This was what I learnt a few days ago this week that someone placed a bullish call trade for TSLA, betting it would be worth at least $3500 by Friday, i.e. today!

The bet for more than double within a few days, likely due to the extremely bullish expectation for its earnings on Wed, is already beyond believable. What's more astonishing is the magnitude of the betting: someone bought several thousands of call contracts for the Jul 24 TSLA $3500, which cost over $750,000. By now, we know how badly the guy(s) have lost as every penny of their bet is gone now! Ouch!! Quite often, big option bet on the short side is used to hedge for the held big position to avoid a sudden crash that may happen following the earnings. But I don't think would be case at all as the strike price is so much higher than the share price and there is no sense at all for protection purposes. So this is a purely bullish speculation for a quick double.

This is kind of craziness right now we are seeing. Chasing highs at any cost is not something rare but widely popular. TSLA has already doubled within just a couple of weeks and someone was still willing to bet that it could double again within days. Of course, not everyone is so much keen on chasing TSLA. Here is the information from my friend:

Doug Kass of Seabreeze Partners thinks it is the time to short TSLA. Here is what he wrote:

Shorting Tesla!

* I have been waiting patiently to short Tesla for years

* Tesla goes on my Best Ideas List (short)Tesla (TSLA) is no longer a hard to borrow (short) – so, in accordance with my core shorting tenet of avoiding high short interest relative to average daily volume and float, I am free to short the stock.

Which I did this morning at $1,642.

I shorted even though I expect the stock to be included in the S&P (which I believe to be fully discounted – and more!) after achieving profitable quarterly results.

Tesla, with a market capitalization of over $300 billion, reached profitability by virtue of a heavy dose of regulatory credits, so it was a poor quality report.

While the capacity expansion of the next gigafactory in Texas will expand the company's delivery capacity, I have written volumes on Tesla's fundamentals – a more competitive EV market, etc. – in the past so I see no need to reiterate my views which have not changed.

Bottom Line

It is my view that Tesla will trade at $1,000/share before it trades at $2,000/share.

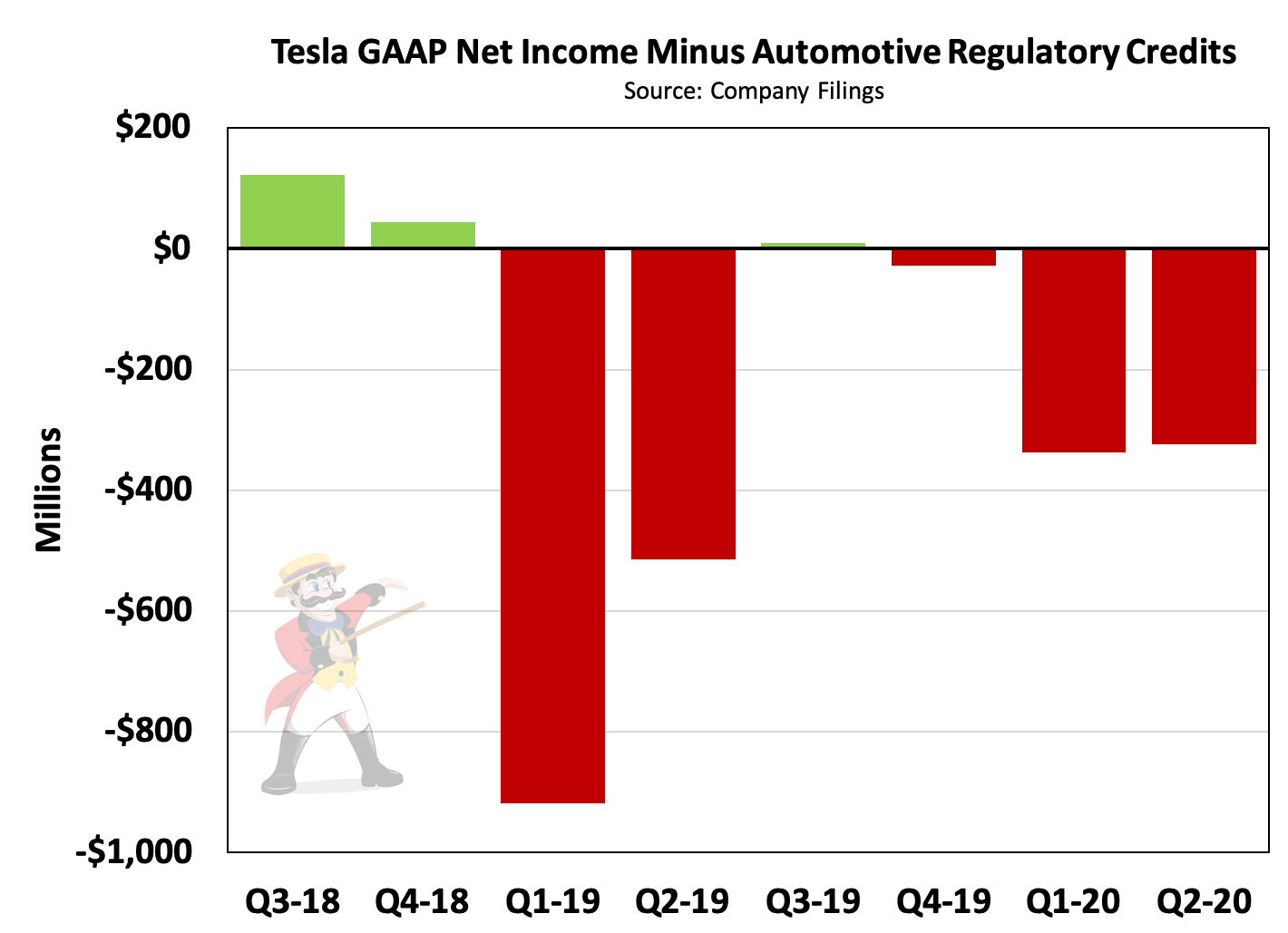

Regarding Doug's point about the source of Tesla's profitability, here are the facts: in the past four quarters, the company has reported cumulative GAAP net income of $368 million – but not from selling cars. Rather, this has been driven by carbon credits of more than $1 billion. (Over the same period, Tesla's market cap has grown by $248 billion.) This is what Tesla's net income would have been minus those credits (from @TESLAcharts on Twitter):

|

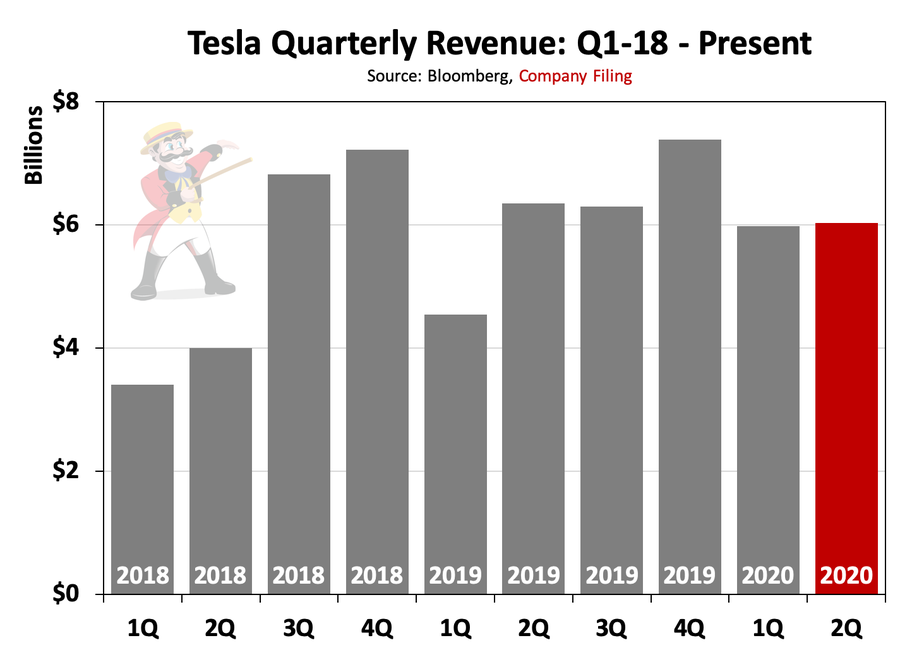

And, unlike other richly valued tech companies like Amazon (AMZN), Alphabet (GOOGL), and Facebook (FB), it's not like Tesla has been growing. In fact, as you can see in this chart (also from @TESLAcharts on Twitter), the company's revenue has declined over the past eight quarters:

|

Hello I’m a spell caster i have herbal cure for,CANCER and more i also cast spells such as

ReplyDelete* love spell

*self love spell

* money spell

* weight loss/gain spell

* get your ex back

* Lucky charm spell

* lottery spell

* job promotion spell

* do as I say spell

* pregnancy spell

*Diabetes

*lupus

Remember a problem share is a problem solved....

contact on email or hangout... priestvoodoohoodoo@gmail.com