Options speculators are outspending hedgers 3-to-1

Options traders' enthusiasm didn't let up as they closed out the year. In fact, it got only more intense.

To end last week, the smallest of traders accounted for 45% of all opening call purchases, dwarfing the largest traders who accounted for only 30% of volume. That's the 2nd-widest spread since 2000.

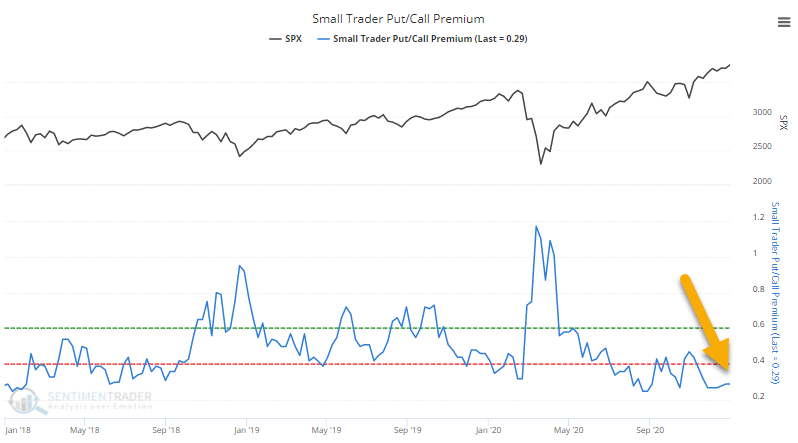

During the last week of December, the smallest of traders spent nearly $3.50 buying call options to open for every $1 in puts they bought. Our Backtest Engine shows that returns in stocks over the 1-2 months were unkind.

The most reliable sentiment measures tend to be those that focus on real money and leveraged instruments. That's when emotion has the greatest impact. And when we look at some of the most leveraged vehicles available to investors, there is widespread evidence of extreme speculation.

No comments:

Post a Comment