Following the quick flash down last week due to the hawkish FOMC tone, the market has bounced back strongly, probably more than "strongly" as it has not only gained back everything it has lost, it has managed to be on the verge of challenging its new all time highs. It is quite impressive of course for the bull's tenacity but can that bullishness be maintained? See below the historical data to get an idea what is most likely coming in the few weeks ahead.

********************************************************

With internal weakness that's been festering for a while, then a dip in most stocks to end last week, some sensitive breadth measures neared oversold territory. Monday's surge took care of much of that.

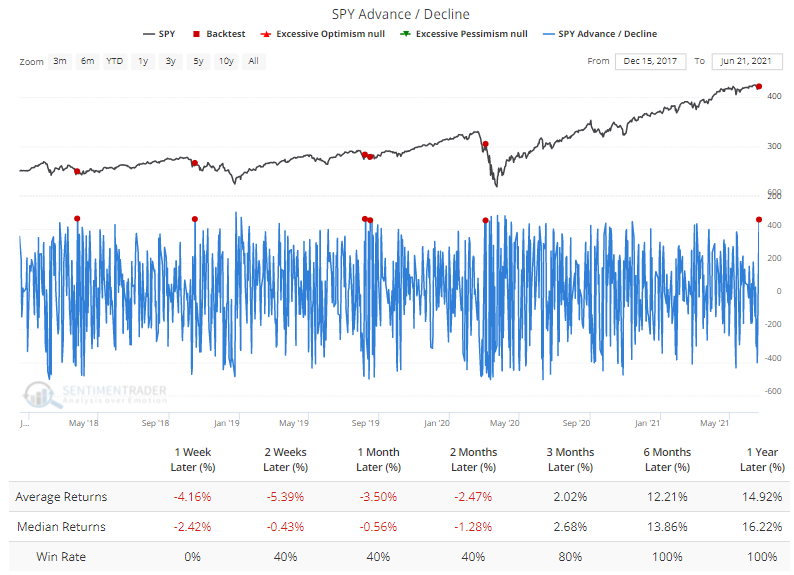

Traders get excited when there is a lopsided day in the markets. On Monday, it was all-aboard to the upside, with few stocks failing to rise. There have been more than 450 net advancing stocks within the S&P 500 only five other times in the past five years.

No comments:

Post a Comment