As I have said lately, we are seeing increasing evidence of excessive exuberance comparable to the dot.com era. Apple is one of the hottest tech stocks with an epic run nearly in a straight line up and it is the only stock that has surpassed the $2 Trillion mark in terms of the market cap. This is an unbelievable achievement, a truly real life case of "as rich as a country". Apple is undoubtedly a great company with fantastic fundamentals to support its high share prices. But here is the thing: regardless how great a company is, its stock can be a bad one to hold if its valuation goes too much ahead of itself. In the short run, stocks can go a lot higher away from its fundamentals but in the long run, it will eventually come back to its basics. In other words, exuberant valuation won't last forever! I'm sharing with you one fundamental analysis done by an investment group, Generation PMCA Corp regarding their view on Apple.

In their latest letter to investors, entitled "Not the Apple of My Eye," they outline why AAPL shares are "vulnerable to an approximate 25% decline... and that's with some reasonably optimistic assumptions." Actually 30%-40% downside is not unthinkable in the event AAPL simply reverts to historical P/E multiples.

You can read their entire letter here, and here's an excerpt:

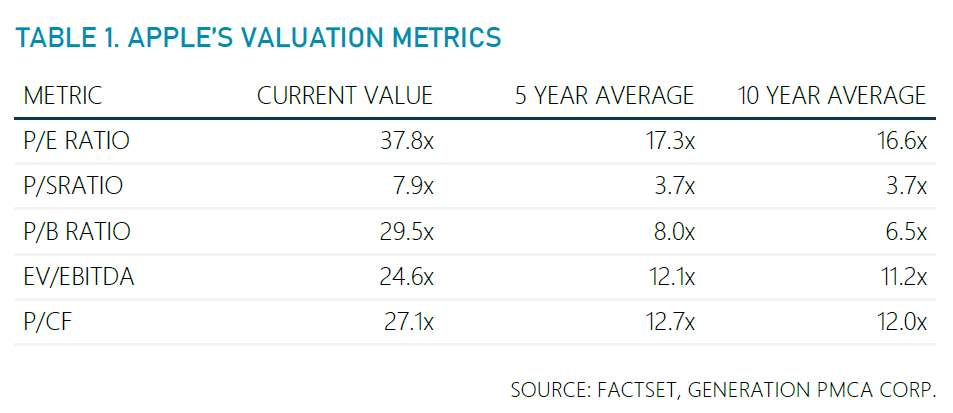

Apple's market valuation looks rather rich. Summarized in Table 1, Apple's multiples are well above its 5- and 10-year averages...

With the stock priced for beyond perfection, a bad quarter, product flaws, production issues, a cyber-incident, or competitive disruption could lead to a large correction. Investors should wait for doubts about Tim Cook's leadership skills or questions about Apple's ability to innovate to washout growth expectations. We've seen it before and we'll no doubt see it again...

The valuations and index weightings of Apple and other richly valued Info Tech and Communications stocks have potential negative implications for the overall market. Thanks to these companies, the median implied growth of the S&P 500 constituents is 6%, a 20-year high – higher than in the dot-com bubble.

But be aware though, they don't think Apple's stock is a good short. I have actually placed some long positions yesterday betting a short term bounce by APPL.

******************************************************Despite Apple's lofty valuation, it would not be a candidate for short-sale in our view. We believe short sale candidates should be companies with near-term downside catalysts, poor earnings quality, or other problems. And valuations could extend even further, like they did during the tech bubble.

By the way, if you are interested in joining my DW investment group, we have set up a Telegram group.

Here is the link for "DW 谈股论金": https://t.me/joinchat/SgYa_xNrjTNHk9cS51ke0A.

Importantly, you cannot join directly via Wechat. Two options:

- When open the blog in Wechat, 点击右上角的三点,然后选在Safari 中open,然后点击the link and then join

- Or copy the link and paste to Safari to open and then join

No comments:

Post a Comment