Sir Isaac Newton once said:

"I can calculate the motions of the heavenly bodies, but not the madness of the people.."

As my friend said: "Virtually EVERY talking head in the financial media is widely bullish right now. They're not just ridiculing anyone who might be bearish – if they can even find them. They're lambasting folks who express even a hint of caution. This sort of hubris among the talking heads almost always leads to a "humbling" moment."

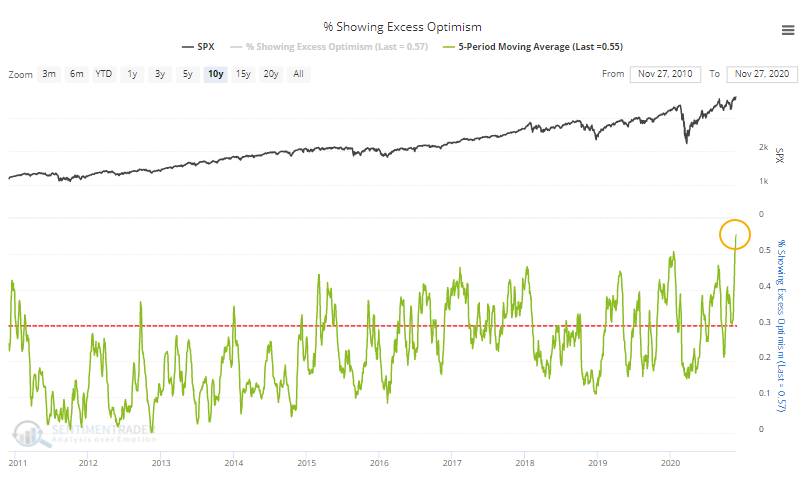

We are approaching the extreme we saw just before the Mar crash. See what I wrote in Feb:

"I can calculate the motions of the heavenly bodies, but not the madness of the people.."

As my friend said: "Virtually EVERY talking head in the financial media is widely bullish right now. They're not just ridiculing anyone who might be bearish – if they can even find them. They're lambasting folks who express even a hint of caution. This sort of hubris among the talking heads almost always leads to a "humbling" moment."

We are approaching the extreme we saw just before the Mar crash. See what I wrote in Feb:

When people lost mind....

I was laughed at by many after being a crying wolf for weeks till the moment suddenly hit! I'm sure it is so laughable as well at the moment to talk about caution when everyone is so happy in the market, enjoying new highs again and again. I just wish widely bullish folks can dodge the next humbling moment when it hits again inevitably. It is not if but a matter of when and how much.......

I was laughed at by many after being a crying wolf for weeks till the moment suddenly hit! I'm sure it is so laughable as well at the moment to talk about caution when everyone is so happy in the market, enjoying new highs again and again. I just wish widely bullish folks can dodge the next humbling moment when it hits again inevitably. It is not if but a matter of when and how much.......

from SentimenTrader

Last week, options traders returned to their speculative ways. Traders large and small plunged into call options, buying them at a pace twice as great as put options.

Options activity is but one of the many extremes that our indicators are showing. So many, in fact, that an average of more than 55% of the core indicators have been in extreme territory over the past week.

Spread out over a week, this is the most extremes we've seen among our indicators in 15 years. Other times we've seen more than 50% become extreme, stocks have had a tough time holding their upside momentum.

No comments:

Post a Comment