Last week’s newsletter discussed how the S&P 500 index failed the Santa Claus Rally. To wit:

“With the Santa Claus Rally a no-show, we will now focus on the return for the first five days and the entire month. The old Wall Street axiom says, ‘So goes the first five days of January, so goes the month, so goes the year.’ Since 1950, there have been only three occurrences when the Santa Rally failed, and the first five days and the month of January were positive. Two out of three years were up over 20%, and 1994 was flat, at -1.5%. The average gain for those 3-years was 14.8%.

Next week, we will know how the first five days turn out.“

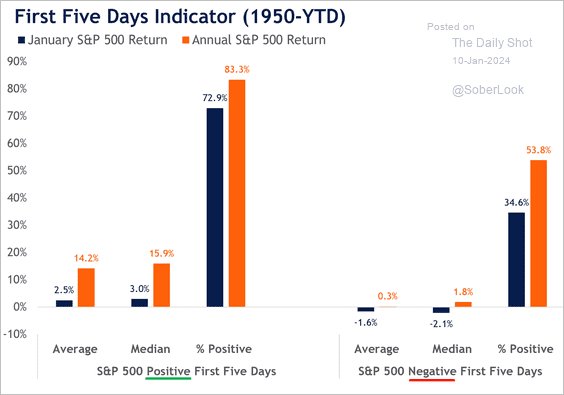

Unfortunately, the S&P 500 Index failed that initial test of the New Year by providing a negative return over those first five trading days. As shown in the chart below, the implications of the failure are potentially lower returns for the entire year.

When the S&P 500 index is negative during the first 5 days of the year, it substantially lowers the odds of the year being favorable. Not only do the odds of a positive year decrease, but also the average annual rates of return.

Lance Roberts

No comments:

Post a Comment