I'm sharing this writeup which is very consistent with the Thanksgiving spirit! Hope you like it👏

|

|

LEGAL DISCLAIMER Please note everything discussed at this site is a personal opinion of the author and may contain errors or omissions. NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT. It would be your sole responsibility for actions you undertake as a consequence of any analysis, opinion or advertisement on this site.

I'm sharing this writeup which is very consistent with the Thanksgiving spirit! Hope you like it👏

|

|

I'm showing you two charts below to let you judge yourself what will happen if Biden is indeed allowed to steal the votes to become the next fake president!

I guess you don't need me to decipher what Trump has done economically to the country in the past 4 short years. No one since 1929 has done what he has done to so much boost the income level for general Americans.

|

The U.S. withdrawal from the Paris Agreement has been used to label the U.S. as anti-environment... But the chart above gives us a fresh perspective. We're doing a great job protecting our environment.

So what a Biden presidency (God forbidden if it indeed materializes) will do to this fantastic economic trend for the country? You can safely bet the US will revert back to the economic stagnation and become much worse than what Trump has done! Two reasons:

Early this month, I said a rotation has likely started for the most beaten down sectors like energy and banking to shine again (see here). Sure enough, both of them have been doing quite well in the past few weeks. Here is the current bank index chart, which is clearly showing a straight line up since early Nov. Of course, you can argue this is merely a dead cat bounce that it will repeat what it did back in June to back down again.

Sure no guarantee that it must be a new uptrend for banks but I'm more convinced that banking as a sector has bottomed by now and is ready to go much higher from here. As shown below in the weekly chart, the sector has broken out from the multi months triangle since early Nov and has even burst through the immediate resistance from the Jun highs. This is quite bullish, especially supported by the very strong weekly momentum. I think the sector is moving towards challenging its recent major highs before the Mar crash in the next few months ahead.

Having said that, don't expect a straight line up for too long and rush to buy bank stocks now. Most likely it may cool off a bit first to take a rest before resuming its next leg up. This will be healthy for the sector if it wants to indeed sustain its uptrend from here!

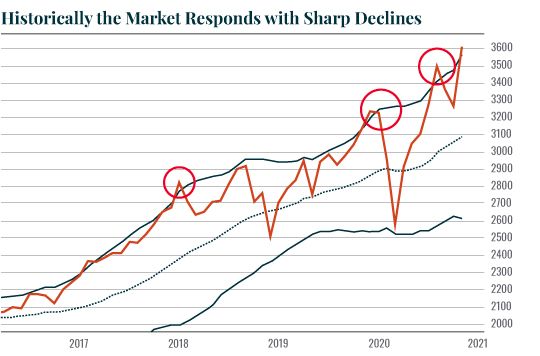

By the way, regarding the overall market, be aware the first two weeks or so are typically the time for money managers to dump stocks to realize their capital gains and rebalance the portfolio for the year end. So don't be surprised to see some selloffs in the next week or two, especially right now with the sentiment supper high, more so than that just before the Mar crash. This is a contrary indicator, suggesting the risk is quite pronounced at the moment. Be cautious!!

Relaxed Turkeys, Beware of Coyotes |

By Jeff Clark, editor, Market Minute Yesterday I discovered a turkey carcass on the hillside behind my house. I guess coyotes celebrate Thanksgiving too. On the previous morning, I stood on my porch and watched a flock of wild turkeys scratching around my backyard, hunting for whatever it is that turkeys hunt for. It seemed odd to me that these birds felt so comfortable in my presence. Didn't they know Thanksgiving was this week? Didn't they know a relative of theirs was on the menu? Didn't they fear they'd be put on the menu as well? Apparently not. I ventured off the porch and walked out among the feathered creatures. They hardly noticed me. Oh sure, if I got within a few feet of any of them, the flock would saunter away in the opposite direction. But, rather than cackling and flapping their wings and scattering, they casually just strolled away – putting a little extra distance between us. "Pretty darned relaxed," I thought – for turkeys to be so fearless and complacent this close to Thanksgiving. They reminded me of investors. On Monday, the CBOE Put/Call ratio – one of the best tools for measuring investor sentiment – closed at 0.65. That's one of the lowest levels of the year. Folks are jumping over themselves buying speculative call options. Investors, just like the turkeys that frolicked in my backyard, are relaxed and comfortable – maybe too comfortable. Of course, that's what happens when the stock market makes new highs just about every day… And, that's what happens when the biggest declines we get are just one or two percent, and last only a couple of days. Investors, like country-club turkeys, stop worrying about the potential dangers of their environment. For the past couple of weeks, we've been warning about the dangers of complacency. But, when stocks are running higher, no one wants to hear that sort of thing. It's kind of like the grandmother who hurries through the sand to tell all the teenagers at the beach party to wear sunscreen. The teenagers nod politely and thank her for her advice. But then they roll their eyes once she moves on. Of course, at the end of the day, someone always gets burned. It seems as though almost everyone is bullish right now. Traders are buying call options like crazy. The talking heads in the financial media are suggesting there's nothing to worry about. It's nothing but blue skies and new highs for the stock market. At this point, though, with the Dow hitting 30,000 for the first time ever, and with the S&P 500 trading at its highest level of the year, it may make sense to cackle, flap our wings wildly, and scatter in all directions. Otherwise, we might end up as coyote food. |

**********************************************************************************************************************************

By Jeff Brown

Announced on May 15 of this year, Operation Warp Speed (OWS) has already been one of the most successful public-private partnerships in history. And it certainly has been the fastest to produce results.

The partnership was designed to do one simple thing: develop vaccines and therapies effective against COVID-19 as soon as is humanly possible, and most certainly before the end of this year.

And it delivered.

Immediately following the election, we have already seen several major announcements of both Phase 3 clinical trial results as well as Food and Drug Administration (FDA) approvals for emergency use authorization (EUA).

And the last three days were no exception.

On Saturday, the FDA authorized Regeneron's COVID-19 antibody therapy for treating mild to moderate cases of COVID-19 in patients 12 years of age or older. This authorization is especially useful for the most at-risk population of those older than 65 years.

Regeneron's approach is different than the vaccines in that its antibodies attach to the COVID-19 virus and prevent it from replicating. They basically help our bodies shut down the virus before it can cause too much trouble.

This authorization comes on the back of the FDA's previous authorization for Eli Lilly's antibody therapy earlier this month.

And if that weren't enough, early this morning AstraZeneca and the University of Oxford announced that their COVID-19 vaccine was as much as 90% effective in large clinical trials.

Equally important is that there were no serious safety events related to the vaccine in the trials. This news comes immediately on the back of Moderna's announcement of 94.5% efficacy and Pfizer/BioNTech's 95% efficacy.

That's not one, not two, but three effective vaccines that will soon be available in the coming weeks. And it's all the result of Operation Warp Speed.

There are now three approved therapies for COVID-19: Gilead's remdesivir, Eli Lilly's antibody therapy, and now Regeneron's antibody cocktail.

So how did this all happen? Was it just luck? Absolutely not.

It was money, plain and simple. It was an explicit commitment of funds that backstopped the development and large-scale manufacturing of the vaccines and therapies.

This allowed the biotechnology and pharmaceutical companies to race ahead, at warp speed, without any risk of losing money.

Need proof? Here it is:

AstraZeneca received up to $1.2 billion of support on May 21.

Moderna received up to $483 million in support on April 16. This was later expanded to an additional $472 million for late-stage clinical development.

Moderna received up to $1.5 billion in funds to support large-scale manufacturing and delivery of its vaccine on August 11.

Pfizer received up to $1.95 billion in funds to support large-scale manufacturing of its vaccine on July 22.

Regeneron received $450 million in funds to support large-scale manufacturing of its antibody therapy on July 7.

Eli Lilly received a $375 million agreement for the sales of its COVID-19 therapy on October 28.

I remember reading so many negative articles and opinions about this public-private partnership and how so many "experts" told us that it would be years before we saw a vaccine.

They were dead wrong.

When the risk of bankruptcy was removed and all work was guaranteed, the industry didn't have anything to lose. The normal "risk versus reward" business decisions were no longer necessary. There wasn't any risk, and there was a lot of reward. And that's why it happened so quickly.

Moving at this speed wouldn't have been possible inside the bureaucracy of a government laboratory.

But in the labs of leading-edge biotechnology companies, this kind of fast innovation is not only possible but normal when there is funding available.

I hope you share my overwhelming sense of optimism.

Why? Because if we can develop vaccines and therapies within the span of six months, we can also start to tackle many of the world's other diseases that are far more dangerous than COVID-19.

And we're not going to have to wait a decade or two before the "cures" become available.

Last week was a big one for Tesla shareholders.

After languishing since August, Tesla shares rallied 21.2%.

This was on the back of the news that Standard and Poor's is adding Tesla to the S&P 500 Index.

Tesla will be the largest company to ever join the S&P 500, rocketing into the index's top 10 holdings from day one.

If you own an S&P 500 index fund, you'll soon be a Tesla shareholder.

Is this good news for soon-to-be Tesla shareholders?

Or is this the beginning of the end for Tesla, as it was for Yahoo back in the dot-com boom?

Of course, no one can predict the future.

But the analysis below can help you answer that question.

Does S&P Inclusion Signal a Top for Tesla?

Overhyped growth stocks often reach their peaks not long after joining the S&P 500 Index.

Yahoo joined the S&P 500 in December 1999.

The stock price peaked four months later, when Yahoo's market cap soared to $125 billion.

Fast-forward to 2017, and Verizon purchased Yahoo for $4.5 billion - a 96% discount to its peak valuation.

Will Tesla share Yahoo's fate?

Time will tell.

One thing is for sure. Tesla's valuation today is nothing short of silly.

The only thing sillier is the intellectual gymnastics Morgan Stanley's analysts go through to justify Tesla's valuation.

Last week, the bank included Tesla's ancillary services - like its Autopilot software, its home energy products, its insurance and the long-awaited Tesla network - in a valuation of the company.

Meanwhile, back in the real world, Tesla can't even make any money selling cars.

Tesla's profits come from selling regulatory credits, rather than selling cars.

Everything else is just promises on a press release.

To grow into its valuation, Tesla would have to achieve record-breaking growth and unprecedented margins, all in an increasingly competitive environment.

It may do that. But it is not a bet any rational investor would make.

Is Tesla Now a "Big Short"?

The Tesla story reminds me of Yahoo in another way.

I've written before about one of my favorite trades ever - Mark Cuban's options trade on Yahoo.

In 1999, Cuban and his partner Todd Wagner sold Broadcast.com to Yahoo for $5.7 billion.

Cuban received 14.6 million shares of Yahoo.

With Yahoo shares trading at $95, he became a billionaire overnight.

Cuban wasn't alone. The internet bubble made a lot of people rich. But after the bubble popped in March 2000, most of them lost their fortunes.

Cuban, on the other hand, actually got to keep his money.

Because he had the foresight to execute a shrewd option trade to protect his wealth.

Cuban had a feeling that Yahoo stock was funny money. Yet, as part of his deal with Yahoo, he wasn't permitted to sell his shares immediately.

So he entered a massive options trade to protect his $1.4 billion stake.

For every 100 shares of Yahoo stock, Cuban bought one put contract (strike $85) and sold one (strike $205). The term of each option was three years.

He bought a whopping 146,000 puts and sold 146,000 calls.

The cost of the puts exactly offset the premium of the calls. So Cuban's trade was practically free.

At first, it looked like the trade was a costly mistake.

Yahoo's share price shot up to $237 by January 2000 - much higher than the sale price of his $205 call options.

Then the internet bubble burst.

And two years later, Yahoo shares had sunk to $13.

If Cuban hadn't executed his options trade, he would have lost more than 85% of his wealth.

Instead, he managed to hold on to almost all of his money.

Tesla bears could replicate the same trade today.

The bottom line?

Yes, the news of Tesla entering the S&P 500 is bullish.

Bloomberg estimates that when Tesla joins the S&P 500, index funds will have to buy roughly $40 billion worth of the company's shares.

But remember, as public knowledge, this news is baked into the share price.

Here's my hypothesis: Tesla's admission into the S&P 500 just might signal the end of its historic run.

Put another way...

Tesla is not the next Apple.

It is the next Yahoo.

As I've noted previously, unless President Trump formally concedes, Joe Biden is NOT the president-elect until December 14 at the earliest. (That's when states formally cast their electoral college votes.)

Note that the word "media" is not used anywhere in the above paragraph. The mainstream media has no say in how elections turn out. And similarly, they have no idea what they're talking about in terms of who will ultimately win the election.

I say this because the media has begun to claim that every market rally is due to Joe Biden saying or doing something. The media is literally acting as though Biden is now directing the stock market as president of the United States.

But the global markets actually say otherwise…

The China Indicator

Regardless of your political affiliation, I believe practically everyone can agree President Trump was the first anti-China president in the last 40 years. He certainly was more anti-China than Joe Biden, who was openly critical of President Trump's trade war and tariffs.

And then of course, there is the fact that the Biden family has received millions (if not billions) of dollars in financing from Chinese business and government-linked entities over the years.

With that in mind, I want to point out that China's stock market is struggling to make new highs. It initially exploded higher the day after the election, when the media called the win for Joe Biden (blue circle). But since that time, it's basically flatlined (red circle).

If Joe Biden was definitely winning the presidency, which would mean an end to the trade war between the U.S. and China, shouldn't China's stock market be exploding higher?

With that in mind, I stand by my original forecast that President Trump will end up winning this election in the courts.

Best Regards,

Graham Summers

Editor, Money & Crisis

By the way, if you are interested in joining my DW investment group, we have set up a Telegram group.

Here is the link for "DW 谈股论金": https://t.me/joinchat/SgYa_xNrjTNHk9cS51ke0A.

Importantly, you cannot join directly via Wechat. Two options:

"Investors buy the most at the top, and the least at the bottom."

This is not my words but wisdom from a veteran investor!

Following the election, we start to see more signs of investors piling into stocks in earnest and actively chasing highs. Let me show you some charts to demonstrate it.

First is the money inflow into stock funds, which has recently hit all time highs. The last time we saw this type of surge was in December of 2017, followed by a near 20% decline just two months later.

Then the famous "fear/greed" indicator, which primarily comprises investor positioning, shows much of the same as "bullish sentiment" pushes back to extremes. Do you see any fear here?

Here is another sentiment indicator, the AAII bullish sentiment, which has remained consistently depressed since March but all of a sudden, it shot up to the extremely bullish level similar to that seen before the Mar crash.

The percentage of bulls in the American Association of Individual Investors (AAII) survey rose to 55.8% while bears dropped to 24.9%, pushing the Bull Ratio, a more accurate measure of optimism, above 69%. The last 2 times it got this high, stocks ended up running into trouble eventually." – SentimenTrader

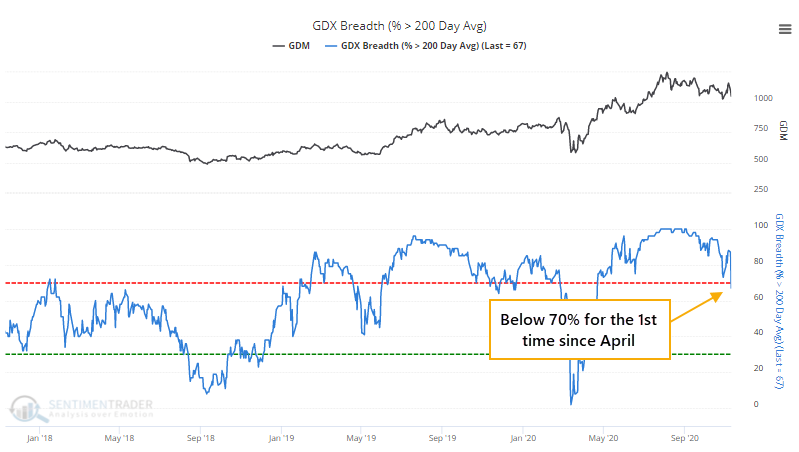

The relief rally this week, while historically broad, certainly didn't bring along all comers. Gold stocks have been looked at as a potential safe haven this year, even though their record on that score is mixed at best. Even so, investors saw no need for them this week.

As a result of the selling pressure, fewer than 70% of gold miners have managed to hold above their 200-day moving averages, the fewest since April.

This ends a long streak with more than 70% of miners being in long-term uptrends. Going back to 1986, there have only been a few times when more than 70% of mining stocks held above their 200-day averages for more than 6 months. The most recent one was the 4th-longest ever.

In most markets, when we see an end to a protracted streak of momentum, there is often some shorter-term weakness, but longer-term strength. Momentum does not die easily, but commodity-related markets are different beasts.

Disclaimer: None of the following is meant to be political analysis. I am not endorsing nor disparaging any candidate. I'm simply outlining the facts pertaining to the U.S. Presidential election.

I want to warn you that the next few months in the U.S. will be extremely ugly.

The country was already deeply divided before this election. And unfortunately, it's only going to get worse.

The fact is that Joe Biden HASN'T actually won this election yet.

That is not a typo. The media has done the U.S. a great disservice by claiming that Biden is the winner this early in the game.

How the Real Election Process Works

Everyone needs to take a step back and understand how the actual election process occurs based on federal law, not media reporting.

1) The election occurs in early November.

2) Votes are tallied while officials from both parties (Democrats and Republicans) are present.

3) Provided officials from both parties are present during the vote tallies and there are 1) no credible accusations of fraud and 2) no software glitches, the vote tallies are then ratified.

4) If the vote margin between winner and loser is 0.5% or smaller, an automatic recount is required.

5) If the margin between the winner and loser is larger than 0.5%, but either candidate (or a third candidate for that matter) wants to dispute the results, he or she can pay to have a recount performed. The cost is roughly $3 million per state.

6) Once the recount is completed (or if no recount is necessary) the individual states formally declare the winner on December 14 when they officially cast their electoral college votes for that candidate.

7) In early January of the following year, the new congress meets to count the electoral college votes, and formally declare the winner.

8) The new president is sworn into office on January 20.

This is how presidential elections work in the U.S. under normal circumstances.

The media cannot decide who wins. The media can simply project who they think will win based on vote totals at a given time. And unless the loser formally concedes prior to December 14, the election remains in play.

So Where are We in Terms of the 2020 Presidential Election?

For starters, the races in multiple states (Georgia, Pennsylvania, Nevada, Wisconsin, Michigan, and Arizona) are close enough to require mandatory recounts (within a margin of 0.5%).

On top of this, the Trump administration will be filing lawsuits in Georgia, Pennsylvania, Nevada, Wisconsin, Michigan, and Arizona alleging fraud, illegitimate votes being counted, and GOP officials being barred from witnessing the ballots being tallied.

Whether or not the Trump administration is right about this remains to be seen.

However, the fact lawsuits are being filed means the election will move into the courts. If the courts decide that the evidence the Trump administration presents is compelling, they can require a formal vote audit.

If, during the vote audit, actual fraud is discovered, the court can rule the fraudulent votes are no longer valid. The formal vote counts would change, and it is possible that a given state ends up declaring a different winner.

Fraud isn't the only factor that the courts can rule on. If there are problems with the ballots (the wrong type of ink was used to mark a ballot or a hole punch doesn't go all the way through the ballot as was the case in Florida in 2000, etc.), the courts can deem those problematic votes as illegitimate as well.

This again can mean the formal vote counts can change, and it is possible that a given state ends up declaring a different winner.

Mind you, that's if the courts resolve the issue to everyone's liking on the first go round.

If either party or candidate is dissatisfied with a lower court's ruling, they can appeal the ruling, which can result in the lawsuit moving up to a higher court, eventually reaching the Supreme Court, the ultimate arbiter of election law in the U.S.

This was the case in the 2000 election, when the Supreme Court ruled that vote cards from Florida that didn't have clean hole punches were NOT valid. The ensuing recount gave the state to George W. Bush and resulted in Al Gore conceding the election on December 13.

The Bottom Line

None of the above items are conspiracy theory or wishful thinking. These are the actual facts of how presidential elections are decided in the U.S.

The media doesn't decide elections. And technically, Joe Biden is NOT the president-elect, no matter how much certain people might want him to be.

Remember, he wouldn't be formally declared the president-elect until December 14, 2020, and that's under normal circumstances.

And as I mentioned already, this election is anything but normal.

I mention all of this to help you keep a clear head during what is going to be an extremely stressful and psychologically draining four-week period between now and that date.

Again, this election WILL not be decided before December 14. And it's possible things run even longer than that.

Best Regards,

Graham Summers

Editor, Money & Crisis