I assume by now we all have experienced a fast uptick of inflation, especially substantial increases of prices for the daily life goods we need. Don't tell me you are not paying a lot more these days for grocery shopping. The million dollar question is whether this is just a short term transitory flareup of inflation as the Fed chair Powell loves to make you believe or something that will stay and move up much further up down the road! For me, I always try to consult history to see how much our money has been worth over time. I can tell you that it is not pretty at all if you have the habit to rely on your dollar purchasing power. See below an interesting analysis I have just seen.

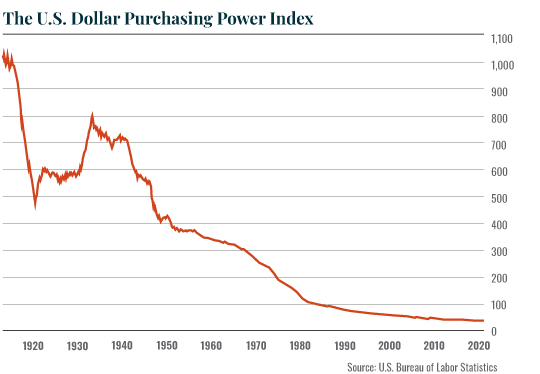

Purchasing power is the proverbial "bang for your buck" — how much of something you can buy for a single unit of currency. In the United States, one dollar today is worth only 4% of what it was worth in 1913. (The year the current Federal Reserve was founded.)

Below is one of the ugliest charts you'll ever see. They don't show this chart in school for good reason.

As you can see, the $USD is one of the worst "assets" to own. Indeed, since 2000 alone it has lost over 38% of its purchasing power! And this is the asset we use to price stocks!

So, what happens when we price stocks in gold, an asset that accounts for inflation and which cannot be devalued by a central bank. Buckle up, it's not pretty.

Yes, you are seeing that correctly. Priced in gold, instead of dollars, the stock market has gone NOWHERE for over 20 years. In fact, stocks are still DOWN 50% from their peak relative to gold in 2000.

So this begs the question… Do stocks even MAKE money?

No comments:

Post a Comment