Gold has some wild gyrations recently and mostly still in a downward trend since its recent peak in August. You should not be surprised by this correction if you have read my blog about gold (see here). While gold may continue to be underperform in the near future for a while, its fundamental strength has not weakened at all. It is just a rest after quite a strong bullish run early this year and for the long term, gold's future has never been so bright!

Per the Sentimentrader.....

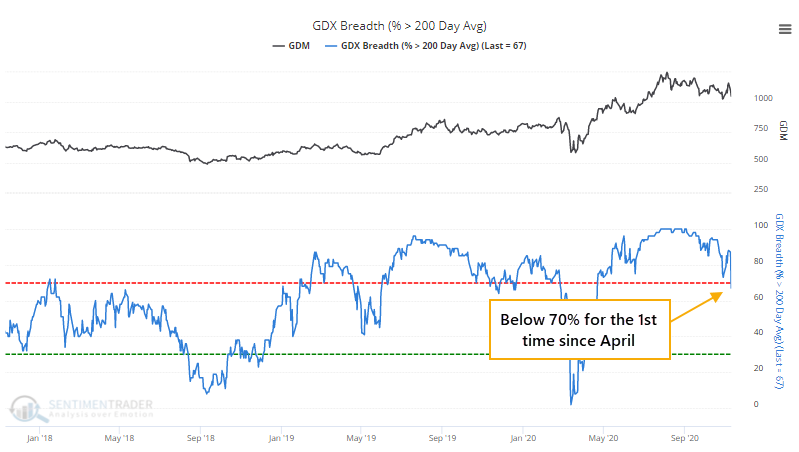

Gold miners haven't had this few uptrends in months

The relief rally this week, while historically broad, certainly didn't bring along all comers. Gold stocks have been looked at as a potential safe haven this year, even though their record on that score is mixed at best. Even so, investors saw no need for them this week.

As a result of the selling pressure, fewer than 70% of gold miners have managed to hold above their 200-day moving averages, the fewest since April.

This ends a long streak with more than 70% of miners being in long-term uptrends. Going back to 1986, there have only been a few times when more than 70% of mining stocks held above their 200-day averages for more than 6 months. The most recent one was the 4th-longest ever.

In most markets, when we see an end to a protracted streak of momentum, there is often some shorter-term weakness, but longer-term strength. Momentum does not die easily, but commodity-related markets are different beasts.

No comments:

Post a Comment