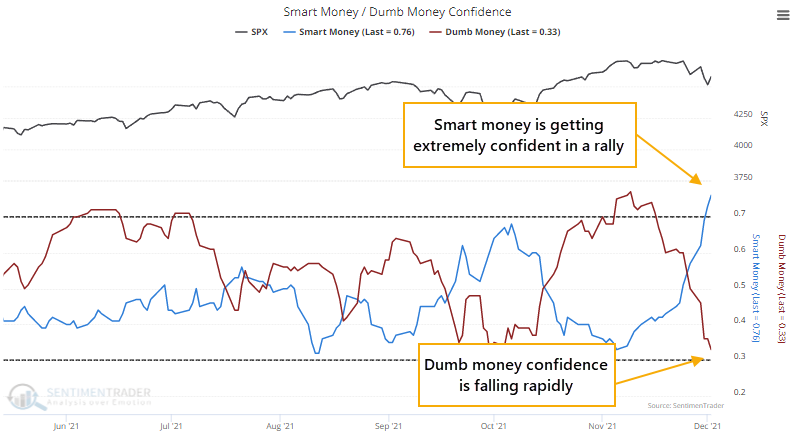

The spread in sentiment between Smart and Dumb Money is historic

Historic spread between Smart and Dumb Money

The past couple of weeks has triggered a drastic shift in sentiment. The confidence in a rally among Smart Money indicators has jumped. It would be even more extreme if there wasn't a curiously large plunge in "smart money" commercial hedger positions in equity index futures.

We can see the stark change in attitude below. Despite the weird increase in a net short position in index futures, Smart Money Confidence jumped to 77%, the highest since late April 2020. Dumb Money Confidence plunged to 30%, the lowest since early April 2020.

This adjustment in behavior has caused the spread between them to rise above 45%. The S&P 500's annualized return when the spread is above 45% was +52.6%, nearly 10x the return when sentiment was neutral.

No comments:

Post a Comment