least in a short-term. Eventually though, gold will not be bounded by the US$ and will continue to go up substantially in its huge bull run, since gold has become more and more a currency, not a metal.

So when US$ goes up, what is the next obvious victim? I hope you can guess: yes, it is Euro. I think Euro has run its upward course already by now. Likely it will start to decline from the current level of $1.29. I won't be surprised to see Euro plunge to below $1.20 this time. I have talked about EUO many times in the past, which is a 2 x leverage ETF against Euro. In other words, when Euro drops 1%, EUO should go up 2%. You may notice interestingly below that EUO was also range bounded between 19-20 in the past 2 months and has just broken through the upper bound over 20 now. If indeed US$ appreciates in the next few months, Euro will decline and EUO will go up in parallel.

Saturday, October 27, 2012

Is it the time to buy gold?

First of all, I hope all my friends will be safe when Hurricane Sandy hits us in the next few days. Keep my fingers crossed that we will still have power in service.

Some friends ask me whether now is a good time to buy gold, given gold has corrected quite some percentage now in the past few weeks. It is a difficult question because my answer will be Yes and No, depending on your situation. It is YES, if you haven't bought any gold yet. For me, gold should always be an important part of your portfolio. It may not be cheap compared with a few years ago but it is still very cheap if you look back a few years later. This is what I'm pretty sure about. We can try our best to speculate what may be the bottom of this correction and then wait for that point to get in, but any analysis is indeed just a wishful thinking, which may not always be exactly correct. Good technical analysis may decipher the right direction but it is very hard to pinpoint the exact entry point. I will be very disappointed to miss the big uptrend simply by waiting for an artificial ideal entry point, which may just be a few dollars difference. However, if you have already got some gold and are waiting for a better chance to get more, then I think more correction is likely in the next few weeks. At the moment, gold is sitting around $1700, just dropping below its 50 day moving average (DMA). There is a good chance that gold will further decline to test its 200 day MA around $1660. However, that is a rather strong support for gold and I think it will hold there and start to bounce back. Below is the chart for GLD. You may notice that the 200 DMA for GLD is at around $160 (the red line) and interestingly it is also the low end of the Bollinger Band (the lower grey line). Stocks usually bounce back and forth within its Bollinger Band. This coincidence is further suggesting that gold is likely to bounce back from its 200 DMA. If you are waiting for a better chance to get in, I'd wait till it drops to that level.

Some friends ask me whether now is a good time to buy gold, given gold has corrected quite some percentage now in the past few weeks. It is a difficult question because my answer will be Yes and No, depending on your situation. It is YES, if you haven't bought any gold yet. For me, gold should always be an important part of your portfolio. It may not be cheap compared with a few years ago but it is still very cheap if you look back a few years later. This is what I'm pretty sure about. We can try our best to speculate what may be the bottom of this correction and then wait for that point to get in, but any analysis is indeed just a wishful thinking, which may not always be exactly correct. Good technical analysis may decipher the right direction but it is very hard to pinpoint the exact entry point. I will be very disappointed to miss the big uptrend simply by waiting for an artificial ideal entry point, which may just be a few dollars difference. However, if you have already got some gold and are waiting for a better chance to get more, then I think more correction is likely in the next few weeks. At the moment, gold is sitting around $1700, just dropping below its 50 day moving average (DMA). There is a good chance that gold will further decline to test its 200 day MA around $1660. However, that is a rather strong support for gold and I think it will hold there and start to bounce back. Below is the chart for GLD. You may notice that the 200 DMA for GLD is at around $160 (the red line) and interestingly it is also the low end of the Bollinger Band (the lower grey line). Stocks usually bounce back and forth within its Bollinger Band. This coincidence is further suggesting that gold is likely to bounce back from its 200 DMA. If you are waiting for a better chance to get in, I'd wait till it drops to that level.

Friday, October 26, 2012

Apple is likely bottoming

Apple announced its earnings yesterday, which was very disappointing. Its stock immediately dropped in after-hour trading. I thought it would be a bloodshed day for Apple today. Yes, it was, but just a few hours. See below the price movement for Apple today. It indeed declined below $600 as I hoped and at one moment plummeted over $15 to $590. I hope you have got the chance to get in. However, amazingly Apple managed to climb back all the way and closed only a few dollars below the yesterday's price. I must say I was very impressed by Apple's performance and I think Apple is likely near its bottom, if not yet at the bottom. Why? It is a Wall Street famous saying that when a stock acts well during a terrible time (e.g. poor earnings or bad news), the stock has usually bottomed. In other words, those who want to sell the stock have already all sold the stock and the only people left are those who want to buy. This will of course push the stock upward. Apple today's price action seems to demonstrate that. I and no one know if this is the exact bottom for Apple. Only the time can tell. But I'm starting to pick up a few shares of Apple now.

Monday, October 22, 2012

10 times increase of college costs over 30 years?

I know there are some friends who still have young kids. Don't want to scare you but thought you at least should be informed what is going on regarding inflation, especially related to college costs. Just read something which could be interesting to you. See here. The text below pointed to a 10 times increase of college costs in the past 30 years. What will happen in the next 30 years? I bet it will only be worse. Be prepared!

If you are looking for out-of-control inflation in the US, look no further than the college and hospital next door. The CPI data show that college tuition and fees have increased 1,036% since January 1979 vs. 546% for Medical Care Goods & Services vs. 238% for the overall CPI. In other words, college costs have more than quadrupled relative to the CPI over this period, while Medical Care has more than doubled relative to the CPI.

If you are looking for out-of-control inflation in the US, look no further than the college and hospital next door. The CPI data show that college tuition and fees have increased 1,036% since January 1979 vs. 546% for Medical Care Goods & Services vs. 238% for the overall CPI. In other words, college costs have more than quadrupled relative to the CPI over this period, while Medical Care has more than doubled relative to the CPI.

Sunday, October 21, 2012

Ready to bite APPLE

I was tied up with a business trip in Switzerland last week and did not have much time to read and watch. So just a quick note on a stock I have been watching closely for some time. It is Apple (AAPL), a stock I like very much but haven't got into it.

I guess I don't need to say too much how successful Apple is as a company. Everyone knows it and most people admire its products. It is changing the world in many aspects. However, its stock has dropped by about 15% in the past 2 weeks or so, from its top at $705. Why? It has gone ahead of itself too far, too fast. Whenever people got too excited about something in investment, the direction will reverse. No difference for Apple! After shedding 15% of its weight, Apple becomes more attractive from the long-term perspective. I'm still a bit hesitant though, due to the overall market condition. Currently Apple is trading hands at about $610. I think and hope it will come down further to below $600. If that happens, I may start to pick up Apple's shares. By using the naked puts technique, I can also sharply bring down my cost and can buy Apple shares for below $500.

I guess I don't need to say too much how successful Apple is as a company. Everyone knows it and most people admire its products. It is changing the world in many aspects. However, its stock has dropped by about 15% in the past 2 weeks or so, from its top at $705. Why? It has gone ahead of itself too far, too fast. Whenever people got too excited about something in investment, the direction will reverse. No difference for Apple! After shedding 15% of its weight, Apple becomes more attractive from the long-term perspective. I'm still a bit hesitant though, due to the overall market condition. Currently Apple is trading hands at about $610. I think and hope it will come down further to below $600. If that happens, I may start to pick up Apple's shares. By using the naked puts technique, I can also sharply bring down my cost and can buy Apple shares for below $500.

Sunday, October 14, 2012

Buy HongKong stocks to get onto the Bernanke bubble train

The way Bernanke is doing to print money unlimitedly will turn all assets into huge bubbles. No question about it. It is not whether but just when. That's why everyone should buy gold and silver as part of their investment portfolio. In addition to that, I have got an idea to catch up the bubble train via stocks, the HongKong stocks. Why so? This is because the unique feature involving the HongKong dollars (HK$).

Not sure if everyone knows that HongKong has pegged its currency to the US$, i.e. the HK$'s exchange rate with the US$ is fixed, which is up and down consistent with the US$ value. In other words, the H$ is not valued based on the HongKong economic conditions but rather it is purely determined by what the US Fed wants to do. Right now, the US economy is in a big mess and its inflation appears to be quite tamed due to very slow economic activities. But this is not the case in HongKong, which is actually economically doing very well. When a currency is depreciating in a strong economy like HongKong, what will definitely happen? High inflation! In other words, as long as Bernanke is printing money as he is doing now, the HK$ will be further depreciating along with the US$, leading to more and more severe inflation in HongKong. You probably have heard that the HK housing market is super hot at the moment, a clear sign of a bubble unfolding. Actually when inflation picks up its pace, everything will go up. I think there is a good chance that the HK stock market will go up much higher than anyone can imagine. There is actually another factor favoring the HK stock market. As I said at the previous blog, I think the Chinese stock market may pick up its steam soon. If that's the case, it will further propel the HK market. This is almost like a double-dosed stimulus for the HK market. As you can see the chart below, the HK stock market (via ETF: EWH, the blue line) is generally doing much better than the Chinese stocks. If you believe this thesis, consider to buy EWH at its pullback.

Not sure if everyone knows that HongKong has pegged its currency to the US$, i.e. the HK$'s exchange rate with the US$ is fixed, which is up and down consistent with the US$ value. In other words, the H$ is not valued based on the HongKong economic conditions but rather it is purely determined by what the US Fed wants to do. Right now, the US economy is in a big mess and its inflation appears to be quite tamed due to very slow economic activities. But this is not the case in HongKong, which is actually economically doing very well. When a currency is depreciating in a strong economy like HongKong, what will definitely happen? High inflation! In other words, as long as Bernanke is printing money as he is doing now, the HK$ will be further depreciating along with the US$, leading to more and more severe inflation in HongKong. You probably have heard that the HK housing market is super hot at the moment, a clear sign of a bubble unfolding. Actually when inflation picks up its pace, everything will go up. I think there is a good chance that the HK stock market will go up much higher than anyone can imagine. There is actually another factor favoring the HK stock market. As I said at the previous blog, I think the Chinese stock market may pick up its steam soon. If that's the case, it will further propel the HK market. This is almost like a double-dosed stimulus for the HK market. As you can see the chart below, the HK stock market (via ETF: EWH, the blue line) is generally doing much better than the Chinese stocks. If you believe this thesis, consider to buy EWH at its pullback.

Saturday, October 13, 2012

Chinese stocks become attractive

Am I crazy to be interested in the Chinese stocks? The Chinese economy is quickly deteriorating. Its housing market is substantially cooling down. Inflation is rampant....You name it. Nothing seems to point to a rosy picture for the Chinese stock market. Indeed, the Shanghai index is among the poorest performers in the world, declining over 10% in the past year. It seems most of the Chinese investors have become very desperate and even given up totally. Well, this is actually the time you may find good opportunities for great values. I cannot say the Chinese stock market has absolutely bottomed but if the Shanghai index can hold above 2000 for a while, then its uptrend seems quite solid. At the moment, the index is fighting against this support level. See below:

If indeed this turns out to be the bottom for the Chinese stock market, what is the best way to trade on this trend? You can look for good individual stocks but I'm not so comfortable with this approach since it is very difficult to know whether the fundamentals of each company published are credible. One better way for me is to buy the ETF for the top 25 Chinese companies' stocks, FXI. Collectively, these stocks reflect the best managed companies in China and actually it has consistently outperformed the Shanghai index (the green line for FXI vs blue line for Shanghai index).

If indeed this turns out to be the bottom for the Chinese stock market, what is the best way to trade on this trend? You can look for good individual stocks but I'm not so comfortable with this approach since it is very difficult to know whether the fundamentals of each company published are credible. One better way for me is to buy the ETF for the top 25 Chinese companies' stocks, FXI. Collectively, these stocks reflect the best managed companies in China and actually it has consistently outperformed the Shanghai index (the green line for FXI vs blue line for Shanghai index).

Saturday, October 6, 2012

Oil may drop another $15 from here

About 2-3 weeks ago I predicted that oil would decline substantially when it was high $90s. It did and it is trading below $90 now. An over 10% drop within a few weeks is quite substantial. So do I think it has bottomed now? I don't think so. There are 2 major forces pushing oil down the slope. The main reason is the fundamental one that oil should not be this high. You see, the global economy is deteriorating quickly and is slowing down everywhere. The three major economic bodies, US, EU and China, are all suffering from significant recessions. Without an economic growth, the oil consumption cannot be supported. Making the situation even worse is that the oil production in the US has increased dramatically in recent years, thanks to the new technology such as frackings and horizontal drilling. It is an economics 101 that high supply with low demand will only lead to a low price of any product. Oil is no exception. So why oil could still be that high till now? It is largely due to the geopolitical tension in the Middle East, especially the Iran's nuclear program. People are worried that if Iran's is attached by Israel or US, the oil production and transportation in that area will be impacted substantially and will cause shortage of crude oil. This leads to the 2nd main reason why oil price has dropped so much in the past few days and will continue to push it down. Iran has been under a very severe economic sanction led by the US. This has led to its significant currency depreciation. Iran's currency, RIAL, has declined its value by 75% in the past few years, and it dropped 30% just in the past few days. Such kind of dramatic currency depreciation associated with hyperinflation has caused its social turmoils and riots in the street. Now there is speculation that the Iranian government may not survive the sanction and the regime may be changed. If that's the case, the risk of a war has been greatly reduced and the sanction may be lifted if the new government yields to the Western pressure to stop the nuclear program. If so, its oil production will increase substantially. With this kind of logical thinking, how can the crude oil price still remain at this level, when it is not supported by the economic fundamentals? Some experts even predict that the oil price may drop another $15 from the current level. I won't be surprised if it indeed happens. Of course, it won't be a straight line dropping down. It may even come back a bit but that will be a great time and opportunity to short it. ERY is the 3 times leverage ETF to short crude oil but obviously this is very speculative with a high risk.

Friday, October 5, 2012

3-D Printing: next life-changing technology megatrend?

I'm not a tech guy and cannot really say too much about this field. But late days, you probably have also heard a lot of talking about 3-D printing. It seems this technology will become part of our life pretty soon. Even as a layman, I'd think this will be a huge market. Today, I'm really shocked and amazed to see this video: the 3-D technology to be used for making a lightweight and flexible working prosthetic for Emma, a magic arm. This is really a life-changing technology, which will change everything we rely on such as how to make or build medical implants, homes, airplanes, etc. That's why it is estimated that this industry is worth at least $1 trillion ( $1000 billion). I think this is a super megatrend one should not miss. So which company is the leading manufacturer for 3-D printer? Stratasys Inc. (SSYS)! Well, as you can see from the chart below, those early investors sensitive to technology have already jumped into this company. In the past year, SSYS has advanced 3 times. At a PE ratio of 70, I think it is a bit too pricey. I will be patiently monitoring this company and jump in if it comes down in the next few months. In the long run, there is a huge potential to get onto this train.

Tuesday, October 2, 2012

Be careful about what you put in your luggage

This is nothing to do with investment but thought it would also be interesting to you. Stealing of valuable stuff from your checked luggage in airport appears very common. If you think they are safe, be careful and think twice. See this report here.

Saturday, September 29, 2012

A hidden value stock: Barnes & Noble

Whitney Tilson, the co-founder of the T2 Partners, is a very successful value investor. When he speaks, I listen. A while ago, I saw he was discussing Barnes & Noble (BKS) on CNBC and said that at the price of around $11, it had a potential to go up over 300%. They were long this stock. Here you can see more details about his thoughts.

In a nutshell, BKS has 3 core businesses: 1) the Retail bookstores, which is dying and bleeding 2) the college bookstore business, which is stable, and 3) the Nook eReader platform which sells the devices and digital content. The Nook is really its hidden gem, which has a 25% share of the eBook market, No 2 behind Amazon. According to Tilson, its book value is around $11, meaning there is little risk to see it go down much further. The market seems to agree with him. It has come down several times in the past year but always bottomed around $10-12. If you have patience with a long-term perspective, BKS may be a good value stock to consider. I haven't got in but am thinking to use the current market correction to get some BKS.

In a nutshell, BKS has 3 core businesses: 1) the Retail bookstores, which is dying and bleeding 2) the college bookstore business, which is stable, and 3) the Nook eReader platform which sells the devices and digital content. The Nook is really its hidden gem, which has a 25% share of the eBook market, No 2 behind Amazon. According to Tilson, its book value is around $11, meaning there is little risk to see it go down much further. The market seems to agree with him. It has come down several times in the past year but always bottomed around $10-12. If you have patience with a long-term perspective, BKS may be a good value stock to consider. I haven't got in but am thinking to use the current market correction to get some BKS.

Friday, September 28, 2012

More signs for gold to go up

I have talked about gold or precious metals a lot over the past 2 years. Don't want to repeat what I have already talked. Just a quick note about what I have recently read that two more signs to support why gold will continue to go up, A LOT HIGHER!

One is what central banks worldwide are doing with gold. In the past 20-30 years, central banks had always been the net seller of gold each year. But the situation has changed in the past 2-3 years. Central banks have become the net buyer of gold. In June and July this year, about 150 tons of gold were bought by central banks. The Chinese central bank is probably the most aggressive one for buying gold. Not only all the gold mined in China has all been bought by the central bank (it is illegal to export gold by Chinese miners), substantial amount of additional gold has also been imported each year by the China central bank. It is still rumor but I believe it is credible that the Chinese government is accumulating gold in order to support RMB (the Chinese Yuan) to be the only world currency backed up by gold. If this is true, then RMB may replace the US$ to become the world reserve currency eventually.

The other news very bullish for gold is that Samsung is providing financial support to a mining company, Cluff Gold, and in return to get gold bullion; See the press release of Cluff Gold:

Cluff Gold plc, the dual AIM/TSX listed West African focused gold mining company, is pleased to announce that it has signed a Memorandum of Understanding for a long term strategic partnership with Samsung C&T Corporation (“Samsung”). This alliance commences with an unhedged US$20m facility to provide additional funding to Cluff Gold to further the development of its portfolio of assets.

Through this long term partnership Samsung will have access to a reliable supply of gold bullion, underpinned by the Company’s strong operational and management team whilst Cluff Gold will benefit from Samsung’s financial support. The relationship is expected to result in a significant financing in Cluff Gold’s Baomahun project, subject to the outcome of the feasibility study, together with an ongoing commitment to jointly assess other opportunities in the region.

This is a rather significant development, indicating that major companies cannot stand the continuing depreciation of currencies and are turning to gold as their cash reserve. In other words, companies will more and more treat and accept gold as money. I won't be surprised to see that soon gold and/or silver will be the acceptable currency for business and services between corporations. Think about the implication for gold and silver prices in the long run! But be careful about the very short-term volatility for gold and silver, which need a healthy pullback before turning up again.

One is what central banks worldwide are doing with gold. In the past 20-30 years, central banks had always been the net seller of gold each year. But the situation has changed in the past 2-3 years. Central banks have become the net buyer of gold. In June and July this year, about 150 tons of gold were bought by central banks. The Chinese central bank is probably the most aggressive one for buying gold. Not only all the gold mined in China has all been bought by the central bank (it is illegal to export gold by Chinese miners), substantial amount of additional gold has also been imported each year by the China central bank. It is still rumor but I believe it is credible that the Chinese government is accumulating gold in order to support RMB (the Chinese Yuan) to be the only world currency backed up by gold. If this is true, then RMB may replace the US$ to become the world reserve currency eventually.

The other news very bullish for gold is that Samsung is providing financial support to a mining company, Cluff Gold, and in return to get gold bullion; See the press release of Cluff Gold:

Cluff Gold plc, the dual AIM/TSX listed West African focused gold mining company, is pleased to announce that it has signed a Memorandum of Understanding for a long term strategic partnership with Samsung C&T Corporation (“Samsung”). This alliance commences with an unhedged US$20m facility to provide additional funding to Cluff Gold to further the development of its portfolio of assets.

Through this long term partnership Samsung will have access to a reliable supply of gold bullion, underpinned by the Company’s strong operational and management team whilst Cluff Gold will benefit from Samsung’s financial support. The relationship is expected to result in a significant financing in Cluff Gold’s Baomahun project, subject to the outcome of the feasibility study, together with an ongoing commitment to jointly assess other opportunities in the region.

This is a rather significant development, indicating that major companies cannot stand the continuing depreciation of currencies and are turning to gold as their cash reserve. In other words, companies will more and more treat and accept gold as money. I won't be surprised to see that soon gold and/or silver will be the acceptable currency for business and services between corporations. Think about the implication for gold and silver prices in the long run! But be careful about the very short-term volatility for gold and silver, which need a healthy pullback before turning up again.

Sunday, September 23, 2012

Yahoo: a good value investment with little risk

Early this year, I started to become interested in Yahoo and thought it could be a target of acquisition. I'm still thinking so and believe it is becoming more and more so. I'd really be surprised if Apple does not want to buy it at this price with such a great synergy involved. Of course, Apple is not consulting me and I don't know what they are going to do. But regardless, I think Yahoo, at a price of around $15 per share, has become a great value stock with virtually no risk associated with it. Why so? As I said before, Yahoo has a huge stake in Alibaba, a monopoly player in China similar to Amazon or eBay. Yahoo also has a good portion of ownership of Yahoo Japan. Simply with these 2 positions, Yahoo has got a $18 Billion value if liquidated. What's Yahoo's current market cap? Also $18 Billion! In other words, even without talking about a lot of other valuable patents and techniques Yahoo has, Yahoo's current share price is fully covered by the values it owns for Alibaba and Yahoo Japan. To put it another way, there is virtually no risk for any substantial loss if you buy Yahoo at about $15, but there is a great potential for Yahoo to go up either being acquired or via joint venture of some sort. One just needs some patience to wait for it to happen one way or the other. Of course, its share price may still go down a bit as the market is not always rational and it may become so depressed that it will bring down virtually anything regardless. But any such decline for value investors is always a great opportunity to get in for bargaining prices of good companies. I think Yahoo is one of them. As I said, I have already bought some of Yahoo's shares and are going to buy more if the overall market corrects, which I expect will come soon.

Friday, September 21, 2012

Sep 12, 2012: Beginning of End