Gas Prices Go Berzerk; Time to Bet on a Republican Blowout (in the Nov mid election)

This is the headline I have seen. I guess everyone has felt the pain at the gas station. Oh no, those who support the radical left like the idiot Joe and Harris should actually feel happy to see everything going up with hyperinflation. After all, that's what they know should be coming with radical policies. Congrats to them to have their dream coming true😜

For me, I'm both happy and sad. I definitely don't want to pay more for anything but sadly nothing we are consuming is not going up these days....quickly! On the other hand, I'm happy to see oil/gas prices going up because I'm one of those who benefit from the inflated oil and gas. How so? Well, you can see the blog below that I shared with my Family last July. Here is the thing. In general you want to buy something when it is cheap, right? While it was not super cheap last July for oil, technically speaking it was in a good sweet-spot that was poised to fly higher from a relatively low level. That's the time I shared the idea to buy oil/gas stocks. Sure enough, oil prices have gone to the roof steadily since then and are going parabolic at the moment. This has greatly boosted my share price of AMLP of course with additional dividends that have been reinvested, which has further enhanced my gains. That's why I'm happy to see oil go up!

I'm not sure it is a good idea to chase oil stocks right now and I'm adding a covered call to protect my AMLP for now. I think it is a high chance that we will see a correction soon for oil.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

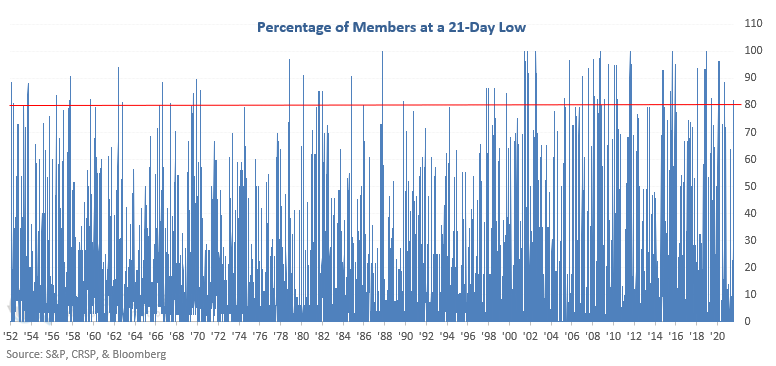

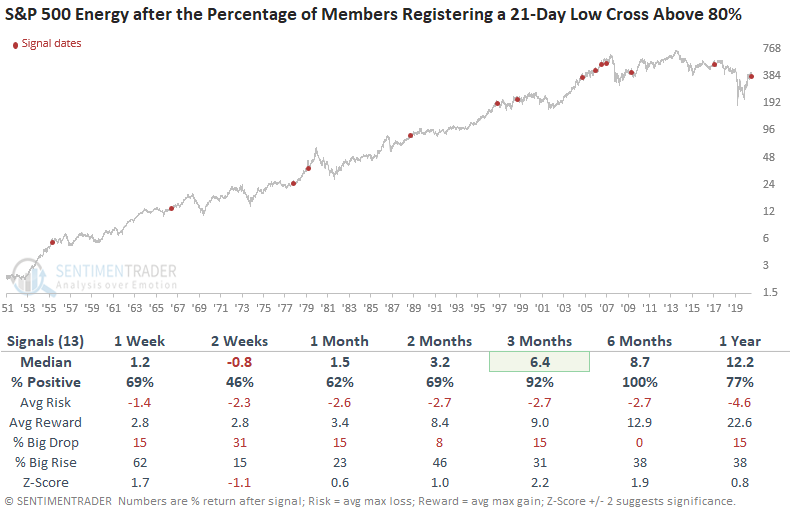

Below is the sentiment tracking information, suggesting the oil sector will be doing great for the long term.Today's sharp selloff has offered a great entry point for AMLP, which has broken out of a multi-year long term downtrend recently but is correcting right now. At today's price around $32, we will lock in a 8% dividend yield for DRIP. Don't miss it!

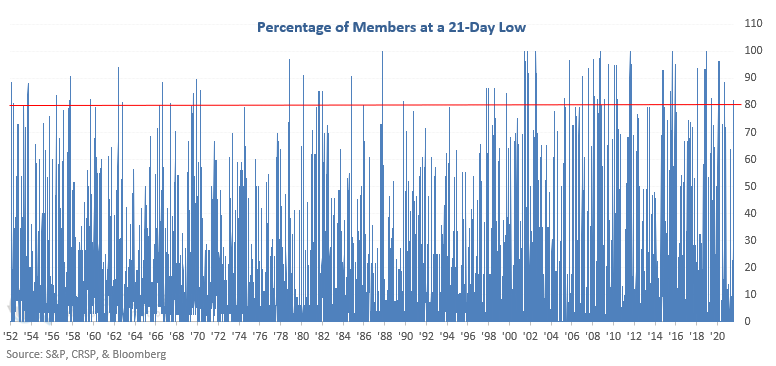

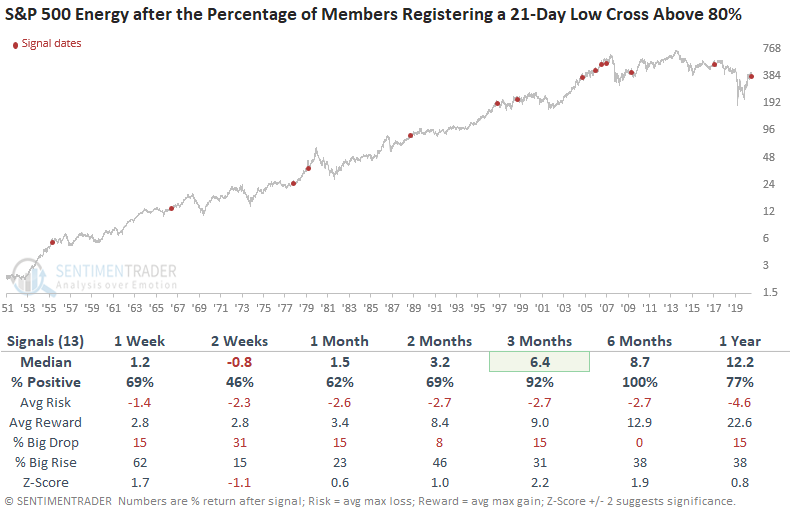

*******************************************************************************Energy stocks are weak, and there has been a surge in them falling to their lowest prices in a month.

Last week, Dean shared a trading signal for the S&P 1500 Oil & Gas Exploration & Production sub-industry that suggested a cautious short-term outlook for the group. The energy sector weakened considerably on the day, enough so that 82% of energy stocks fell to at least a 1-month low, the most since last September.

As much as possible, we like to look at indicators in different contexts. Signals in healthy environments tend to act much differently than those in unhealthy ones.

So, Dean looked at future returns in the S&P 500 Energy sector after a surge in those stocks falling to 1-month lows, but only when it triggered within about a month of the sector being at a 1-year high.

The sector often wobbled in the short-term, but it had a consistent tendency to rebound over the next few months. By six months later, it was higher every time.

No comments:

Post a Comment