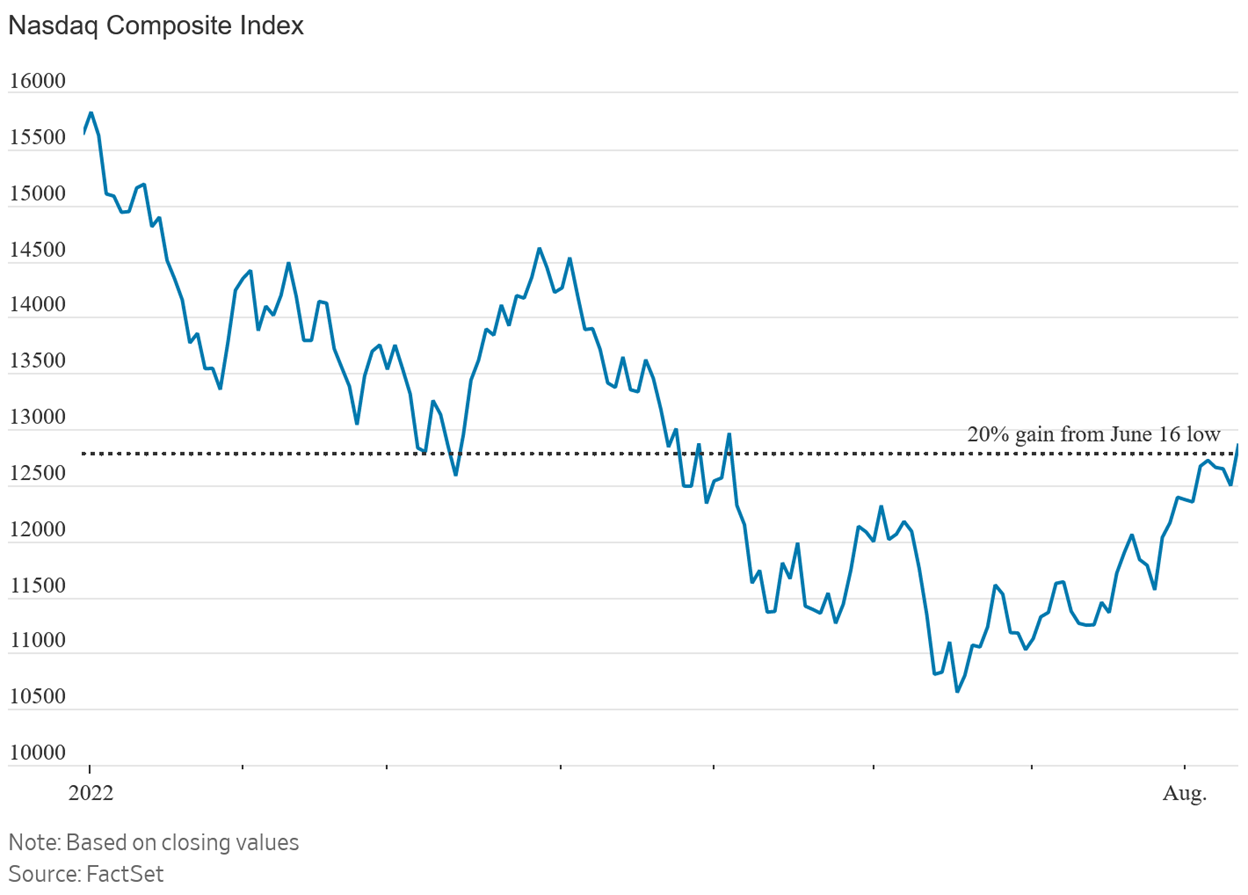

After yesterday's 2.9% rally, the tech-heavy Nasdaq is now officially in a bull market after rallying more than 20% from its recent lows. Here's the WSJ with the story and a chart: The Nasdaq Composite Is Back in a Bull Market. Excerpt:

It looks like more and more people are calling the Jun 16 low as the bottom of this bear market. It may very well be but the market tends to fool people into something that most people believe so. With that I'm quite cautious now with the thought of another major leg down to test the Jun 16 low in the weeks ahead. I can certainly be wrong but I'm willing to bet on it with some strategy that has a high risk/reward ratio in the range of 1:3 or more.The Nasdaq Composite is officially in a new bull market.

The technology-focused index rose 2.9% Wednesday, reflecting a rise of more than 20% from its low in mid-June. It climbed with other major indexes after a softer-than-expected inflation reading raised investors' hopes that the Federal Reserve may soon moderate the pace of its campaign of interest-rate increases.

The recent rise in the Nasdaq ended its longest bear market since 2008 in the depths of the financial crisis. It is still down 18% this year and was off 32% at its low on June 16.

Stocks have rallied in the past month after posting one of their worst first-half performances in decades, reflecting a popular bet on Wall Street that cooling inflation will permit the central bank to take a more supportive stance toward markets.

No comments:

Post a Comment