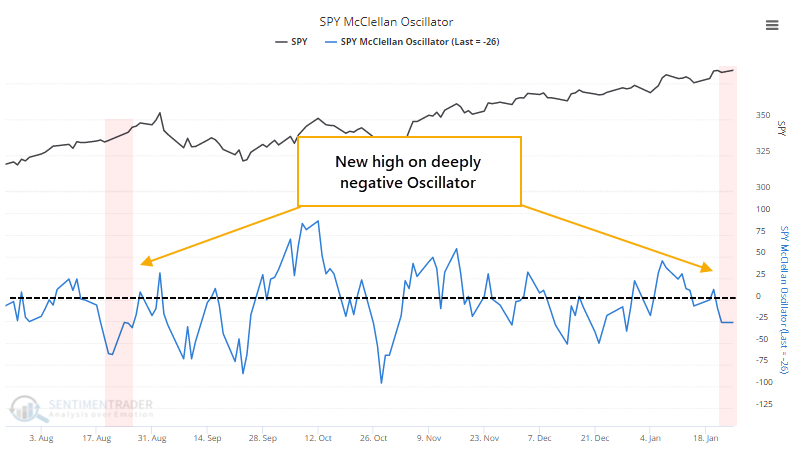

We saw this setup last August when S&P was up 300 points in the month, pretty good Um?

The S&P hit a high, but most of its stocks are in downtrends

Since markets bottomed last fall, a lot of stocks (and bonds) were rising, and the buying pressure was impressive. That kind of activity tends to lead to longer-term gains.

Shorter-term is a different matter, but even that has led to only inconsistent losses. The biggest issues have come when underlying momentum wanes and we see cracks under the surface.

That's what's happening now.

Relatively few stocks have been rising on days the S&P 500 shows a gain. That difference between advancing and declining stocks has been negative enough that the McClellan Oscillator for the S&P 500 is well below zero.

It's unusual to see the Oscillator below zero, and especially well below zero, when the index itself closes at a 52-week high. The only time in recent years that it triggered was last August.

No comments:

Post a Comment