As expected, the market indeed had a wonder rally but lasted just one and a half days!! But judging by the VIX and a few other indicators, I feel the bounce may have not just been done yet. Likely we may see some further rally early next week before we see another more profound plunge. For that I opened a few long positions for SPY and TSLA etc, last minute before the closing today. Having said that, I'm pretty sure we are going to see more volatility in the weeks ahead. And I even have an increasingly stronger conviction that we probably will see a lot longer lasting volatility post the election, probably in terms of months at least. I will post more thoughts about this later. For today, I'm sharing an interesting observation about what has driven the current bubbish euphoria in the past few months. We are always told that the market is largely controlled and driven by the deep pocket money, the institutional investors. But nowadays, we are witnessing something never seen before: the smaller retail traders, or the dumb money, are playing a more and more important role in the market moves. I'm sure the following is an interesting reading for you.

Per SentimenTrader:

Throughout much of July and August, Dumb Money Confidence was exceptionally high, which typically precedes poor returns in stocks. Yet the major indexes consistently hit new highs. Almost never before has "dumb money" been so right for so long, which we also saw has typically been about "it" for those traders.

Perhaps now we know why.

The biggest story in markets over the past few days has been the unveiling of Softbank as a large buyer of call options on a few big tech stocks. But this is not really the true story at all. It's easy to package and sensationalize a simple narrative that a single huge entity has been buying a bunch of calls. The more accurate story is that it's mom-and-pop driving these stocks higher, not Softbank.

Unless Softbank's traders divided up their orders into tiny lots, the massive jump in call buying is from the average stay-at-home gambler. And last week's volatility didn't discourage them, it did the exact opposite. They added to their bullish bets.

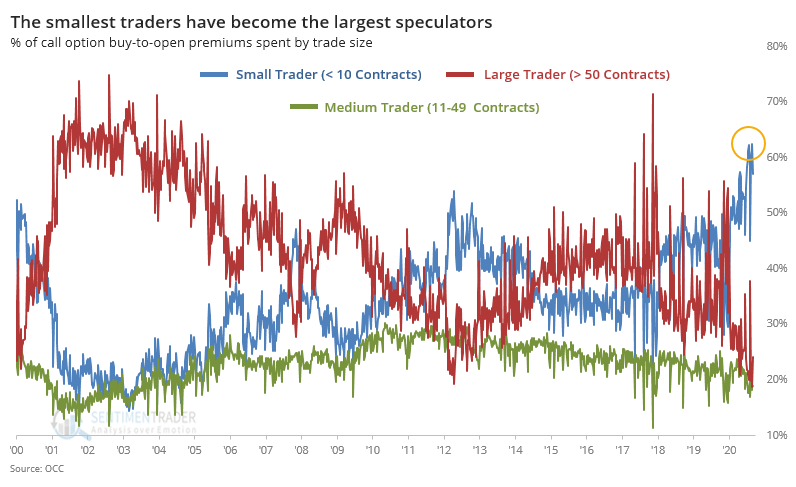

Among trades for 10 contracts or less, 53% of total volume went into buying call options to open. That's a record high.

These small traders have become the biggest part of the options market. Since mid-July, trades for 10 contracts or fewer have consistently accounted for more than 60% of all opening call purchase premiums, massively dwarfing larger trade sizes.

Over the past four weeks, retail traders have generated exposure accounting for nearly 1.7% of the S&P 500's entire market cap. In the coming weeks, most of these contracts are going to expire, exposing traders who bought the underlying stocks as a hedge. Unless they sell - and that's a lot of stock to sell.

++++++++++++++++++++++++++++++++++++++++++

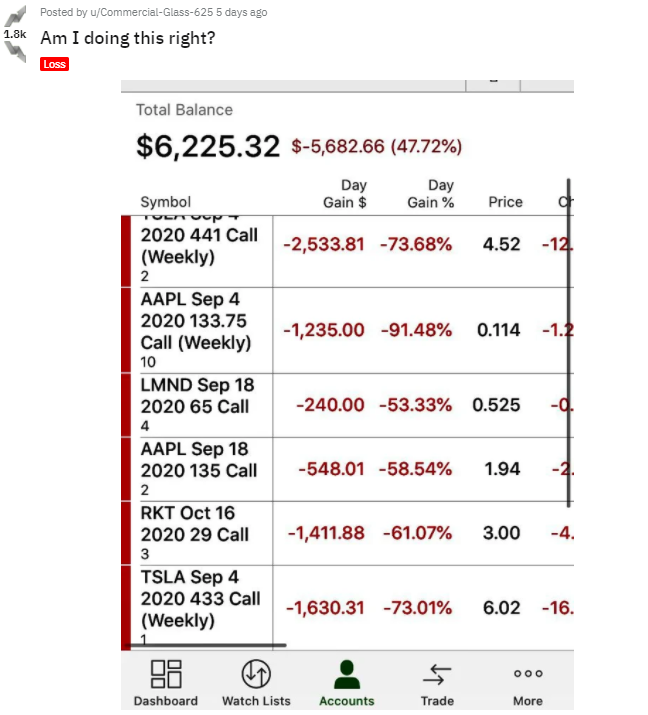

But dumb money is often doing something foolish and dumb, especially when they are chasing or FOMO at the extrems. Here are two examples as proof of the foolishness that has been going on recently. One screenshot post from Reddit...

|

Here's another trader's post from Twitter...

|

I hope those who read my blogs would take my advice and become more conservative lately and would be able to mostly avoid the carnage in tech over the past few days.🤓

******************************************************

By the way, if you are interested in joining my DW investment group, we have set up a Telegram group.

Here is the link for "DW 谈股论金": https://t.me/joinchat/SgYa_xNrjTNHk9cS51ke0A.

Importantly, you cannot join directly via Wechat. Two options:

- When open the blog in Wechat, 点击右上角的三点,然后选在Safari 中open,然后点击the link and then join

- Or copy the link and paste to Safari to open and then join

No comments:

Post a Comment