I hope all the friends are safe and sound without problems by now. After a few days of no power and Internet, we are finally back to normal. But still it is difficult to find gas locally here.

The Apple stock got hit quite hard last few days. I guess I was too early again. But for Apple I'm not a trader; rather a long-term investor. As long as its value is good, I'm fine to be a bit earlier. I will buy more if it drops further. Actually by the way I'm buying Apple I will not lose a penny until it drops to $500. At $576 at the moment, I don't think it will get to that level but I could be wrong of course.

As I predicted, gold is indeed coming down as well. With a $37 decline yesterday to $1678, gold is very close to its 200 day moving average at around $1650-1660 area. As I said, this is a strong support level and I think is a good entry point. However, I have learned over years that I should never be too confident about what I believe in. While I believe gold is likely bounce back from this support level, there is always a chance that it may not hold up there and may further go down. Whenever possible, I want to set up a position in such a way that my loss could be minimized. So what is the strategy to hedge against this possible short-term over correction for gold?

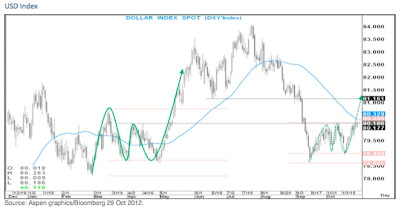

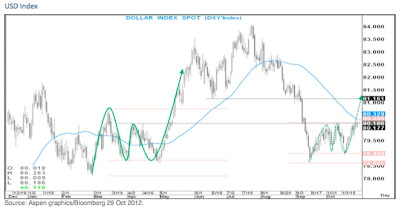

About 2 months ago in Sep,

I said US$ was likely bottomed and would appreciate. See below that this is exactly what has happened. The US$ index has been range-bounded roughly between 79.0 -80.1 in the past 2 months. But it appears it has just broken through the upper bound. This will likely push US$ up to 81-84. I think this is one major reason why gold has declined so much lately, because a strong US$ will push down gold price at least in a short-term. Eventually though, gold will not be bounded by the US$ and will continue to go up substantially in its huge bull run, since gold has become more and more a currency, not a metal.

So when US$ goes up, what is the next obvious victim? I hope you can guess: yes, it is Euro. I think Euro has run its upward course already by now. Likely it will start to decline from the current level of $1.29. I won't be surprised to see Euro plunge to below $1.20 this time. I have talked about EUO many times in the past, which is a 2 x leverage ETF against Euro. In other words, when Euro drops 1%, EUO should go up 2%. You may notice interestingly below that EUO was also range bounded between 19-20 in the past 2 months and has just broken through the upper bound over 20 now. If indeed US$ appreciates in the next few months, Euro will decline and EUO will go up in parallel.

If you buy gold and at the same time short Euro (e.g. by buying EUO), you essentially buy your gold in the Euro term. If gold goes down due to a stronger US$, EUO will go up due to a weaker Euro to offset your loss in gold, a perfect hedge to me. But be aware, this is just a concept to let you know how to hedge your gold for a potential over correction. As we discussed before, I don't like to simply buy EUO due to the headache in tax filing for it, since EUO is structured as a partnership fund. I'd either buy EUO call options or buy FXE (a direct Euro fund) put options. For those who don't know options, maybe simply use the dollar averaging technique to buy some gold at its current level and buy more if it further drops. In the long run, I firmly believe you will be doing very well. My gut feeling tells me that this is likely the last chance to buy gold at such cheap levels for a long long time. So whatever the levels this correction will bring down gold and silver to, to me it is a great opportunity to buy more cheaper gold and silver. Don't miss it!