The market fell hard on the option expiry date on Thursday with some panicky selling towards the end. But I advised my Family members to buy SPY calls along with the market selloff. It appears I'm not the only one thinking about that. See below an analysis that is consistent with what I'm thinking.

*****************************************************************************

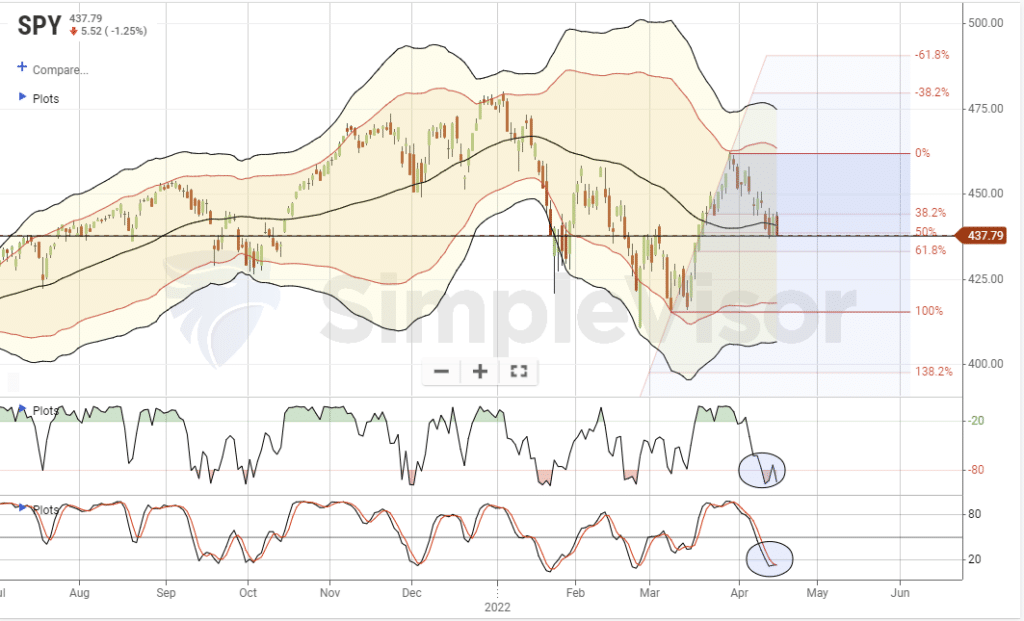

On Thursday, markets sold off, reversing the previous day's gains as April options expiration led to a bout of volatility. The good news is that the market held support at the 50% Fibonacci retracement level even with the selloff. Furthermore, the market is oversold and close to triggering a short-term buy signal.

Given the oversold market condition and the fact the week after "tax day" trends positive as liquidations to pay tax bills complete, the odds for a reflexive rally are encouraging.

However, as we will discuss next, any rally into May is likely a good opportunity to reduce and rebalance portfolio equity risk.

Could you share what indicators are in your picture?

ReplyDelete