The euphoria overall is of nosebleed high at the moment, which is consistent with the messages I have seen lately in various chat groups. Why bother for the downside risk when the market can make daily new highs, right? I'm happy to ride the mood swings on a daily basis regardless which direction it goes. I guess I should not complain too much about constantly cashing in a few thousands overnight by either short or long depending on the daily herd mood gyrations, right?😏 Ultimately, we will see the theater fire calling that will trigger the panicky rushing towards the narrow exit at the same time, a moment of trampling. Believe me, it will come sooner or later and I hope you are not one of them being trampled!😢

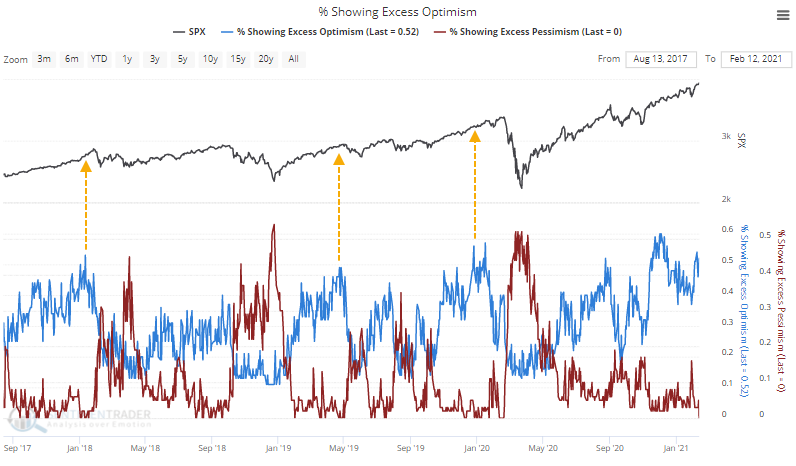

Per SentimenTrader:

Options speculation is spiking yet again, volume in the most leveraged parts of the market has never been greater, and signs of euphoria are everywhere.

With so many indicators showing optimism, there are usually a couple of odd exceptions that suggest pessimism. It's rare for everything to agree at the same time. This is one of those rare times, though, with more than 50% of our core indicators showing an optimistic extreme and exactly 0% showing a pessimistic one.

This kind of lopsided skew among indicators has preceded some tough markets.

The Risk/Reward Table, which shows the biggest losses and largest gains at any point across the various time frames, shows limited upside relative to the downside, with 2017 really being the lone exception.

No comments:

Post a Comment