While the short-term technical underpinnings have improved as window dressing ensued, I remain cautious currently for several reasons:

- The market is GROSSLY overbought in the short-term and must either consolidate at current levels or correct to lower levels to resolve it.

- Negative trends are still in place, which suggests the current rally, while significant, remains within the context of a reflexive rally.

- Volume is declining on the rally, suggesting a lack of conviction.

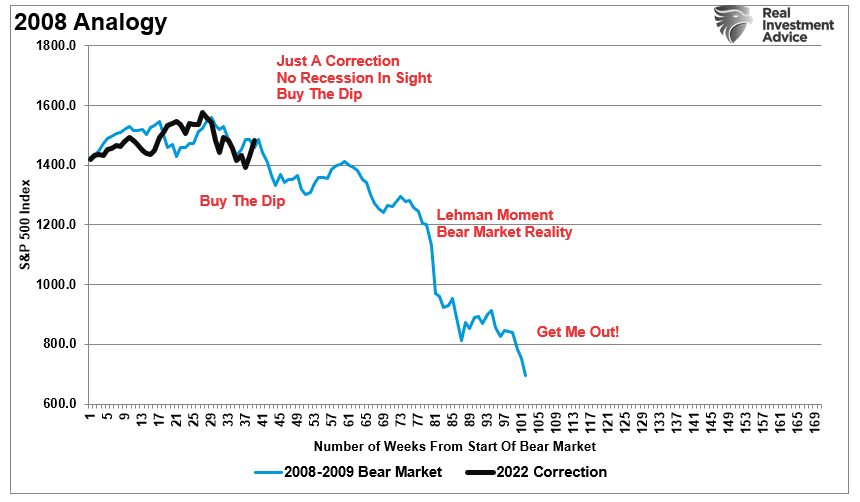

- The current rally looks similar to the rally in 2008, except the fundamentals are substantially weaker. (i.e., valuations.)

NOTE: We are not saying the market is about to go into a protracted bear market. However, the recent 10%ish rally in the market is similar to what we saw during the 2008 market.

Notably, in early March, we discussed that after two-negative months of returns and the worst start to a year since the "Financial Crisis," it would not be a surprise to see a positive return. As noted in "The Revenant:"

"There is a high probability of an outsized reflexive rally over the next two months due to several factors. While we expect a significant rally from current levels, likely following the Fed's meeting next week, such should get used to reduce risk and rebalance exposures accordingly.

- Extreme negative sentiment

- Bearish portfolio positioning

- Higher levels of cash holdings by fund managers

- Dumb money is bearish

- Put/Call ratios are offside

- The number of stocks trading at 52-week lows.

While the reflexive rally was likely, whether or not it turned into a sustainable "bull market" trend depends on whether recessionary factors persist.

With the yield curve rapidly inverting, the risk of a recession is certainly more elevated than it was a month ago.

No comments:

Post a Comment