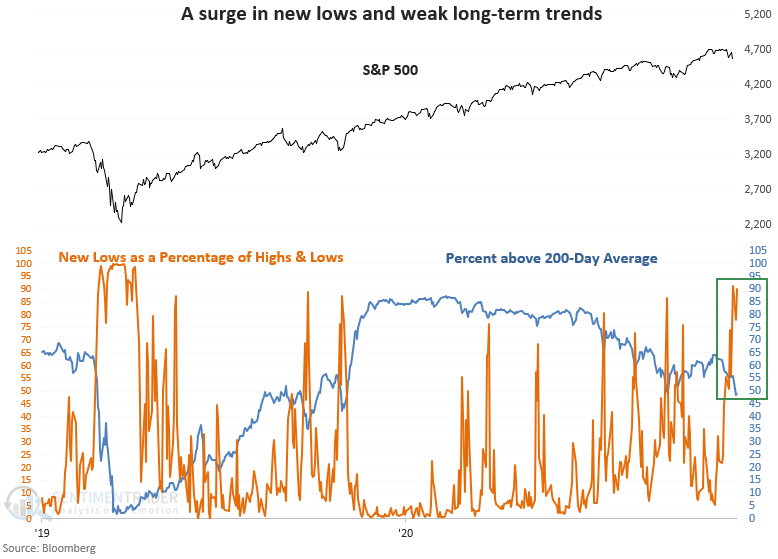

New lows spike as trends deteriorate

A new signal from a voting member in Dean's TCTM Risk Warning Model registered an alert on Tuesday.

As a percentage of highs and lows, new lows have risen to the highest level since the pandemic crash. At the same time, the percentage of NYSE common stock members above their 200-day moving average has deteriorated to the lowest level in more than a year. When we compare the long-term stock trends to the price of the S&P 500, the divergence is noteworthy.

This signal triggered 25 other times over the past 93 years. After the others, future returns and win rates were weak in the 2-4 week time frame. The 1-year results look unfavorable.

No comments:

Post a Comment