by Graham Summers

The last two times that inflation ignited as a result of government stimulus/ money printing were during Franklin Delano Roosevelt's New Deal in 1933 and Lyndon B. Johnson's Great Society plans in 1964.

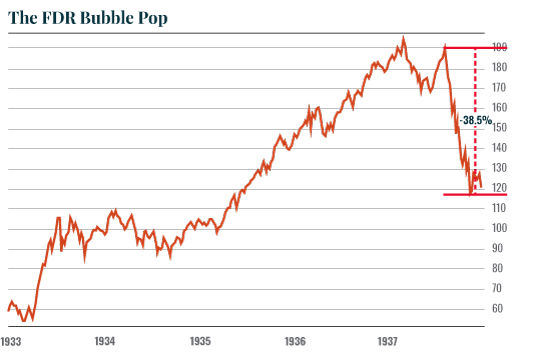

FDR's government stimulus plans occurred in two stages. The first was launched soon after his 1933 inauguration. That ignited a four-month stock market rally. After that, stocks rolled over until FDR introduced new, greater spending programs.

That second round of spending programs triggered a bull market that lasted over two years until inflation reached a boiling point and the Fed was forced to tighten. Stocks promptly crashed roughly 40%.

Bottomline: during the massive government spending programs of FDR, the stock market boomed until inflation was so out of control the Fed was forced to hike rates.

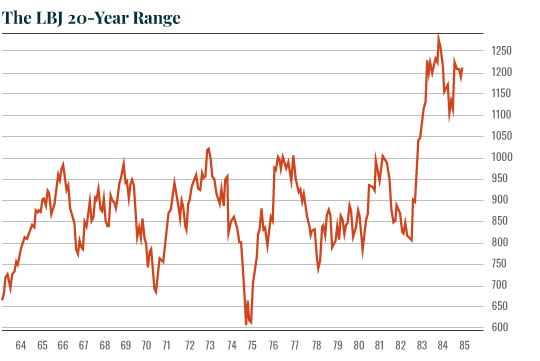

A similar pattern played out during LBJ's Great Society plan in 1964: stocks initially erupted higher on greater spending from 1964 to 1966. They then peaked as inflation entered the financial system and effectively traded sideways for the better part of the next two decades.

So here again we see that stocks love the initial burst in government spending. But the subsequent inflation soon erases those gains.

Food for thought as the Biden administration seeks to mimic FDR and LBJ.

No comments:

Post a Comment