If you don't know yet, dumb money is a reliable contrary indicator, especially so when all the major sentiment indicators are coming together at the extremes. This time it is extremely euphoric, which is usually associated with the market top. Just make up your own mind whether or not it is the time to chase with FOMO further.

*************************************

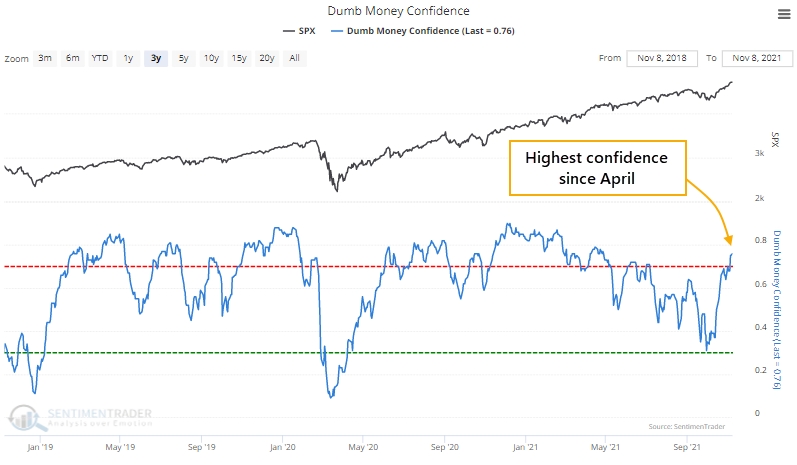

Dumb Money Confidence has made a furious comeback (by Sentimentrader)

The dumb money is confident again.

After a streak of optimism, Dumb Money Confidence turned pessimistic at the end of September. The ends of other long streaks of optimism led to higher prices, as buyers finally saw a good chance to step in.

The lack of optimism didn't last long, and now it's back to an extreme. On the lower end of that threshold, but still.

We update several other models of sentiment based on public information released by other sources. And each of them is showing similarly high levels of optimism among those who tend to be wrong at extremes.

- The Fear & Greed Model, based on similar inputs and methodology to the one published by CNN, has also made a furious comeback and is now pushing well into Greed.

- The Panic/Euphoria Model, constructed using a methodology described by Citigroup in public posts, has rebounded and is once again above its Euphoria threshold.

- And the Bear Market Probability Model, described in interviews by Goldman Sachs, has soared to one of the highest levels in 50 years.

If we combine all four models into one, we can see how a broad cross-section of sentiment-related measures compares versus other periods. And there are almost no precedents.

This composite model never got above 90% since we have data starting in 1998...until this year.

No comments:

Post a Comment