LEGAL DISCLAIMER Please note everything discussed at this site is a personal opinion of the author and may contain errors or omissions. NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT. It would be your sole responsibility for actions you undertake as a consequence of any analysis, opinion or advertisement on this site.

Total Pageviews

Friday, April 30, 2021

A rather bearish move for Amazon

How will "Tax the Rich" destroy this great country!

Biden's 'Tax the Rich' Plan Is Pure Socialism

By Trish Regan

President Joe Biden has been in the White House now for 100 days... 100 days of inching toward a new system of government... 100 days of setting the stage for a new Socialist order.

Can you imagine what the next 100 days will be like?

Buckle up, America... If President Biden gets any of his Socialist nonsense through, we won't have much of a country left.

And believe me – he's trying.

"America is ready for a takeoff," he told viewers Wednesday night in his first address to a joint session of the Congress as president. He tried to sound hopeful... But you can't help but wonder if his policies are instead sending us straight for a crash landing... for those of us that are capitalists, anyway.

You see, President Biden wants to massively take (you might even call it "steal") from those who work and earn, and redistribute that wealth to those that do not earn.

He wants to take the profits from those that risk their money in the markets and redistribute the gains to those who don't take those chances.

He wants the IRS to target high-earners who he believes may be shielding their income via tax loopholes – despite his own use of Barack Obama's tax loopholes to protect his some-$13.8 million income during 2017 and 2018. Indeed, during those years, the president and Jill Biden employed some creative accounting techniques enabling them to keep $500,000-plus that would otherwise have gone to Uncle Sam.

You know what they say... "Tax savings for ME, but not for THEE."

The entire effort is ambitious, preposterous, and flat-out dangerous. If successful, the government would be responsible for picking winners and losers in industries and personal lives. The government will yield all power – a departure from the small-government intended by our founding fathers.

Make no mistake... Biden and his team want to create a dependent class of Americans – addicted to government spending and addicted to the Democrat party. In doing so, they will keep themselves in power.

The Numbers: Read Them and Wince

We're talking about some real numbers here... It's so much money that it's easy to forget how much we're really talking about, but this is the most massive amount of spending ever proposed.

His new plan includes the $2.3 trillion infrastructure package that encompasses not only new spending on bridges, roads, and broadband Internet... but $1 trillion in social spending including:

- $225 billion for a national paid family and medical leave program

- $200 billion for free universal preschool for 3- and 4-year-olds

- $225 billion for childcare programs

- $109 billion for two years free community college

- $80 billion in Pell Grants for college

- $46 billion for historically Black colleges and minority-serving institutions

- $25 billion for food assistance, including $17 billion in free meals for children in poor districts, $2 billion investment in nutrition, and $1 billion to help public schools offer healthy food

Are you kidding me?

Don't we have a lot of these things in place already – and if they're not working, why would we dump more money into them?

From yesterday's Wall Street Journal editorial board piece,

One question to ask is: Haven't we tried this before? What is Head Start if not government pre-school education and childcare? Weren't school lunches and the Women, Infants and Children program supposed to prevent child hunger? Food stamps, welfare checks, child-care subsidies, and a supplement to earned income plus public housing. Weren't all of these programs and more from previous decades supposed to end poverty?

Did the trillions of dollars spent on those programs fail? And if they didn't work, why do we need more?

Great questions... And the short answer is, we don't need more... They failed because the government is too big and too bloated, and handouts don't actually result in meaningful changes in behavior.

We have real issues – in some cases related to crime and the family structure – that will not be solved via checks from Uncle Sam.

Plus, let's get real... We don't have the money to pay for this anyway.

'Tax the Rich!'

Typically, when ambitious Leftist politicians want to recreate the world into a Socialist, power-hungry, authoritarian state designed to help themselves and their party, they go back to the well of class warfare and demand that the reason some people in life have not succeeded is the fault of those that have.

The "solution" from this class of politicians is therefore always, Tax the rich! Who cares if they suffer? They don't "deserve" the money they earned anyway. After all, as President Obama (whose economic policy feels almost quaint in light of the Biden team's efforts) once infamously said, "You didn't build that," when referring to the businesses that small and large business owners built.

There's a serious resentment from the Left directed at businesses, investments, and earnings. They want that money to go to Uncle Sam... or in this case, Uncle Joe.

What they continually fail to comprehend, however, is the reality that if you penalize businesses and earners, they won't care to earn or work as hard. And then, revenue will go down.

It's like my longtime friend and economist Art Laffer so brilliantly demonstrated to President Reagan on a napkin many years ago – by CUTTING tax rates, the government will secure more tax revenue because growth will be that much stronger. When the Trump administration cut taxes, federal tax revenue soared to the highest level ever recorded (this was, of course, pre-COVID).

Meanwhile, it's not just business taxes they want to raise, it's not just income taxes that they want to raise... The Biden team wants to tax your investments as well, courtesy of a massive increase in capital gains between 39.6% and 43.4%!

Frankly, it's moronic.

And the Biden administration argues it will only affect those earning more than $1 million a year. Now that's what you call false advertising. The truth is, the increase will affect EVERYONE since it will suck money out of the markets and the economy.

Investment banking company UBS has predicted that it could knock 7% off market valuations, and I'd argue it could be even more. What Biden isn't telling America is that by depressing investments in U.S. equities, firefighters, teachers, and police will all be affected – actually anyone who has money in a retirement fund!

When money comes out, the market goes down.

But I'd argue there's a sinister method to the Biden madness... Biden's team doesn't really care if markets go up or if the economy succeeds. Instead, they wish to create a dependent class of Americans in need of government help. And if they're successful in achieving some of these policy goals, they will destroy the American economy and American lifestyle as we know it.

Thursday, April 29, 2021

Victim of inflation

I assume by now we all have experienced a fast uptick of inflation, especially substantial increases of prices for the daily life goods we need. Don't tell me you are not paying a lot more these days for grocery shopping. The million dollar question is whether this is just a short term transitory flareup of inflation as the Fed chair Powell loves to make you believe or something that will stay and move up much further up down the road! For me, I always try to consult history to see how much our money has been worth over time. I can tell you that it is not pretty at all if you have the habit to rely on your dollar purchasing power. See below an interesting analysis I have just seen.

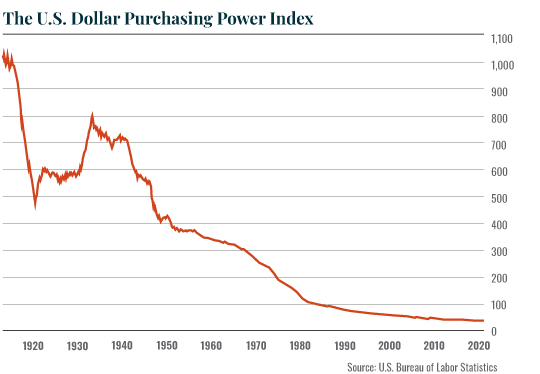

Purchasing power is the proverbial "bang for your buck" — how much of something you can buy for a single unit of currency. In the United States, one dollar today is worth only 4% of what it was worth in 1913. (The year the current Federal Reserve was founded.)

Below is one of the ugliest charts you'll ever see. They don't show this chart in school for good reason.

As you can see, the $USD is one of the worst "assets" to own. Indeed, since 2000 alone it has lost over 38% of its purchasing power! And this is the asset we use to price stocks!

So, what happens when we price stocks in gold, an asset that accounts for inflation and which cannot be devalued by a central bank. Buckle up, it's not pretty.

Yes, you are seeing that correctly. Priced in gold, instead of dollars, the stock market has gone NOWHERE for over 20 years. In fact, stocks are still DOWN 50% from their peak relative to gold in 2000.

So this begs the question… Do stocks even MAKE money?

At suicide watch

The fake president finally gave the State of the Union speech last night, which I of course had no interest whatsoever to watch. But I just saw an insightful decipher of the speech that can let you understand better what the dementia fake president was talking about:

He did not mention his predecessor and his entire address of over an hour was based on the only argument the Democrats have put forward on their own behalf in the last five years: Trump hate. He assumed the headship of "a nation in crisis," in which our "house was on fire," and "We stared into the abyss of insurrection and autocracy," a pitiful and almost subliminal appeal to the Trump Monster.

The country had "done nothing about immigration in 30 years," (most of them under Clinton and Obama), except that under Trump illegal immigration was reduced by 90 percent, and the principal problem was effectively solved until Biden stopped construction of the southern border wall and reopened the borders. He said it was time to do something about the "dreamers" but that was not the policy of his party when Trump attempted to help them. Biden called for resources to deal with the "root cause of why people are fleeing" Central America as if it were the business of the United States to raise the welfare of those poor countries, and feed more graft into them, rather than to monitor its own border and apply a sane system of an admission of immigrants.

He revived the old Obama nonsense about combating employment with unionized green jobs, and leaped into the time warp of bygone days with the bunk that "the middle class built the country and the unions built the middle class, and we must promote the right to unionize." Unions today are an almost wholly retrograde force redundant to market pressures for higher wages and better working conditions and largely confined to the stagnant backwater the public sector.

The former administration created huge numbers of "millionaires and billionaires who cheat on their taxes…adding $2 trillion of debt and extending the pay disparity between the chief executive and the lowest wage earner to 320 to 1." Naturally ignored were the facts that under his predecessor the income taxes of 83 percent of taxpayers were reduced, the number of positions to be filled exceeded the number of unemployed by over 750,000 and the lowest 20 percent of income-earners was in percentage terms gaining income more swiftly than the top ten percent.

He taxed the former administration with "trickle-down" economics, though that charge was leveled at President Reagan's massively popular and successful economic policies. Most outrageously, Biden took all credit for 220 million vaccinations with no hint that if it had not been for Trump's direct intervention to accelerate the development of vaccines, none of it would have happened.

Almost as disingenuous was the claim that House of Representatives Bill Number 1, which would effectively eliminate any serious method of verifying the validity of individual votes, is really an attack on the Republican effort to attack "the sacred right to vote." That bill is almost certainly unconstitutional, would institutionalize and protect mass ballot harvesting, and it ignores the fact that 77 percent of Americans support photo-identification for voters.

The climate was again bandied as an "existential crisis" even though Biden acknowledged that the U.S. only provides 15 percent of the world's carbon emissions. He also omitted to mention its splendid record in reducing those omissions even though there remains no convincing argument that they are relevant to the alleged crisis. Foreign affairs was an unrecognizable dreamworld: "while leading with our allies" and "working closely" with them to deal with Iran and North Korea, (principally by recommitting the West to acquiescing in Iranian nuclear militarization), he will "stand up to (Chinese leader) Xi" whom he realizes is "in deadly earnest" in his determination to supplant the United States as the world's most important country.

After the usual reassertion that everyone is created equal, Biden slipped in the need to "root out systemic racism that plagues America… White supremacy is terrorism" and has "surpassed Jihadism" as a menace. He gave no hint of what he thinks of organizations that are constantly threatening to burn America down if they're not successful in extracting a full-body immersion in self-humiliation from the majority of Americans who despise all racism. Rarely in his rabidly bowdlerized summary of the nation's affairs does the president allow the truth to intrude. This made the opposition response by Sen. Tim Scott of South Carolina particularly effective.

In sum, Biden's address was cringe-worthy, fatuous, and deeply distressing. The State of the Union is almost at suicide watch.

Wednesday, April 28, 2021

Sign of top...historical margin debt

While the market has nowhere yet to an immediate crash into a prolonged bear market like 2000 or 2008, we are seeing more and more signs similar to the frenzy activities that preceded to the top during the dot.com crash and the housing crisis in 2008. I will share more such signs moving forward to prepare you for what is coming. Be clear, I'm not expecting a bear market will start very soon but if history is any guide, we are probably just 6 months to a year away when a blowoff top is formed, followed by a sustained downtrend. When the next bear market hits, it will likely last for several years, not not in a decade as we have also seen before.

Here is one of the top signs:

Investors had borrowed $814 billion against their portfolios as of late February, so-called total margin debt (TMD), according to data from the Financial Industry Regulatory Authority ("FINRA"). Understandably, During a bull market, margin debt tends to rise as more people want to trade and invest.

But today's levels are well above the historical levels, especially 3 times in the past 20 years when TMD blew off sharply within a short period of time just prior to the epic market crashes. Two of them were the prologue to the famous bear markets: The most recent jump happened back in 2007 before the financial crisis. And the other jump occurred during the Melt Up of 1999. In addition, we also saw a similar catapult of TMD prior to the splendid market crash in Mar 2019.

So where will this vertical up move of TMD lead us to? It is a big question mark of course at the moment but keep this in mind as such kind of fast debt accumulation is never a bullish sign. Sooner or later, it will bite those who blindly chase highs!

|

Tuesday, April 27, 2021

Important day if you want to protect your privacy...

Hers is something important for iPhone users. I'm forwarding the following message for your information if you ever care about protecting your own privacy!!

Yesterday (Apr 26) was actually a pretty big day in the world of digital advertising.

Apple released its latest iOS 14.5 operating system for all iPhones around the world. It may not sound like a big deal, but Apple's new software implements a range of privacy changes that directly impact the digital advertising industry.

Most of us don't realize this, but many software applications that we download to our phones track our activity. This is especially true of any free software applications.

Since these companies don't generate any revenue from the sales of their apps, they do so by selling our data to advertisers, advertising networks, and data brokers.

Now with Apple's new software, users will be notified of which apps are actually tracking them, which ones are sharing their data, and most importantly… users can opt out.

This is wonderful news for those of us that use iPhones.

And it's terrible news for companies like Facebook and advertisers that want to reach us on our mobile phones.

Facebook recently issued guidance to its customers – the advertisers – about the new limitations on things like reporting results, campaign breakdowns, and ad targeting. All of these limitations are the direct result of Apple's latest software update.

These privacy improvements have been in the works since last summer. So they have been long awaited by some and dreaded by others.

This overhaul also comes on the back of changes made last spring by Apple, which blocked third-party cookies (small bits of software) used to track all of our internet and web activity from being downloaded to our devices.

Again, most of us have no idea that this has been going on. Yet these egregious violations of our privacy are the foundation upon which companies like Facebook and Google were built.

All of their wealth came from these practices.

My advice for those who use an iPhone… Go into your settings and download iOS 14.5 as soon as possible. And after that, opt out from applications that are tracking you.

And for those that use an Android-based device…

Sadly, you won't have that option.

Monday, April 26, 2021

What we really need is a vaccine for the financial pandemic!

The Vaccine We Really Need |

By Jeff Clark It's pretty remarkable when you think about it. In less than one year, scientists came up with a vaccine to battle the most serious pandemic we've faced in our lifetimes. That just goes to show what can be done when the right amount of money and motivation are thrown at a problem. And, it got me thinking… Why haven't we come up with a vaccine to prevent financial pandemics? As devastating as COVID-19 has been, and as crass as it is to compare loss of money to loss of life, the global financial crisis of 2008 arguably caused just as much grief and despair. Yet, nobody is doing anything to prevent that sort of pandemic from happening again. We all changed our behaviors to battle COVID-19. We locked down. We masked up. We stood six feet apart from one another. We work, eat, and play in plexiglass cages. The Wuhan Applebee's reported that orders of bat soup are way down. And now we have a vaccine. Yet, when it comes to our money, we're still doing the same darn thing that has caused every financial crisis – ever. We're using borrowed money to buy expensive assets. Think about it… The Tulip Mania of 1637, the South Sea Bubble of 1720, and the stock market crash of 1929 were all caused by speculative leverage. In our lifetimes, we can look at the 1987 crash, the Asian currency crisis of 1997, the dot-com bubble of 2000, and the global financial crisis of 2008. Be assured, the next financial catastrophe will be caused by speculative leverage as well. And, by the look of things, that catastrophe may not be too far away. The New York Stock Exchange recently reported that margin debt levels – the amount of money borrowed to buy stocks – reached an all-time high in March. That means that as the stock market averages are trading at their highest levels ever, investors are borrowing more money than ever to put in the stock market. At the end of March, the total margin debt was over $822 billion. That's 70% higher than where it was just one year ago. It's nearly 120% higher than in July of 2007 – just a few months before the start of the global financial crisis. And this is just the money that has been borrowed to buy stocks. It doesn't count the leveraged purchases of high-yield bonds, non-fungible tokens, Miami real estate, or cryptocurrencies named after a dog. This isn't going to end well. The Federal Open Market Committee meets this week to talk about the economy, and the appropriate target level for interest rates. No doubt, Chairman Powell will reiterate the need to keep near zero percent until the end of 2023. The economy needs the easy money. He'll do his best to squash any fears of inflation, or the falling dollar, or the massive speculative activity in the financial markets. "Don't worry," he'll say. "We have everything under control." For some reason, I suspect there was a scientist in a Wuhan laboratory that said the exact same thing about a year ago. |

Saturday, April 24, 2021

Don't waste money on college

| (Forwarding a good piece from my friend...) College education, especially in the US nowadays, is a crazy place for brain-washing. I have heard many heartbreaking stories recently from friends who said they couldn't believe how their beloved sons and daughters have become so strange to them as they don't share the same values anymore! Really sad, especially for Chinese parents who usually spend big money for their kids for college. Hope this piece may provide some food for thought for those friends who still have young kids before college with respect to the value of receiving college education through the formal system. Doug Casey: Do This Instead of Wasting Money on College |

Rachel Bodden, managing editor, Casey Research: We've spoken before about some of the investment implications of a collapse … but you hinted there are even bigger problems than just those related to the market. What are some specific steps that you suggest people take pre-collapse? Doug Casey, founder, Casey Research: If you're retired or approaching retirement, you should mainly try to conserve capital – not gamble in hopes of getting lucky. As Richard Russell liked to say, in a depression, the winner is the one who loses the least. From an action point of view, that means owning physical gold, silver, and Bitcoin. Although I understand that last will outrage some people. Also, buy mining stocks and oil stocks – they're bargains, with huge upside from here. Many people are using the stock market as a substitute for a casino, however, using trading services like the tout sheets at a race track. It's a very bad idea at this stage in the business cycle. Younger people are in a different position, of course. But I think they too can find much wiser uses for their time and money than playing the market. When you're younger, you shouldn't worry about money so much as getting experience that will serve you well throughout life. I've long advocated that people take off a year, or two, or three, to do things best done while you're young, instead of going to college. Use just a small portion of the money that you'd spend going to college to do memorable things. Go to different and strange countries, broaden your horizons, and see how the world works. I promise it will be vastly more valuable than sitting at a desk, listening to Marxist professors try to indoctrinate you. In addition to the kind of experience that's only available through travel, you should be reading constantly and gaining knowledge. Travel and reading tend to be things most people put off and save for the future. That's a mistake. These aren't things to put on a "bucket list" for when you're older, thinking you'll have the time, and be looking to fend off boredom. Youth is for gaining knowledge and experience. Those things will allow you to see opportunities that you would not see unless you have a huge bank of knowledge and experience. It's a gigantic mistake to sit in a classroom with other young people who know as little or less than you do, while dissipating $200,000 or $300,000 and four or more years of time. Another thing. Use the years most kids misallocate in college to gain skills and abilities, which is a little bit different than knowledge from reading and travel. By that I mean, learn to play sports and activities that will allow you to move with people of a higher socioeconomic background in the future. For instance, this is one of the advantages of learning to play polo. It's expensive, yes. But when I go to almost any major city in the world, if I go to the local polo club, I'm automatically a member and have an entrée into the most successful and richest people in that society. To a much lesser degree, that's true of golf and tennis. But there are all kinds of activities that can give you entrées into different groups of people. For instance, learn to shoot skeet, learn to skydive, learn to race cars, practice martial arts, learn to scuba dive, and become expert in them. Rachel: I love scuba diving. Doug: Super. I've scuba dived all over the world, and have been active at it for most of my life, actually. When you're young, concentrate on knowledge, experience, travel, skills, and making connections. Because there are some things that you really had better do, or maybe can only do, when you're young. Because at some point an accident, an illness, or simply age and entropy will preclude them. Sitting in a classroom to get a credential – a piece of paper – is low on the list. Apart from the fact most students cut classes, fall asleep in them, are bored by poor lecturers, and take bad notes. Rachel: That's excellent advice for younger people. And there's so much pressure for them to just go to college, as if that's the only pathway they are acceptably allowed to have. Your version is so much more enriching and allows you to do so much more and be around so many more people. Doug: I promise it's not only vastly more fun, but should be much more financially remunerative as well. College has become an extremely expensive and stultifying way to transform kids into becoming no more than drones, cogs in the wheel. It actually makes kids feel they're not responsible for improving themselves. Rachel: Speaking of college, I can't imagine that the biggest scam in America can survive a collapse like the Greater Depression. I know that I myself got a degree from a university where a single semester at the time cost about $28,000. So do you think that industry will survive the collapse? Doug: The answer is no. There are way, way too many so-called institutions of higher learning today. I suggest everybody that's reading this, watch the video of the hour I spent on The Phil Donahue Show the day before the national elections in 1980. The audience generally liked me, but there were two things that I said that actually made them boo me. One of them was that I said, even then: Don't waste four years of your life and a whole bunch of capital going to college, unless there's something very specific you need to learn. Of course, many fewer people went to college 40 years ago than today; it was considered more of a privilege for the elite. And the quality of the professors and classes was not only much higher, but it was much cheaper in real terms. For what it's worth, I was a trustee of the tenth-oldest college in the U.S. for five years. I can tell you that not only is the system corrupt, but it's probably incapable of change. I've said college was a mistake for many years, and it's even truer now than it's ever been, for lots of reasons. Most people go off to college thinking that a diploma guarantees them something in life. In fact, it only guarantees an infusion of phony ideas and a lot of debt. People have forgotten that the object of education is to improve yourself, not get a piece of paper. Leonardo da Vinci didn't go to school. He was entirely self-educated. Everybody should follow his model – and that of Ben Franklin, Abraham Lincoln, Thomas Edison, and hundreds of other polymaths and Renaissance men. They proved that all you really need is basic literacy and numeracy – none of them had more than a year or two of formal schooling. You aren't educated; you educate yourself. College is mainly valuable for STEM courses – science, technology, engineering, and math. Why? For those things, it's helpful to have the formal discipline of a class, hopefully a mentor, and laboratories to work in. But other than STEM subjects, I'd say going to college today is actually a negative value. Four years of living in an academic womb, its amniotic fluid chock-full of poisonous memes, isn't a good idea. Rachel: Well, I myself wish that I had spent four years and a fraction of the capital that I spent on a degree that I don't even use traveling the world. I'm lucky that I traveled a lot growing up, but I still should have done more. Doug: You've figured it out. But most people of your generation don't have a clue. You're way ahead of the game. Rachel: Thank you, Doug. High praise from you. Young or old… do you have a few books you consider required reading if you want to be a clear thinker? Doug: Good question. Figure that – even if you're very diligent – reading a book a week from age 10 to age 60, adds up to 2,000 books, maximum. And keep Pareto's Law in mind – one variation of it holds, correctly, that 80% of everything is crap. So it's important to choose wisely. It's hard for me to recommend just a few offhandedly. However, over the years I've done hundreds of interviews with a good number of book recommendations. But two books come to mind and stand out in this context. One is Eric Hoffer's The True Believer, the other Ayn Rand's The Virtue of Selfishness. Both are quite short in length, well-written, and absolutely brilliant. Rachel: Thank you for your time today, Doug. And I just want to remind our readers of Assassin, the third book in your High Ground Novel series. I think it should be required reading, too. |

Friday, April 23, 2021

Something must give....

Per the Sentimentrader's tracking, there is something that has never happened before, a huge divergence between S&P vs Nasdaq and Russell in terms of the stock momentum trend. See details below. Something must give in this situation, either S&P trends down or N/S to catch up to narrow down the gap in the weeks ahead. We shall see.

This major divergence has never happened before

For months, we've seen that sentiment has oscillated around extreme levels of optimism, yet stocks were holding firm. Not just the popular indexes, but most stocks, industries, sectors, even global markets.

That has started to shift in recent days.

It's too early to tell whether this can morph into something larger, but already there are splits that we haven't seen for a long time. As Bloomberg noted, around 80% of S&P 500 members are still holding above their 50-day moving averages, but within the Nasdaq Composite and Russell 2000, it is a vastly different story.

Going back more than 25 years, there has never been a day - until Tuesday - when 80% of S&P 500 members were above their 50-day averages at the same time so few Nasdaq and Russell members were above their own averages.

With Wednesday's rally, the picture didn't change much. The S&P had more than 85% of stocks above their 50-day averages, while both the Nasdaq Composite and Russell 2000 had fewer than 50% of members above their 50-day.

That's never happened before.

This is a great moneymaking joke!!

First about the crazy mini crash of the market yesterday. I was trading for the long side for the week and all was going beautifully in the morning with big greens all over but all the sudden in the early afternoon the market got a mini crash and my screen immediately turned to bloody red😢 The reason? The fake dumb president Biden was reported to propose a hike of taxes for high earning folks. I just cannot understand this fenetic reaction by Wall Street! Raising taxes is nothing new for this Alzheimer who has no clue whatsoever about how to manage the economy. He has been kept telling this for years and I thought those Street elites love this dumb president for higher taxes. Isn't it true they got really excited when Biden was faked into this presidency?! What's the fuss about this? Let alone there is virtually no chance that this tax bill will pass the Senate. I was really mad that my party was ruined suddenly but by carefully analyzing the charts, it was apparent that this was an overreaction and I was betting we would see a nice rebound next day (i.e. today). So I was sticking to my gun by holding my bloody positions and fortunately I did so. Today those Street elites, a bunch of idiots, apparently realized how stupid they were and they wanted to make up the big losses yesterday by buying frenetically today!! I ended up with beautiful greens all around again for the week😇💪

I'm sure you've likely heard about dogecoin. Not sure if you also know that the crypto was created as a joke – which has zero utility and, worse yet, an unlimited supply – is based on a meme of a cartoon Shiba Inu.Since it was a joke, no one took it seriously most of the time since its birth a few years ago until recently. See the chart below, within just a few months, it has shot up vertically in a straight line. The total gain since its birth has been well over 100 times but most of it was made since the start of this year, over 80 times!

While I know this kind of frenzy euphoric move may not be sustainable and I certainly don't know how long it will last, I'm still extremely happy for the moonshot of it. A couple of years ago I bought it as a joke for fun and I never really took it seriously and had almost forgotten that I was holding it. Then all the sudden a big gain is popping up, almost like a chunk of free money lying there quietly waiting for me to pick it up😄😇 With this kind of gain in hand, I cannot help but sell portion of it to not only recoup all my initial invested capital (many times more actually) but also get a good sum of some additional fund to be swapped to other cryptos. I will hold the remaining part to let it lead me to wherever it may want to go. Who knows maybe someday the joke coin will shoot up to over 1000 times as its ultimate destiny! After all, it is now called "People's Coin"🤗

Binance is the biggest microcurrency trading platform on the planet, and their US headquarters just hired Brian Brooks as CEO.

Brian served as the Acting Comptroller of the Currency (OCC) under president Trump.

Talk about a bullish catalyst!

People will see that a former OCC is the new CEO of Binance.US, and will realize that digital asset companies are indeed respectable.

Not to mention, when Binance publicly lists their stock, retail investors will love to invest in a company led by a former US bank regulator.

But it goes deeper than that.

A man like Brian Brooks has a lifetime's worth of powerful connections.

Now he's bringing his White House networking to the digital asset sector's largest trading platform.

I suspect it won't be long before our government finally upgrades our aging financial infrastructure with micro-technology.

Speaking of infrastructure, blockchain technology is also being used to build Europe's future telecommunications network.

Europe's Telecom Infrastructure Being Upgraded To Blockchain

The $87.3 billion telecom powerhouse, Deutsche Telekom AG, is going all in on the future of communication.

Today, the company announced that they've made a significant purchase in CELO, an altcoin made by the decentralized mobile payment company Celo.

Andreas Dittrich, head of the Blockchain Solutions Center at Deutsche Telekom, said:

"It might look like Deutsche Telekom is investing a significant sum in some weird altcoin... We're not doing this to make some money. We are going to be invested for years to come to support this network with a focus on infrastructure. The Celo protocol is very attractive to us as a telco because every phone number is linked to the wallet of a customer."

They're investing in Celo's blockchain network.

Wednesday, April 21, 2021

Truth exposed: how 主要下流媒体CNN cheat audience

CNN Exposé Reveals the Latest Media Corruption

By Buck Sexton

Ethical journalism should seek out the truth and report it... Yet this seems to be pretty rare in today's corrupt media environment.

Instead, it's all about agenda... And look no further than media giant CNN for the latest case of news debauchery.

From the yearslong Russia-collusion hoax to the now-debunked story of Trump supporters "bludgeoning" Capitol Hill police officer Brian Sicknick to death during the January 6 riot (he had no injuries and died of a stroke the next day), CNN is often deeply, inexcusably incorrect. And they don't care... They're not engaged in the practice of journalism.

In case anyone had their doubts about this obvious truth, James O'Keefe's Project Veritas recently scored a direct hit on the "Facts First" mythology that CNN tries to peddle to its credulous Democrat viewers.

Project Veritas, a conservative undercover journalism enterprise, recently released footage of CNN Technical Director Charles Chester explaining that yes, his network is full of anti-Trump propaganda...

Look what we did, we [CNN] got Trump out. I am 100% going to say it, and I 100% believe that if it wasn't for CNN, I don't know that Trump would have got voted out... I came to CNN because I wanted to be a part of that.

This must come as a shock to the brand-obsessed Anderson Cooper, Jake Tapper, and other pompous frauds at the "news" network. They strut around on TV and social media like the heirs of Walter Cronkite, pretending they have no dog in the political fight and are merely speaking truths to the American people.

But in reality, they know what the game is now... Everyone who works in the corporate media does. I spent two years as an on-air conservative political commentator at CNN from 2014 to 2016 and refused to go back for a third year despite an offered contract extension. It wasn't a difficult decision... CNN is a pathologically dishonest place.

But there's more in the Veritas exposé. CNN's Chester went even further than declaring his network anti-Trump, stating that they were willing to manufacture stories as political weapons against the then President...

[Trump's] hand was shaking or whatever, I think. We brought in so many medical people to tell a story that was all speculation – that he was neurologically damaged, and he was losing it. He's unfit to – you know, whatever. We were creating a story there that we didn't know anything about. That's what – I think that's propaganda.

Indeed, it would accurately be called "fake news." None of this is a surprise to people familiar with the disgraceful ethics of Jeff Zucker's CNN in the era of Trump. Forget whatever breaking news you got used to watching in the 1990s... The CNN of today is basically Pravda for Nancy Pelosi and the DNC.

Chester is even on tape admitting how CNN has preyed on the American people's fears of the COVID pandemic...

[COVID] will taper off to a point that it's not a problem anymore. Climate change can take years, so [CNN will] probably be able to milk that quite a bit... Climate change is going to be the next COVID thing for CNN... Fear sells.

But what was the biggest outcome of O'Keefe's outfit holding up the mirror of truth to America's most storied cable news channel? O'Keefe was permanently banned from Twitter for sharing the videos of his sting operation. The tech oligarchs don't like it when their buddies in the legacy corporate media are made to look like fools... This should infuriate anyone in the U.S., Left or Right, who claims to want unbiased, fair news.

This one-two punch is a potent reminder... CNN is indeed fake news, and Big Tech will seek to shut down anyone who points this out. Neither believes in free speech, and both are enemies of the truth. This has been obvious for years, as Twitter has a habit of only suspending or banning conservative voices online. CNN always stands in solidarity with this conservative suppression.

O'Keefe isn't taking this lying down. He recently filed a lawsuit against Twitter for defamation in federal court. You can see a copy of the complaint here. The basics are that Twitter lied about why O'Keefe was banned (they claimed it was for operating fake accounts), and O'Keefe holds that this falsehood constitutes defamation.

The Veritas founder faces an uphill battle in court. Twitter's "community protection" commissars have wide leeway behind the scenes to make decisions about who to ban. While any person paying attention can see Twitter was clearly stacking the political deck in favor of their Leftist buddies at fake-news CNN, Twitter will probably just claim the ban was a mistake and reinstate Veritas.

Alternatively, in this current climate of ultra-woke corporations, Twitter may just assert that decisions about who to ban are entirely its prerogative. Whether it's CNN or Twitter, these Leftist media companies have let the mask drop. They're open, active partisans working for the political benefit of the Democrat party now.

Others are trying to fight back, too... Just this week, Missouri Republican Sen. Josh Hawley introduced legislation to try and restore accountability and competition to Big Tech. The bill, named the Bust Up Big Tech Act, would prevent large companies from dominating multiple industries simultaneously, as well as give the FTC more power to enforce compliance.

The legacy media has always hated Project Veritas because it exposes the truth about who they really are and what they seek to do. As O'Keefe and others continue to show what a fraud corporate journalism has become, the next phase of battle will have to be engaged.

That's going to mean many more lawsuits and an overall media war to show that some of the biggest news and tech corporations in the country need to be reformed or brought to their knees.

Tuesday, April 20, 2021

A deep correction on the way?

As I said a couple of weeks ago, I turned bullish for the month of Apr due to the technical strength and seasonal bullishness of the month. I'm glad I did so as the market has made several new highs in the past two weeks. We are still in the middle of April and the earnings season has just begun. So likely we will continue to see a few more weeks of good time for the market. Having said that, it is undeniable that the current bullish sentiment is nose-bleeding and traders have likely priced in a lot of fantastic good earnings expectations.

Technically S&P by all means is very stretched, significantly deviated from its 50 DMA and 200 DMA. In one word, traders are "all in" at the moment. This is likely setting up for a big correction, especially when we move into the bearish season starting from May. Apparently I'm not thinking that alone.

Recently, Bank of America's Savita Subramanian discussed why the market could drop to 3800. Her big question is whether all the "good news" already "priced in?"

"Amid increasingly euphoric sentiment, lofty valuations, and peak stimulus, we continue to believe the market has overly priced in the good news. We remain bullish the economy but not the S&P 500. Our technical model, 12-month Price Momentum, has recently turned bearish amid extreme returns over the past year."

I'm personally convinced that a big correction is brewing but how big can it be? BofA only expects a 10% correction but I think there is a risk of a deeper reversion.As shown below, over the last 5-years, corrections have ranged from roughly -10% to -33%. Notably, these corrections usually have reverted the index either to the 200-dma or beyond. Given the magnitude of the market's current deviation from the 200-dma, a correction will likely surpass 3800. A retest of the 200-dma seems most probable. Or in other words, we may see a 15-20% correction in the next few months.

Friday, April 16, 2021

US$: on its way to death

Requiem for a Currency... The Slow Death of the U.S. Dollar

By Kim Iskyan

It was November 25, 1980 when Sugar Ray Leonard II pummeled defending champion Roberto Durán for nearly 24 minutes during their World Boxing Council welterweight championship bout (billed "The Super Fight").

With 16 seconds left in the eighth round and knowing he was going to be beat, Durán uttered no más, no más – Spanish for "no more, no more" – as he turned away from Sugar Ray.

Durán waved his glove at the referee and retired to his corner. It was the first time in more than 15 years that a champion had quit a title fight.

And no más might be what global investors say to the U.S. dollar soon...

The steady debasement, through ever-escalating mountains of debt, the dollar is increasingly threatening its status as the world's reserve currency.

At some point – and this is historically inarguable – the dollar won't be king of the castle anymore.

Tectonic shifts like this happen over decades... and almost invisibly. And it's happening now. The good thing is, there's still time to prepare.

The U.S. Dollar Makes the World Go 'Round

Though many Americans may not realize it, the U.S. dollar is the cool kid of the global economy: Everyone else wants to be around him... craves his attention... and wants a piece of him. For more than a century, it's been the world's primary reserve currency.

Central banks around the world hold reserves – in currency or precious metals – so they can trade goods abroad or invest in other countries. Some central banks also use it to maintain exchange-rate pegs. Around 59% of the $7 trillion held by governments around the world in reserves are held in U.S. dollars. Seven different countries use the U.S. dollar as their official currency, while 65 others peg their national currencies to it.

And greenbacks are the world economy's most important medium of exchange, unit of account, and store of value. If they don't use U.S. dollars, it's a lot more difficult – and expensive – for countries, companies, and people to buy oil or gold, sell toys or cars, or invest in hotels or bridges.

When a Vietnamese (or Argentine or Canadian) company wants to buy goods from Brazil (or South Africa or Singapore), they'll likely use U.S. dollars... because it's the common currency between the two parties in most global transactions.

Similarly, when a tourist from Mexico City visits Moscow... or someone from Sao Pãulo goes to Sydney... she'll take dollars with her, not her local currency. Uncle Sam's money speaks every language on Earth, and no matter where you go or what you want to do, you can use your U.S. dollars to buy other money.

The Dollar Privilege

Because everyone wants dollars, the U.S. government – that is, the Federal Reserve, the American central bank – has enjoyed a unique advantage: It's been able to borrow, seemingly endlessly, from everyone else to create new dollars. And the government has been able to defer repaying its lenders by constantly rolling over – and increasing – its debt, seemingly forever.

In the 1960s, French politician Valéry Giscard d'Estaing called the benefits that accrue to the United States thanks to the U.S. dollar's status as a reserve currency an "exorbitant privilege."

Thanks to its privilege, the U.S. national debt stands at $28 trillion (up 20% in 2020). For context, U.S. GDP – that is, economic output – totaled $21 trillion in 2020. That's around $85,000 for every single American citizen.

And there's more. We're moving into a brave new world where trillions (that is... 12 zeros) are discussed with the nonchalance that was recently reserved for mere hundreds of billions, as COVID-19 relief packages revises the notion of big numbers. Total COVID-19 aid has amounted to $5.3 trillion, only some of which is included in current debt figures.

Put it all together, and 78% of all dollars that have ever been made, have been created over the past 12 months. (And... none of that, of course, includes the proposed $2 trillion infrastructure plan announced by the White House in late March.)

The federal deficit is forecasted to hit 15% of GDP in 2021, the biggest deficit since World War II. That's compared with 2.4% as recently as 2015... and 9.7% in 2009, in the depths of the global financial crisis.

It's like the United States has had an open tab at the global money bar... and it's been on a historic bender, evading hangovers with endless Bloody Mary hair-of-the-dogs – and then starting all over again.

Other countries – countries that aren't the United States (with the partial exception of the Japanese yen and Europe's euro, the RC Colas of reserve currencies) – can borrow only as much as others will lend them. As they borrow more, the price of that borrowing increases.

And the cost of borrowing for the U.S. has been rising in recent months – along with the risk of inflation. If the U.S. was a normal country – one that, say, had to pay its bar tab and eventually show up at work the next day after a long night at the pub, bleary eyed and headache-y – it would have gone bust years ago.

Since the dollar is the world's reserve currency, that's not going to happen. It can just sell more debt. But meanwhile, the decline of the dollar's status is accelerating.

America's Declining Market Share

The U.S. dollar has long been in the pole position as the global reserve currency because the U.S. is by far the world's biggest economy, and the dominant player in global investment and finance.

Correction: It was the global economy's 800-pound gorilla. Over the past few decades, America's share of global economic output fell from 40% in 1960 to around 23% today. The U.S. now trails the EU and China in terms of overall volume of exports and imports.

That's partly pure mathematics. The Chinese economy grew by an average of 10.4% for the two decades after 1991, while the U.S. economy grew by an average of only 2.5% over that period. Now China's economy accounts for around 17% of the global economy and will likely overtake the U.S. as the world's biggest within the next five years. (And according to one, lesser-used, methodology to tabulate economic output, it already has.)

So it's not surprising that the global reserve currency holdings of the U.S. dollar, as a percentage of total stockpiles, at 59% is at its the lowest levels since the 1990s.

The recent decline happened "amid questions about how long the dollar can maintain its status as the pre-eminent reserve currency," explained Bloomberg in late March. And the world's economies feel the need to reduce their U.S. dollar "overweight" reserve exposure to the U.S. dollar, as the American economy loses market share.

Reserve Currencies Come and Go

We – that is, anyone reading this in 2021 – only know of a world where the U.S. dollar has been in the cockpit. But just over 100 years ago, it wasn't... and if history is any guide, soon it won't be.

The past six centuries have seen six different reserve currencies. Each lasted for about a century, give or take a decade or two. The Portuguese real was the world's main currency from around 1450 to 1530. Then a royal succession crisis distracted Portugal, opening the door for Spain's currency to become the world standard, for around 110 years.

Subsequently the Dutch guilder took over as king of the hill, until the Bank of Amsterdam issued too much debt in the early 1700s, and lost the confidence of the market and investors. France assumed the throne, followed by Britain in the early 1800s.

The British pound's reign as a reserve currency ended with the declining importance of Britain in global commerce – compounded by the decline in global economic interdependence after World War I.

That's when the U.S. dollar became the dominant currency in the global economy. Its position at the top was solidified in 1944, when the Bretton Woods accord established the ground rules for the global monetary system.

A number of conditions – inflation, high debt, bad policy management, and just plain greed – can play a big role in ending a reserve currency's run. That, and the calendar, suggest that it's after the seventh-inning stretch for the U.S. dollar as the start of the global financial system... and it might already be in the ninth inning. And we'd be kidding ourselves to think – hope – that we're going into extra innings.

What's Next?

"One can hardly pick up a financial newspaper these days without seeing a story about the dollar's impending loss of international prominence," wrote University of California economist Barry Eichengreen... in 2005.

Right now, it's almost as if the U.S. government is doing everything it can to accelerate the extinction of the U.S. dollar as a reserve currency... escalating debt, increasing inflation, and rising deficits are all toxic to the longevity of the dollar as a reserve currency.

If not the dollar, though, then who? The options are limited. The euro – hostage to the EU's political infighting – always seems to be one debt crisis (or charismatic anti-Europe populist) away from calls for its dissolution. And the No. 3 reserve currency, the yen, has as its home an economy that's in the midst of a multi-decade drift into irrelevance.

With the rise of the Chinese economy, the renminbi is an obvious contender. But the renminbi isn't even freely convertible and is still subject to capital controls. It's nowhere close to becoming a global currency – let alone a reserve currency.

What is more promising – or, for the dollar, threatening – is currency digitalization. Many countries have been struggling to figure out how the rise of cryptocurrencies and the blockchain will impact currencies. Most central banks, including the Fed, have alternately ignored, threatened, and weakly embraced elements of the blockchain.

But China, always attuned to an opportunity to exercise ever-greater control, has since 2014 been developing a central bank digital version of the country's currency. Its digital version of the yuan will function like cash – and be completely centralized and controlled by the country's central bank.

As a commentator wrote earlier this week in the Financial Times...

... [the digitized renminbi could] hasten the decline of the dollar's dominance as the world's leading reserve currency. It could also hasten the acceptance of the renminbi as the main rival to the U.S. currency... if China captures the first-mover advantage to meet the world's demand for use of digital currencies to settle international financial transactions and own digital assets, the appeal of its [currency] could rise sharply.

Fundamental to cryptocurrencies is the element of anonymity afforded by the decentralized blockchain ledger. A digital currency controlled by the Bank of China and the Chinese Communist Party – denominated in a currency that's as useful outside of China as fish sunglasses – isn't (ever) going to overthrow the U.S. dollar as the world's reserve currency. It may, though, become widely used in the developing countries, if China were to make receipt of Belt and Road Initiative (formerly One Belt, One Road) investment contingent on using its digital currency.

Most likely is that the U.S. dollar continues to be nudged out of the ring. The other reserve currency options – euro, yen, renminbi, digital renminbi – may become more palatable in relation to a debauched dollar. And in time, bitcoin – or a future cryptocurrency standard bearer – may also be used as a reserve currency.

What to Do?

There's one asset that's held its value over time – and which will continue to do so, regardless of the Fed and China and European bureaucrats: Gold.

Your wealth will be much safer if you're holding at least a portion of it in gold... not in anticipation of the price of gold rising (though it likely will), but just as a way to preserve your capital.

Bitcoin is another – though more speculative – option. If one day the cryptocurrency blue chip becomes only a sliver of a reserve currency holding for the world's central banks, its value will explode. That probably won't happen... but in the meantime, it's the one currency that isn't subject to the whims of central banks and politicians.

And finally... reduce your exposure to the dollar (and the United States). Open a bank account abroad. Buy some foreign real estate, and shares of companies outside the U.S. If you're really feeling extreme, look into giving up your U.S. passport – though only after acquiring another citizenship first.

It's not no más for the dollar yet... But you want to be ready for when it is.

Big loss due to nonsense political correctness!

You must have noticed the historical event of this week: the very first IPO of a crypto stock: one of the well established and best run crypto exchanges, Coinbase (COIN).✌For anyone in the crypto market, this is indeed an existing day as a brand new era has just opened up. Not sure if anyone has bought any shares of Coinbase on this historical day. I did, even though I couldn't believe I'd have done so! As you may know, I'm a FOMO phobia guy, or crowd aversion kind of person and I have never bought any IPOs before. My wife is still kidding me now how stupid I am that I missed the Google IPO, even though she was suggesting I should buy some on that day😭. But I still generally avoid chasing any IPOs regardless how attractive they may be. Not this one, of course. For two reasons:

- I have been using Coinbase for at least 5 years as it is my cradle that empowers me to learn and grow in the crypto world. My very first Bitcoin and Ether were bought in Coinbase, which have turned my initial crypto investment into a 100+ bagger. So even though I very well know I may lose some money by buying COIN at IPO, it is a drop in the bucket. It is more important for me to be part of the historical day!

- I like the CEO of Coinbase. You can see the story below. He is a truly a wise businessman, dares to openly challenge the stupid and nonsense political correctness! Rarely you will see such kind of shrewd CEOs with backbone as nowadays most of them are just spineless villains (见风使舵的小人), politically speaking!

Interestingly, 60 employees of his company took the severance package and left the company as they wanted to be politically correct. I'm pretty sure they are now really sad and sorry 😰for their nonsense action as it has cost them dearly for nothing. If they had stayed, their employee stock incentives would have been a huge return with the company's value having increased so much in the past year!! It is great for the company to not waste any money on such brainless folks😎

****************************************************

We've described the phenomenon before: By co-opting the social justice warriors, the American oligarchy — Wall Street, Silicon Valley, the health care cartel, the military-industrial complex — cements its grip on power. "Social justice" is a brilliant distraction from how the crony-capitalist power structure really works.

Here, for example, is an Instagram post from Visa days after George Floyd's death — with a twist on its "It's everywhere you want to be" slogan.

And of course, we can't forget the absurd image of JPMorgan Chase's CEO "taking a knee" the same day as Visa's meme…

Going into this morning, the cryptocurrency trading platform had an estimated valuation of $65 billion — on par with the New York Stock Exchange's parent firm, go figure. As we go to virtual press, trading has opened at $381 a share — boosting the market cap to $99 billion.Set in this context, the Coinbase IPO today is a remarkable event.

But you can read about the IPO anywhere. Of way more interest to us this morning is how Coinbase eschewed woke doctrine — indeed, any sort of political doctrine — and somehow got away with it.

On a company blogpost last year, CEO Brian Armstrong declared Coinbase would not follow the Silicon Valley herd. Instead it would adopt a politically neutral stance, staying "mission-focused" and sticking to its crypto knitting.

"The reason," he wrote, "is that while I think these efforts are well intentioned, they have the potential to destroy a lot of value at most companies, both by being a distraction, and by creating internal division."

Simple, sensible, reasonable. Not surprisingly, Armstrong and Coinbase got roasted by the mainstream for taking this position.

As Glenn Greenwald writes on his Substack site, "the notoriously censorious and politicized 'tech reporters' of The New York Times punished the company for its heresy of neutrality with a lengthy article depicting Coinbase as a bastion of racism and toxic bigotry."

Amazingly, Armstrong stood his ground. He offered severance packages of up to six months' pay for employees who objected to the policy.

"Life is too short to work at a company that you aren't excited about," he wrote in an internal email. "Hopefully this package helps create a win-win outcome for those who choose to opt out." Roughly 60 people, or 5% of the workforce, took him up on the deal.

That was about six months ago. As far as we can tell, that was the end of it. A web search for "Coinbase social justice" turns up nothing since then.