Wow, the market for initial public offerings ("IPOs") is white-hot...

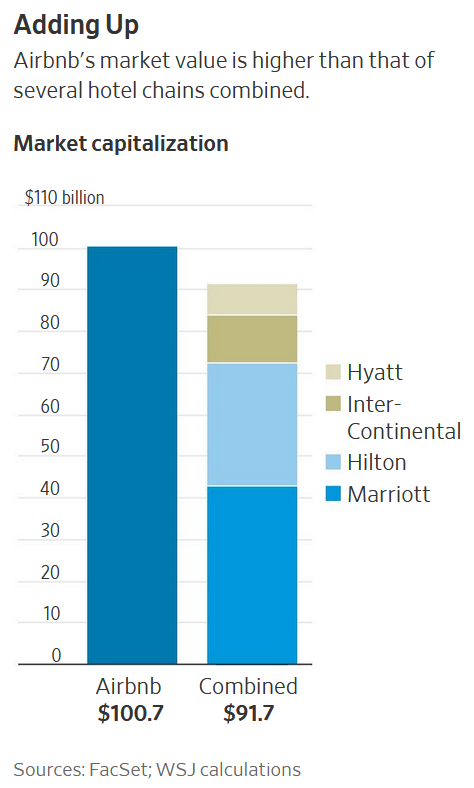

The latest one is Airbnb's (ABNB) astonishing debut on Dec 10, in which the stock soared 113%. Here's a recent article about it on the front page of Wall Street Journal, with a chart showing that Airbnb's market cap exceeds four major hotel chains combined: Airbnb's Stock Price More Than Doubles in Market Debut. Excerpt:

Airbnb's first-day performance is likely to continue to fuel excitement over the IPO market, where investors have been clamoring for shares of hot newly public companies.

"People are just compelled to be invested," said Jim Cooney, head of Americas equity-capital markets at Bank of America. "Even if you don't like the valuation of some of these tech companies, you know they're likely to keep going up, at least in the short term."

In addition to Airbnb, shares of DoorDash and C3.ai also surged on their first day of trading, jumping 86% and 120% respectively on Wednesday. DoorDash's stock slipped 1.9% Thursday, while C3.ai continued to rise, gaining 40.6%.

By both volume and stock price performance, these companies are trading into one of the hottest IPO markets in history. So far in 2020, more than $155 billion has been raised on U.S. exchanges, far exceeding the previous full-year record set at the height of the dot-com boom in 1999, according to Dealogic data that date to 1995.

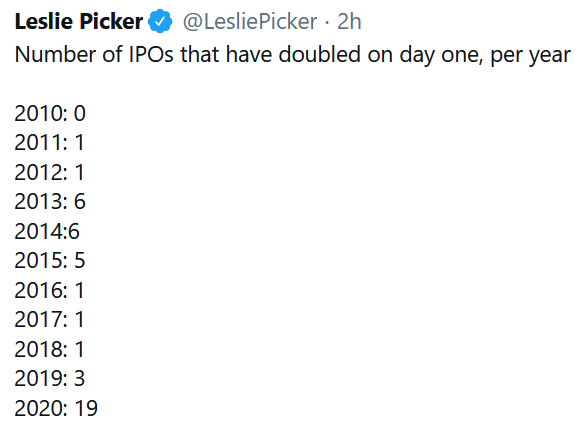

This marks the 19th IPO that has more than doubled on its first day of trading this year – far more than any other year in the past decade, as CNBC's Leslie Picker points out in this tweet:

|

I'm really happy for the great debut of Airbnb as I have a skin in it. While I didn't get the chance to invest at its early rounds of funding when it started, I did put some money in it in a private fund investing in ABNB via one of my connections a couple of years ago. While the IPO market is a bit frothy at the moment, ABNB is one of a few IPOs which are actually already making money. So I'm feeling great for it moving forward although understandably it may need to be cooling down a bit after a quick double on the first day of trading.

Since the overall market is quite extended with quite a few extremes associated with it like historically high valuation and sentiment etc, we may see a good dose of correction in the near future. I'm even thinking we may see a repeating history mimicking the drastic selloff of last March if the current euphoria continues unchecked! With this in mind, putting some money in private equity (i.e. buying pre-IPO stocks or funds) may not be a bad idea. On the contrary, it may be a safe haven sort of speaking as they won't fluctuate like publicly traded stocks. Over the past few years, I have accumulated quite a lot of startup company stocks in various sectors at various stages. E.g. I have also invested in a private fund for SpaceX and Virgin Hyperloop ( 又称超级高铁; also based on Musk's initial idea). Nowadays, it has become increasingly easier to invest in pre-IPOs although it is a tough job to differentiate good vs bad ones. I'm kind of lucky to have a wide network/connections, from which I often get some ideas and insights from time to time. As such I also share some ideas within my DW Family, some of which are already showing sizable growth. As a matter of fact, we are now in an era where we can invest in early startups a lot easier and via a few different alternatives. Some of them can be as easy as buying a listed stock, sort of backdoor way to invest in early startups. As such, we don't need to limit our investment solely in one format, but in variety as part of diversification. Going private is definitely one of the great options!

No comments:

Post a Comment