The Bear Market Case: Why We May Now Be Approaching Another Important Top in the U.S. Stock Market

- The markets have rallied robustly since the June market low.

- To a large degree the rally has been position driven – as the hedge fund community and others derisked and degrossed.

- As the momentum in stock prices began to improve, market structure and the role of passive investing products and strategies – who worship at the altar of price momentum – reversed from sellers to buyers.

- But the fundamental backdrop is arguably deteriorating.

- And valuations are not very compelling at a time in which the Federal Reserve is caught in a policy box given the toxic cocktail of likely sticky inflation and slowing domestic/global economic growth.

- Most investors find it hard to move outside the herd – it might again be time to be a contrarian.

- I have avoided the bearish consensus in June and plan to avoid the growing optimism in late August.

"There are decades where nothing happens; and there are weeks where decades happen."

– Vladimir Ilyich Lenin

Lenin's comments certainly apply to the inconsistent, frenetic, and manic market (down and up) action of the last several months.

While I thought that the move lower in the market in June provided a good entry point, based upon our calculus of upside reward vs. downside risk – the speed and magnitude of the strong advance during the month of July surprised me.

Indeed, the swiftness and size of the rise in equities last month have recently driven the markets back to valuation levels that concern me – reducing the general attraction of equities and posing the risk of more negative outcomes for stocks.

I now believe that risk assets are at risk...

As I have noted, almost every smart hedge hogger I know was bearish at the end of the first half of 2022. In the past I have used Dan Loeb's Third Point hedge fund as a proxy for the hedge fund community. Dan is the best of breed. In his investor letter he said he was over 70% net long at 2021 year end, 40% net long in April I believe, and in June a bit over 20% net long.

In the last two months we have witnessed the dual impact of both passive and defensively positioned active players buying. This has intensified over the last several weeks.

To summarize, while market structure and positioning usually doesn't have a long-term impact on equities, we learned over the last two months that it certainly can impact the short-term performance of stocks.

Renewed Concerns

July's market strength was the polar opposite of June's weakness. Markets experienced their strongest gains since November 2020.

While I was growing more optimistic on a trading basis two months ago, we did not expect the rally to be as swift and as violent to the upside.

To justify buying at today's prices means that one expects a new bull market leg – something I remain dubious of.

To me, besides low valuations, the proximate cause of the July advance was the market's interpretation that the Federal Reserve is on the path of a "soft pivot." We are of the view that market participants have misinterpreted Fed Chairman Powell's intentions.

While I have been in the "peak inflation" camp, I think inflationary pressures will be more stubborn than the consensus expects – in my base case of a "mild and brief" economic assumption. Structural headwinds to lower inflation remain – wages, rents, and the price of durable goods...

The recent easing of financial conditions has run counter to the Fed's likely path, and as seen over the last week, several Federal Reserve members have pushed back on the notion of a soft pivot.

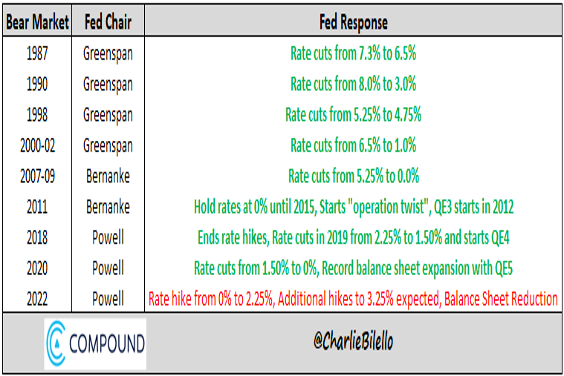

I expect a continued hawkish Federal Reserve and, with equities elevated, there is renewed market vulnerability. A major difference between today and prior bear markets continues to be Fed policy. During the previous eight bear markets the Fed responded with easy money every time, with rate cuts and quantitative easing, etc. This year the Fed is doing the opposite – hiking rates and starting to shrink their balance sheet. The last time we saw a hawkish Fed was during the bear market of the early 1980s when Paul Volcker led the Federal Reserve:

|

Unlike previous cycles, if the economy disappoints greater than expected, the Fed does not have the monetary tools to revive it. Nor do authorities have the fiscal tools and flexibility.

Non-U.S. economic prospects – especially in China and [the] EU – have not improved. In fact, since we turned a bit more constructive on the markets six to eight weeks ago, the non-U.S. economic outlook has measurably deteriorated. Based upon our research, China, in particular, likely faces the threat of lower-than-expected industrial production, retail sales, and fixed asset investment. Unless China abandons its aggressive Zero COVID policy, expected interest rate and reserve requirement cuts are unlikely to reverse the region's southerly economic destination.

I am skeptical that the U.S. can be an oasis of prosperity in an interconnected and flat economic world...

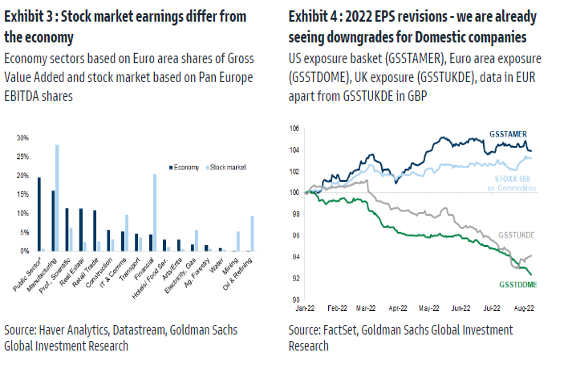

The earnings season, though better than many feared, has still not been good as forward guidance has disappointed and has raised more questions about prospective trends in profitability:

|

Q2 2022 S&P profits, excluding the contribution of the robust gains in the energy space, declined by 3.7%.

Consensus corporate profit expectations are too elevated. Indeed, the pace of the rise in input costs will likely lead to an earnings recession over the next few quarters...

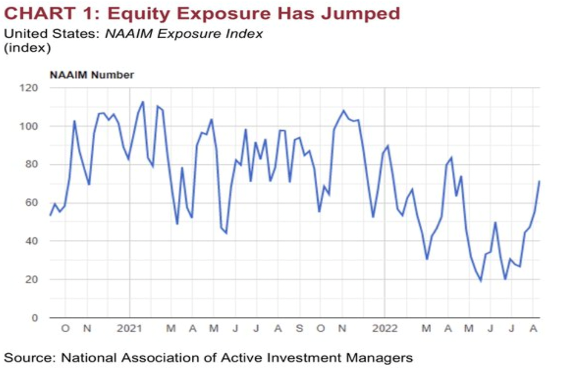

Investor expectations and sentiment, so dour six weeks ago, is now elevated. An oversold market in June has become overbought on every measure we look at as market strength is being bought. Short positions are being aggressively covered and fear of the return of capital has quickly morphed into the fear of missing out ("FOMO"):

|

Valuations have reset higher, quickly reversing the previous lower valuation opportunities. In June only 2% of the S&P Index components traded above their daily 50-day moving averages. We are now back to 86% of the S&P Index above their moving averages!

Bottom Line: Price Is What You Pay, Value Is What You Get

* Market structure and positioning have had a lot to do with the recent market advance

* I now believe risk assets are at risk

* In late July I faded the emotional burst of buying and reduced our long exposure

* Consensus profit estimates remain inflated and inflation will likely be sticky

In my view, the available opportunity set of six weeks ago has likely come and gone and a heightened regime of volatility and market vulnerability may, again, lie ahead.

On a more fundamental basis we continue to remain concerned – as we did at the beginning of 2022 – about the likely path of (hawkish) Fed policy, rising valuations, weakening global economic growth, and the growing vulnerability of U.S. corporate profits (and margins).

On the later score I would note only 57% of the companies that have reported Q2 2022 results have beaten [earnings per share] EPS and sales estimates (it was over 70% in the previous quarter). Moreover, one out of every five companies have lowered guidance.

To conclude, today's column is a reality check.

I have dramatically reduced my long exposure and have reestablished a much more conservative portfolio construction.

For the first time in a while, I am finding appealing short opportunities to complement my long holdings.

Doug Kass

No comments:

Post a Comment