* Consumer 'Cassandras' are multiplying

* But it is important to note the strong position of the U.S. consumer

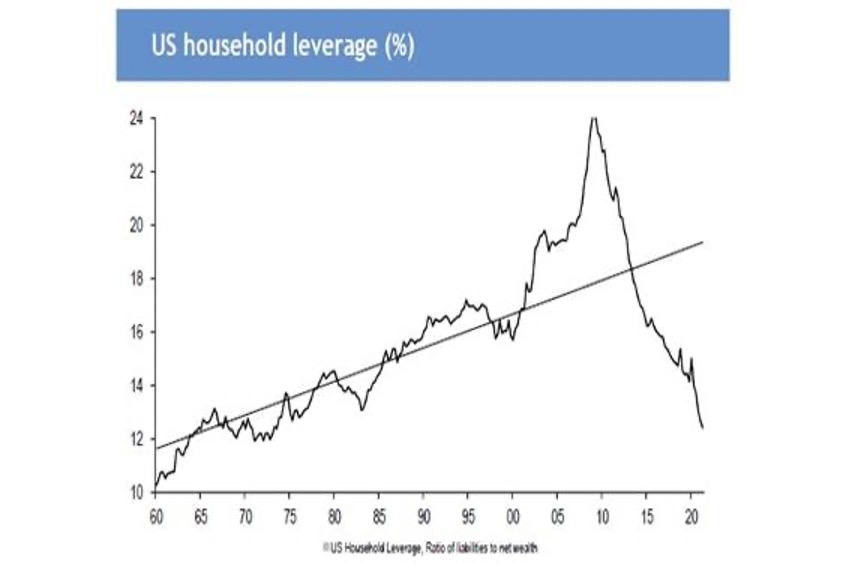

* Consumers' ratio of liabilities to net wealth is at the lowest level in 50 years!

Over the last five weeks I have argued that there are substantive and underappreciated "buffers" that will likely serve as a ballast to the U.S. economy and are likely to lead to only a mild and brief recession, which would have less impact on U.S. corporate profits than the consensus increasingly expects.

The following factors support my case:

* The absence, in large part, of the sort of leveraged positions and segments of the economy that have characterized previous deep economic down cycles.

* Unlike previous economic downturns, especially the global financial crisis, our banking system is far less levered and has sizeable cushions of liquidity and capital.

* There is over $2 trillion of excess consumer savings.

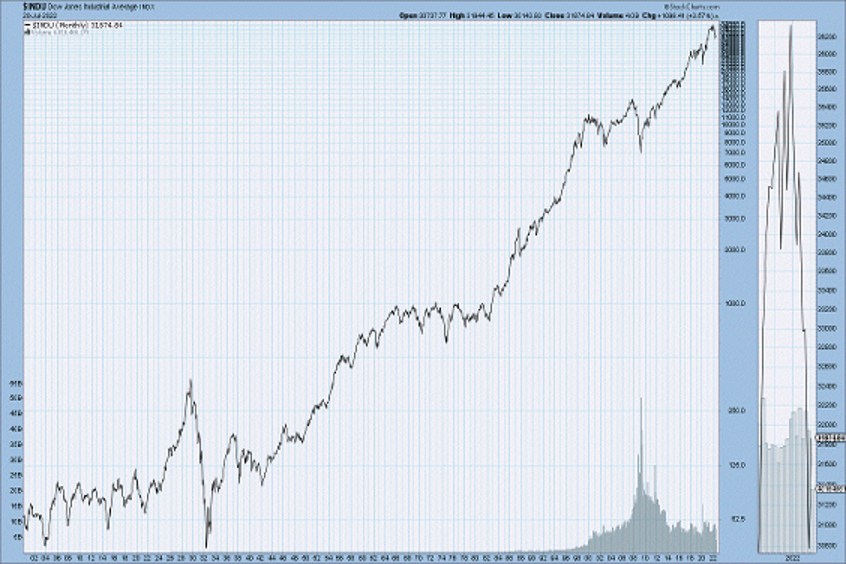

* There is a cushion of sizeable unrealized/embedded gains in the nation's housing stock and large unrealized gains in the U.S. stock market:

* The U.S. has a very strong industrial/corporate base that has generally improved their balance sheets by rolling over into inexpensive debt over the last five years, and that have maintained high profit margins.

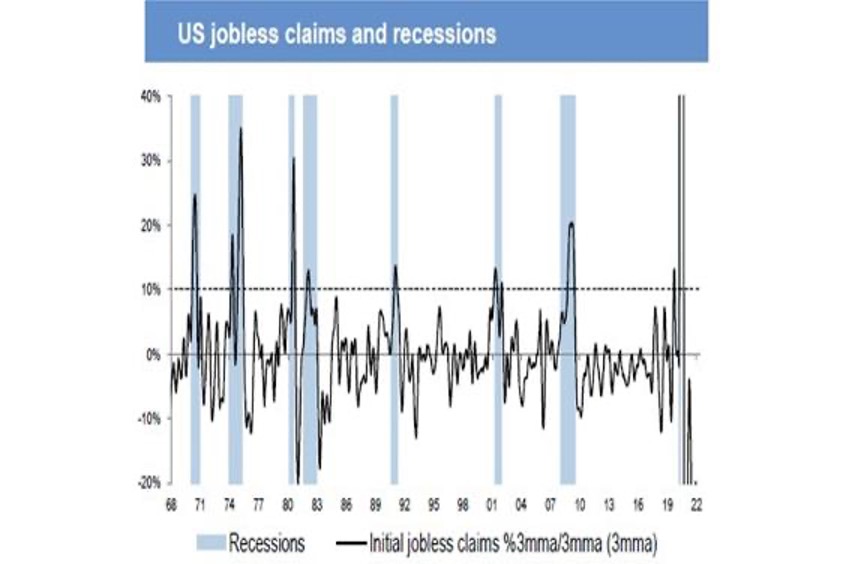

* We have a robust and tight labor market, with solid wage increases in the last several years. Importantly, in the last 60 years the U.S. has never had a recession without a preceding spike in initial jobless claims:

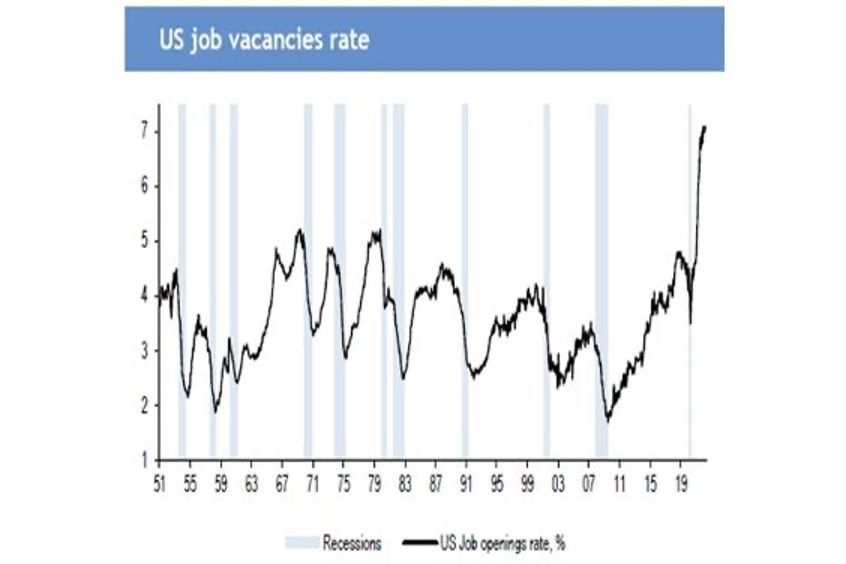

The job vacancy rate is at an all-time high:

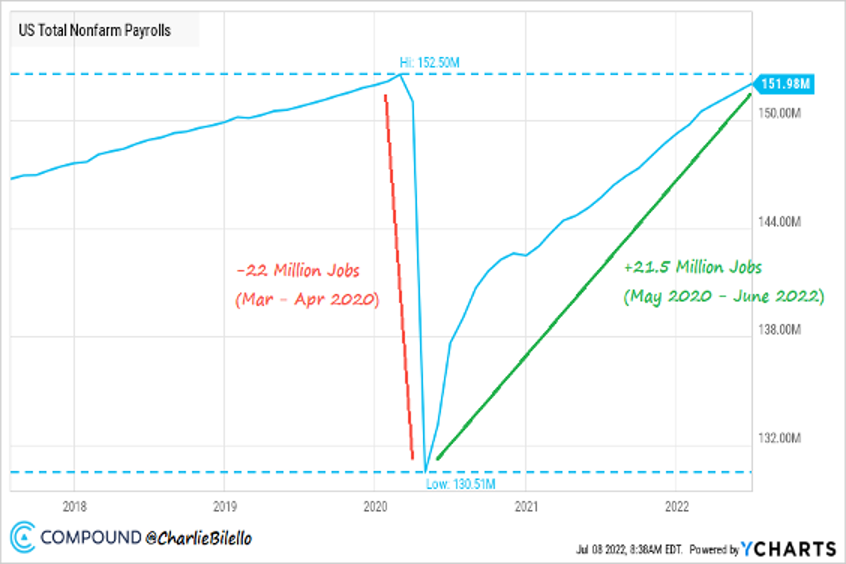

And the U.S. has almost fully recovered the jobs lost in the early months of the pandemic:

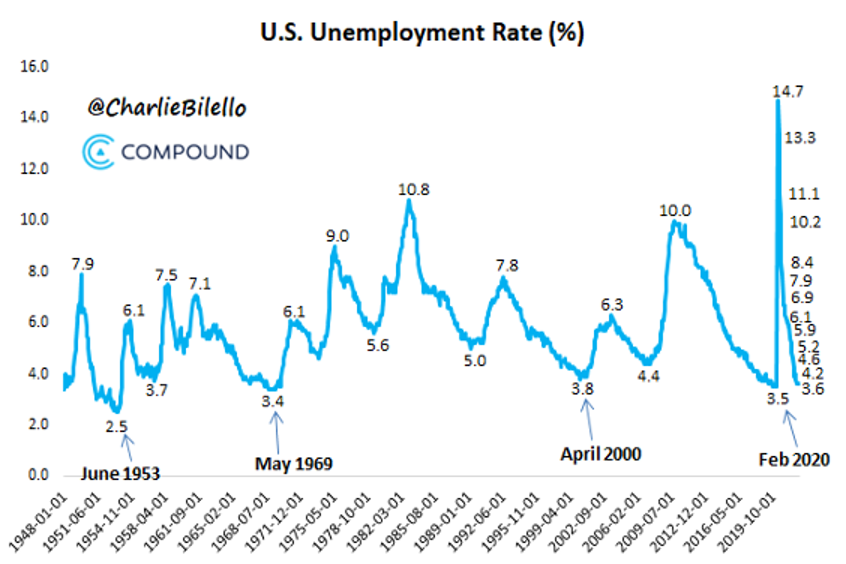

* The U.S. unemployment rate is 3.6%, the lowest level since the start of the pandemic and only 0.1% above the 50-year low reached just before the pandemic in February 2020:

* Some important components of inflation are moderating. The prices of most commodities have fallen considerably over the last two and a half weeks. Copper is down 33% from its all-time high in March and at its lowest level since 2020:

Corn, wheat, and soybeans are all down over 25% from their highs and below the levels they were at before Russia invaded Ukraine:

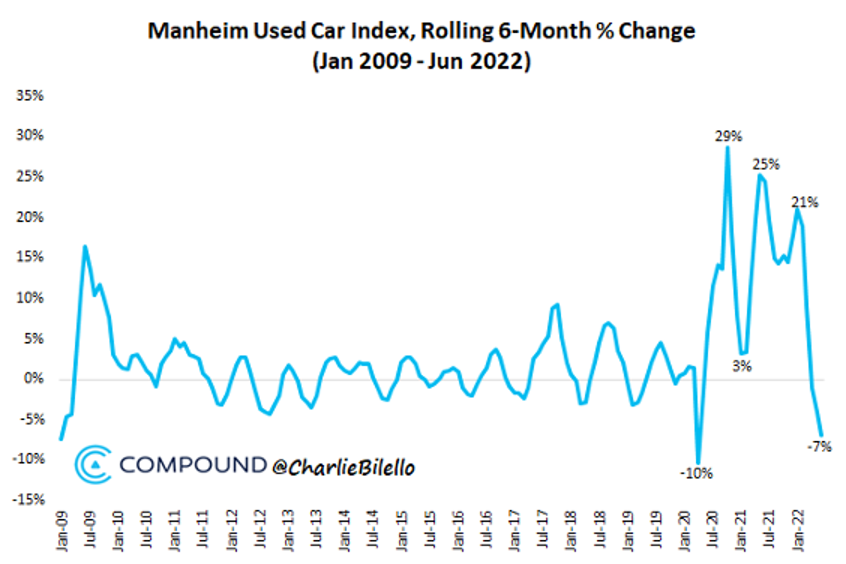

After spiking last year, used car prices are down 7% over the last six months:

Finally, the price of energy products has also fallen precipitously:

* Interest rates may have peaked. The yield on the 10-year U.S. note is about 40 basis points below its recent high.

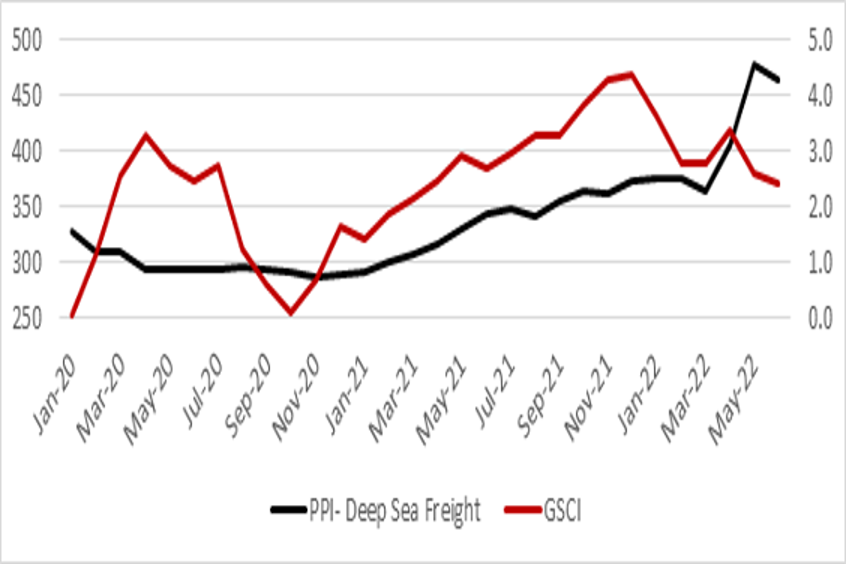

* Several measures of supply chain health have begun to show signs of improvement. Deep sea freight costs (the black line in the below chart), which have been a good proxy for supply chain disruptions, dropped in June. And the New York Fed economists' Global Supply Chain Index (the red line) has fallen to the lowest level since March 2021:

Figure 1: PPI for Deep Sea Freight (black, left) and the GSCI (red, right)

* To the many market participants who are focused on prospective consumer weakness due to the fall in mortgage activity and the marked decline in stocks, I offer the following chart, which demonstrates that consumers' balance sheets remain strong and underleveraged:

Indeed, as demonstrated above, the consumers' ratio of liabilities to net wealth is at the lowest level in 50 years!

No comments:

Post a Comment