by SentimenTrader

If you're invested in one of the groups that has skyrocketed in the past couple of weeks, then it would only be human nature to feel a little giddy. Euphoric, even.

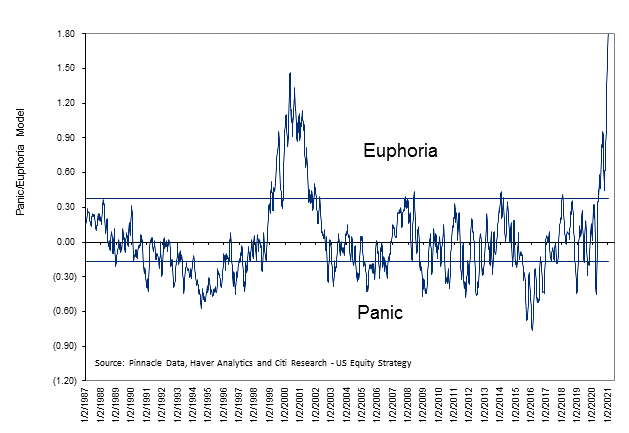

Based on a popular model, that's exactly how many investors are feeling at the moment, as the Citi Panic / Euphoria model has soared to a record high.

We created a proxy model using publicly available inputs, and it shows a fairly clear contrary nature - when it's high, the S&P's returns over the next year tend to be low; when the model is low, the S&P's returns are high.

Whenever this proxy was above 1, occurring about 14% of the time since 1988, the S&P 500 returned an annualized -3.7%, compared to an impressive +21.4% when it was below zero.

Even though this proxy isn't as extreme as the one shown above, it did just record the 3rd-highest reading in 30 years.

No comments:

Post a Comment