Here is another indicator to suggest how frothy the market is becoming now. It is kind of challenging gravity right now that no one cares any risk at the moment. As long as the market keeps going up, who cares when it will come down, right? This is exactly the time we need to be really fearful of no fears. I posted a blog Fear of no fear before, which speaks about the current situation. Be very careful, guys!

****************************************************************************************************

Per SentimenTrader:

In recent weeks, we've had occasion to yet again focus on the behavior of options traders. Depending on the metric, we're currently seeing a record or near-record level of speculation, with very little hedging.

Nothing much has changed. Among all strategies and all traders, the focus on strategies that only pay out if stocks rise continues to hover near record highs, with our Option Speculation Index showing that bullish volume is significantly higher than bearish volume.

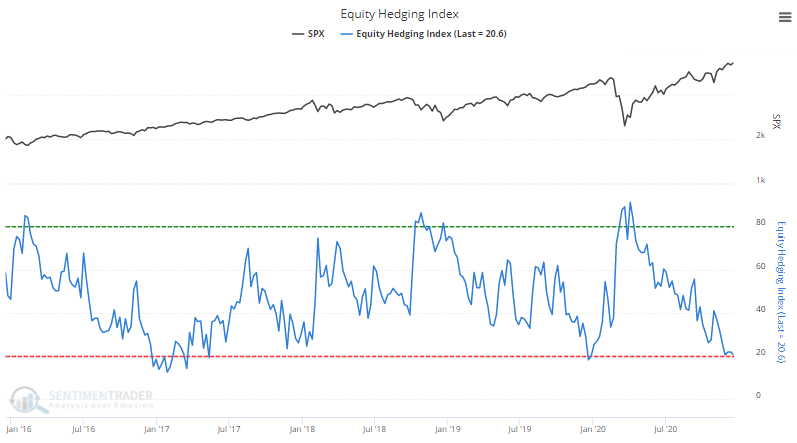

Adding to the concern is that hedging activity, in the options market or elsewhere, has become scarce. The Equity Hedging Index (EHI) is now in the lowest 6% of all readings since 1986.

The EHI looks at the most common ways an investor would hedge their portfolio. The more each indicator shows hedging activity, the higher the Equity Hedging Index will be; the lower the EHI, the less hedging is happening.

Since 1986, when the EHI is below 21, the S&P 500's annualized return has been -2.4% versus +49.8% when the EHI is above 85, suggesting a higher probability of lower returns now given the current reading of the indicator.

No comments:

Post a Comment