Here is more alarming note my friend sent me:

Stock prices are stretched, their valuations are absurd, and investors are all-in.

So notes money manager John Hussman in a recent post outlining the dangers that investors are currently facing. As he states:

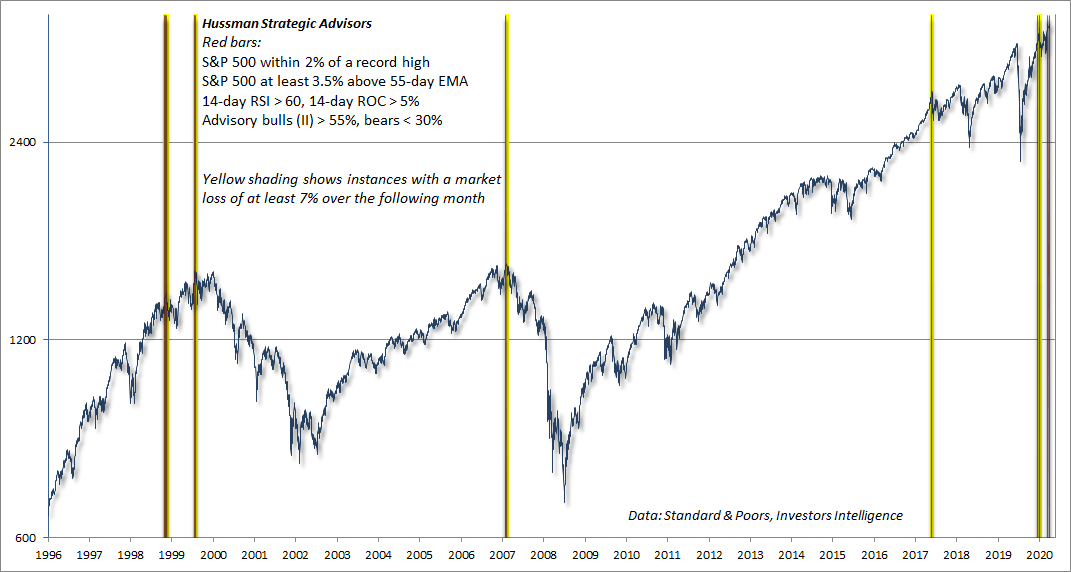

"The red bars in the chart below show one of the more extreme syndromes of "overvalued, overbought, overbullish" conditions one can define. The specific conditions are shown in the chart text. The bars with yellow shading show instances where this syndrome has been in place, and the S&P 500 dropped at least 7% over the following month. All of these instances, prior to those of the past few days, are shaded yellow."

Regarding his latest warning, the criteria that have preceded big declines include:

- The S&P 500 is within 2% of a 52-week high

- It is at least 3.5% above its 55-day exponential moving average

- Its 14-day Relative Strength Index is > 60%

- Its 14-day rate of change is > 5%

- Investor's Intelligence survey bulls are > 55%

- Investor's Intelligence survey bears are < 30%

No comments:

Post a Comment