I'm not talking about myself but a paraphrase for the hedge fund manager, Mark Spiegel.

I think it is useful to share his thoughts about the current market conditions that in many aspects mimic what had happened during the bubble formation period back in the late 90s. No, I definitely don't consider a huge market crash is coming unless Biden wins the election, which can easily trigger a 50% market run. I have more confidence now that this won't happen but it doesn't mean the market is safe right now. Remember, during the late 90s period when the tech melt-up was ongoing, I think there were 7 times the market corrected by 10-15% or more before the final euphoric run towards the ultimate peak.....

******************************************************************************************

Mark Spiegel of hedge fund Stanphyl Capital believes that there's a bubble in growth/tech stocks. In his recent investor letter, he explains why his fund is down this year...

So our short positions have obliterated the profits from our long positions, and yet when this bubble pops we'll be glad we have them.

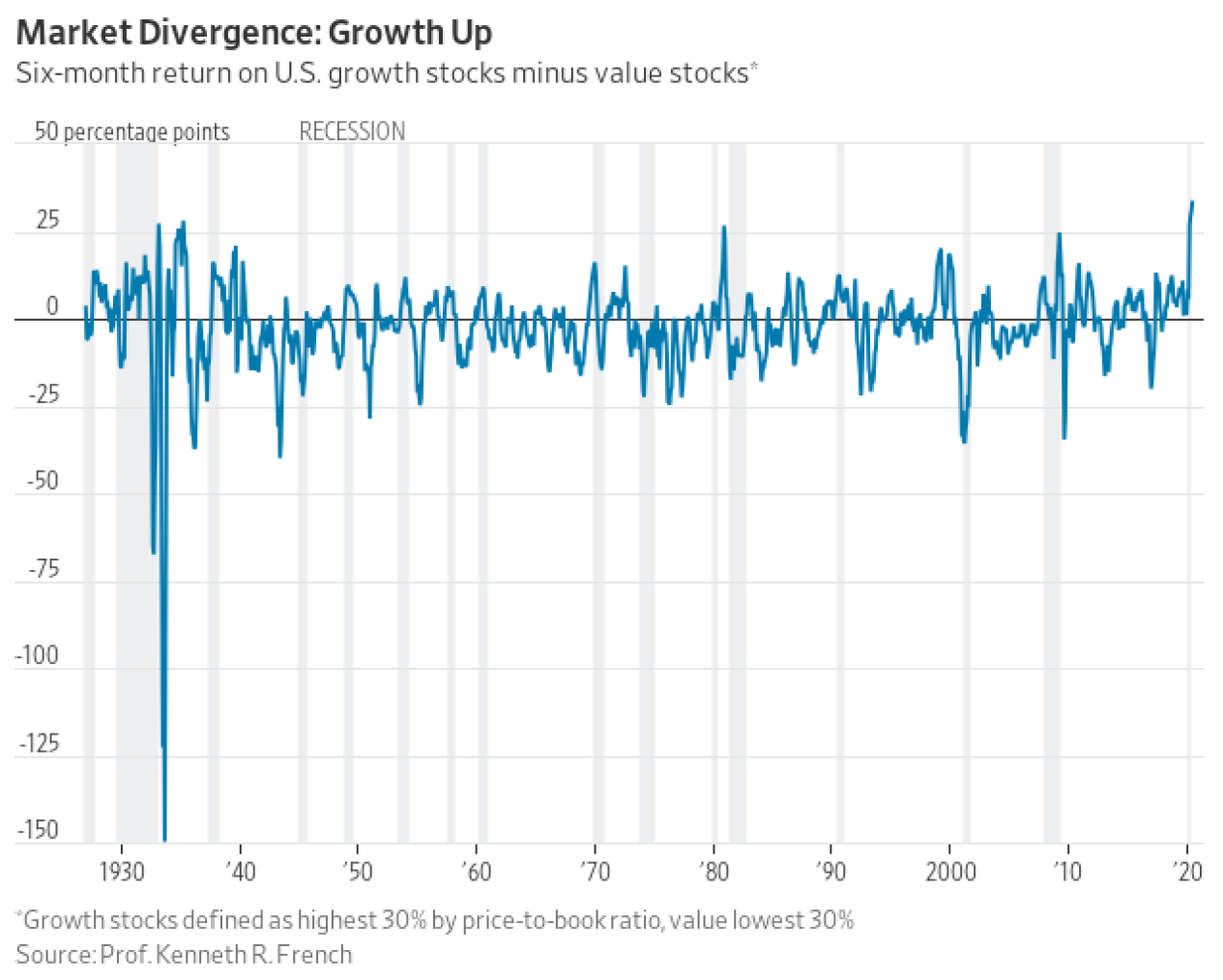

The dichotomy between our longs and our shorts is well illustrated in this chart showing a record divergence between the performance of "growth stocks" vs. "value stocks," yet I believe that as has always happened in the past, this will mean-revert in our favor:

Later, Spiegel explains why he's maintaining a large short position in the Invesco QQQ Trust (QQQ), an exchange-traded fund that tracks the Nasdaq 100 Index:

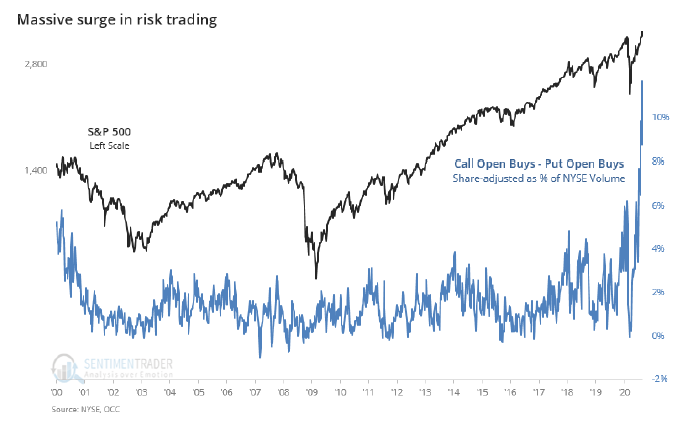

For DW investment group, we have set up a Telegram group. If you want to join, Here is the link for "DW 谈股论金": https://t.me/joinchat/SgYa_xNrjTNHk9cS51ke0A.I have a "near-term reason" and a "long-term reason." Near-term, bullish speculation is (literally) off the charts: for the last two weeks the Put-Call ratio for Nasdaq 100 constituent stocks closed at the extremely low (i.e., "complacent") level of 0.42 and intra-day today it hit 0.21, which may be the lowest level ever. Meanwhile, @SentimenTrader points out that call option buying as a percentage of NYSE volume far exceeds that of the 2000 bubble era...

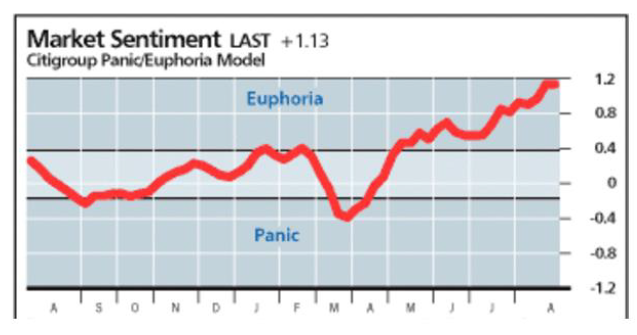

... while @hmeisler shows us that Citi's Panic/Euphoria index is well into "Euphoria" mode – by far the highest it's been since the bubble peak in 2000 (when it hit approximately 1.5):

Valuation-wise, on a forward [price-to-earnings] basis, the S&P 500 is now at the peak of the 2000 bubble...

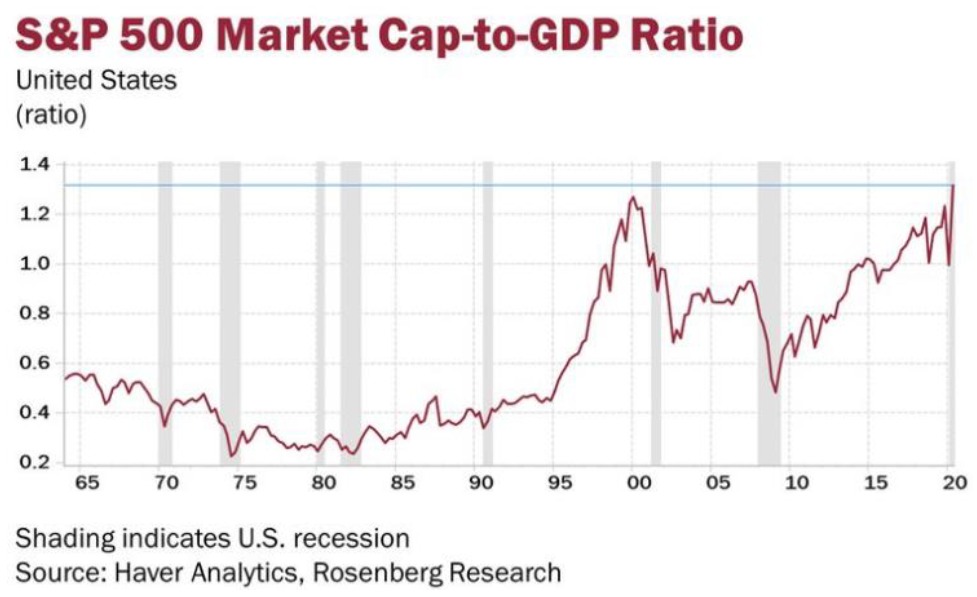

... while as a percentage of GDP the S&P 500 now exceeds the 2000 bubble's peak...

... and the broader stock market (the Wilshire 5000) hugely exceeds the 2000 peak:

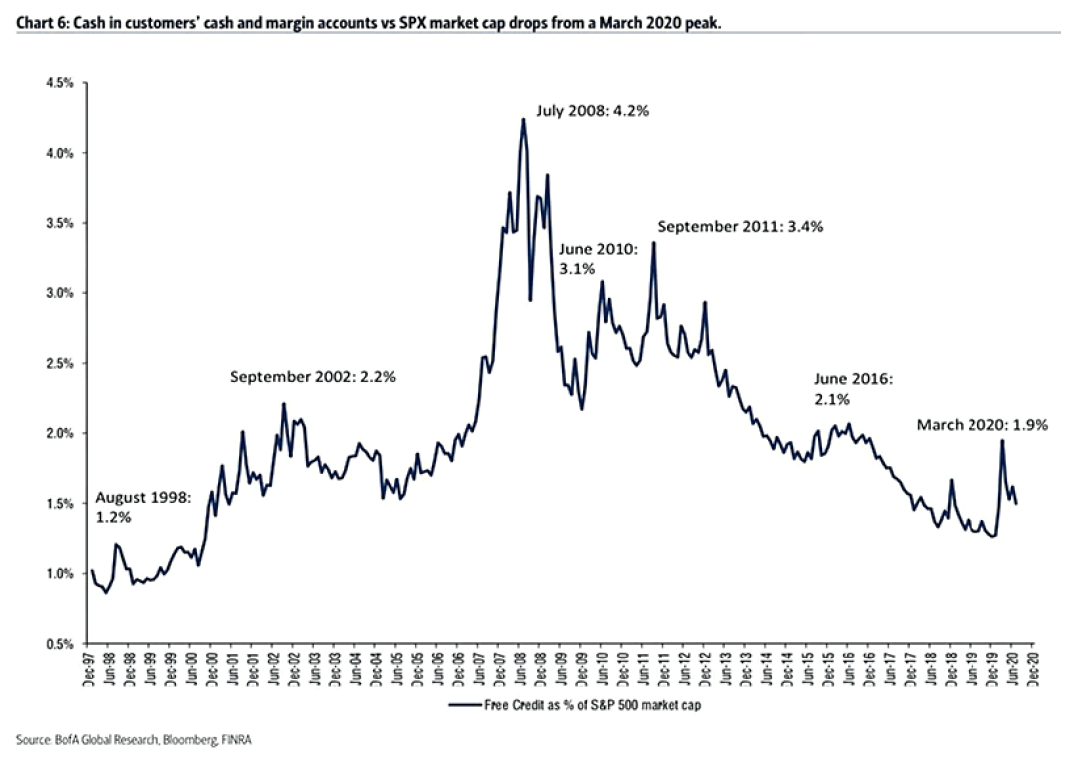

And from @ISABELNET_SA we can see that available buying credit (cash) in customer accounts as a percentage of S&P 500 market cap is down near the level it was at the peak of the 2000 bubble...

... while as @Fxhedgers points out, there are almost no shorts left:

So "excessive bullishness & complacency" is the near-term reason why I maintain our QQQ short position. Medium-to-longer-term I believe the Federal Reserve's endless money-printing combined with massively profligate deficit spending from both parties in Washington and growth-retarding levels of debt will return us to an environment similar to the stagflationary 1970s; i.e., slow growth and high inflation (which we got a hint of this month). In that environment, high-flying stocks (such as the QQQ we're short) will suffer massive PE multiple compression, and gold (which we're long) will climb steadily.

- When open the blog in Wechat, 点击右上角的三点,然后选在Safari 中open,然后点击the link and then join

- Or copy the link and paste to Safari to open and then join

No comments:

Post a Comment