LEGAL DISCLAIMER Please note everything discussed at this site is a personal opinion of the author and may contain errors or omissions. NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT. It would be your sole responsibility for actions you undertake as a consequence of any analysis, opinion or advertisement on this site.

Total Pageviews

Friday, July 31, 2020

I cannot help but short it!

Saturday, July 25, 2020

Unprecedented growth

What has growed fastest this year? It is easy, tech and biotech stocks, right? Not really. It is the money supply!👶

Take a look...

|

As you can see in the above chart, since 1970s, the Fed has got a habit to boost money supply whenever there is a crisis, like the oil shocks in the 70s, the Latin American burst in the 80s and of course the 9/11 and the 08/09 financial crisis both in the 2000s. But none of them were comparable to what we are seeing now, a 25% increase of the money supply which all occurred within just a short few months.

It is truly unprecedented!😴

According to Gavekal Research, a research firm that tracks these things, "This rate of money printing has never been seen before in the history of the U.S., or of any other G7 economy."

This unprecedented money supply has fueled the bubbly increase of nearly all the assets including stocks, one sector is especially beneficial from the runaway debt increases. And amazingly, even it has gone up a lot and is the best performing sector for the year, you still don't hear much talk in the media yet about it, not like stocks that everyday you hear new highs announced and discussed on TV. I'm talking about gold and silver. Gold has quietly jumped to its 7 years high and is very close to challenge its all time high just above $1900. Silver is still far away from its all time high around $50 but is catching up very fast these days. Precious metal stocks are doing even better. See below how much gold stocks have outperformed the stock market so far this year.

The precious metals analysts, Otavio Costa, recently posted the following chart on Twitter. It shows the price of silver compared to the U.S. money supply (M2) over time. As you can see, compared to the amount of money that's been printed, silver prices are still historically low.

Friday, July 24, 2020

TSLA to $3500 by Friday!

This was what I learnt a few days ago this week that someone placed a bullish call trade for TSLA, betting it would be worth at least $3500 by Friday, i.e. today!

The bet for more than double within a few days, likely due to the extremely bullish expectation for its earnings on Wed, is already beyond believable. What's more astonishing is the magnitude of the betting: someone bought several thousands of call contracts for the Jul 24 TSLA $3500, which cost over $750,000. By now, we know how badly the guy(s) have lost as every penny of their bet is gone now! Ouch!! Quite often, big option bet on the short side is used to hedge for the held big position to avoid a sudden crash that may happen following the earnings. But I don't think would be case at all as the strike price is so much higher than the share price and there is no sense at all for protection purposes. So this is a purely bullish speculation for a quick double.

This is kind of craziness right now we are seeing. Chasing highs at any cost is not something rare but widely popular. TSLA has already doubled within just a couple of weeks and someone was still willing to bet that it could double again within days. Of course, not everyone is so much keen on chasing TSLA. Here is the information from my friend:

Doug Kass of Seabreeze Partners thinks it is the time to short TSLA. Here is what he wrote:

Shorting Tesla!

* I have been waiting patiently to short Tesla for years

* Tesla goes on my Best Ideas List (short)Tesla (TSLA) is no longer a hard to borrow (short) – so, in accordance with my core shorting tenet of avoiding high short interest relative to average daily volume and float, I am free to short the stock.

Which I did this morning at $1,642.

I shorted even though I expect the stock to be included in the S&P (which I believe to be fully discounted – and more!) after achieving profitable quarterly results.

Tesla, with a market capitalization of over $300 billion, reached profitability by virtue of a heavy dose of regulatory credits, so it was a poor quality report.

While the capacity expansion of the next gigafactory in Texas will expand the company's delivery capacity, I have written volumes on Tesla's fundamentals – a more competitive EV market, etc. – in the past so I see no need to reiterate my views which have not changed.

Bottom Line

It is my view that Tesla will trade at $1,000/share before it trades at $2,000/share.

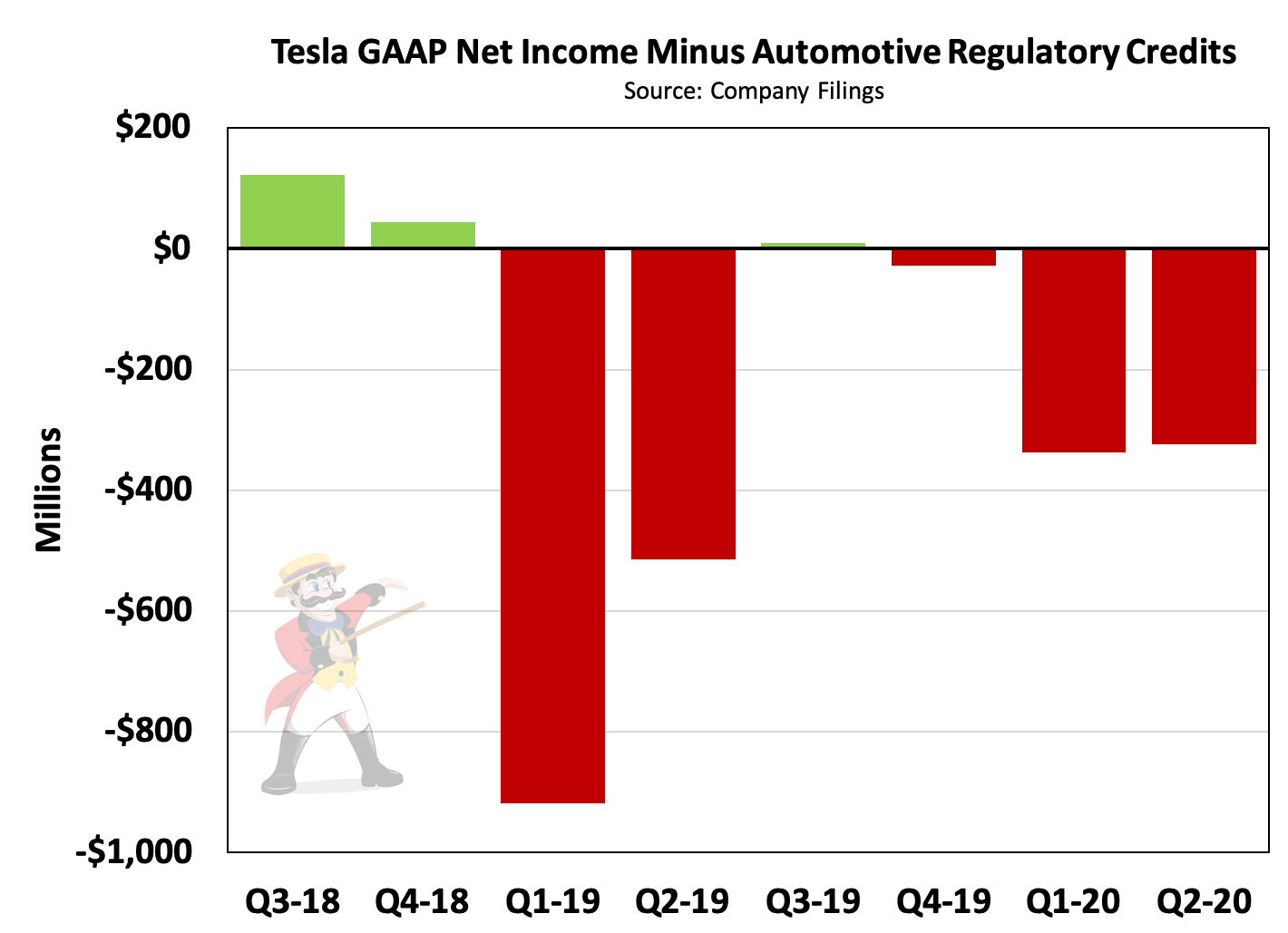

Regarding Doug's point about the source of Tesla's profitability, here are the facts: in the past four quarters, the company has reported cumulative GAAP net income of $368 million – but not from selling cars. Rather, this has been driven by carbon credits of more than $1 billion. (Over the same period, Tesla's market cap has grown by $248 billion.) This is what Tesla's net income would have been minus those credits (from @TESLAcharts on Twitter):

|

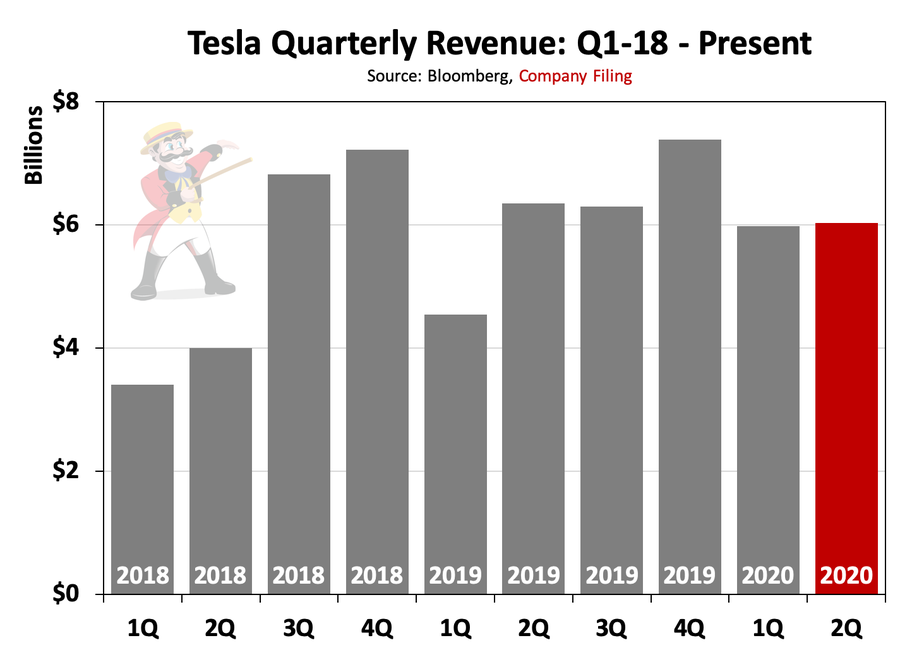

And, unlike other richly valued tech companies like Amazon (AMZN), Alphabet (GOOGL), and Facebook (FB), it's not like Tesla has been growing. In fact, as you can see in this chart (also from @TESLAcharts on Twitter), the company's revenue has declined over the past eight quarters:

|

Saturday, July 18, 2020

When TSLA parabolic run may hit to its halt?

First, let me clarify how to join Telegram as it cannot working directly via Wechat. Two options:

- When open the blog in Wechat, 点击右上角的三点,然后选在Safari 中open,然后点击the link and then join

- Or copy the link and paste to Safari to open and then join

Here is the link for "DW 谈股论金": https://t.me/joinchat/SgYa_xNrjTNHk9cS51ke0A.

****************************************************************************************

The tech stocks have made an epic bull run in the past couple of months but more evidence is emerging that it may be starting to enter the parabolic stage in the scale only seen in late 1990s. Sure I'm not saying the exact top is already in for techs as the parabolic move can last for quite some time before running to its end, but at least we can say tech stocks are quite frothy at the moment and are very vulnerable to a sudden sharp correction. After all, during the final stage of the melt-up in late 90s, we saw several 15-20% corrections in between while new highs were made again and again.

TSLA may be one of the typical parabolic moving stocks for now. After jumping 250% for this year and topping at $1800, could it continue to jump another 100% in the remaining of the year? Sure it is possible as we have seen many amazing moves in the market that cannot be explained by normalcy. But apparently not everyone believes so. See this report first:

While I'm not smart enough to tell you how to value and analyze the stock as it is just not a general stock that you can analyze with regular FA/TA, I have found an interesting theory that explains the recent parabolic move and the likely timespot when the move may come to its halt.

The start of the National Football League season

Anecdotal evidence points to frustrated sports bettors as another group pushing up the price of Tesla. With sports shut down by the coronavirus outbreak, regular sports gamblers have discovered the potential of Tesla options. Call options are short-term bets that stock will go higher. As long as the stock price keeps going up, options are a great bet. If the stock price stagnates for a month or so, the options will turn into 100% losers, and you can bet the gamblers will find another game.

Few investors know that when traders buy calls, the market makers on the other side of the trades must buy shares to protect their capital. The explosion in Tesla option trading forces market makers to buy more shares, putting additional upward pressure on the share price.

The question is: when the pro football season starts, will the former sports gamblers want to keep trading Tesla call options, or would they rather bet on the Sunday afternoon games? I think you know the answer.

The Tesla stock price story shows how a rapidly rising share price can become a house of cards, where pulling just one card can cause the whole structure to tumble. Tesla is a great company, but its stock price at this level is that house of cards.

The famous Robinhood data seems to support this theory partially. You see, when its shares got cheap, the masses came flooding in. But over the following months, the number of folks holding this stock has moved in near-perfect lockstep with the price. If this is indeed an important part of reasons for the recent parabolic move, then what happens when a large number of those Robinhood folds get distracted, e.g. by the resuming sport season, and dump the stock? Could the $300 drop in the past few days have already started the process? Again I'm not smart enough to advise you. I'm just sharing with you some interesting information as food for thoughts for your own reasoning and decision.

|

Friday, July 17, 2020

S&P would have been down by 10% if......

Also, just in case we lose connection for whatever reasons but you still want to follow my blogs, just save/ bookmark this blog address for future reference: https://redbullmoneytalk.blogspot.com/ You can visit it anytime for updates and check for the past blogs as well.

The market has never been so much concentrated! When you buy a broad market index like S&P 500, it's natural to think that you are very diversified across the 500 stocks in the index, right? Not so much anymore! Actually, the index is largely driven by 5 stocks, the FAANG stocks. They refer to five of the most prominent and best-performing American technology stocks in the market: FB, AMZN, AAPL, NFLX and GOOGL. See the heatmap below. The size of each block in the map represents the company's market capitalization, or how much it's valued in the market. These five tech stocks are among the biggest, greenest blocks in the chart.

|

And here is the chart view of their weight in the index with MSFT in lieu of NFLX. |

So how powerful these stocks have in terms of their impact on the market performance? Well it is likely beyond your widest imagination!

Sunday, July 12, 2020

Joe Biden Supports 2 Regulations That Would Destroy Entire Industries—and My Job

Excerpt (the whole post can be read here):

The New York Times reports that investors are growing alarmed over Joe Biden's rise in the polls. Some worry that his promised massive tax hikes and sweeping regulations could spell doom for the stock market and hurt business more broadly. However, it's not just stockbrokers on Wall Street and 401k holders relying on the market for retirement who should be worried.

Joe Biden's regulatory platform would eliminate entire industries and therefore millions of jobs—including my own. Supposedly, the appeal of Biden's presidential campaign is a return to stability. Yet his platform includes endorsements of radical regulations that would undermine the economy as we know it.

Biden's support for job-killing regulations extends beyond independent contracting and the tech industry to many other walks of American life. The candidate's wrong-headed agenda reminds us of a stubborn lesson big government advocates rarely seem to learn: Unintended consequences will always plague sweeping mandates put together by politicians and bureaucrats huddled together in the nation's capital hundreds of miles away from the on-the-ground realities of the jobs they're regulating.

The lesson is clear: pure intentions do not necessarily result in positive outcomes.

"It's not enough... to endorse legislation that has a nice title and promises to do something good," economist Robert P. Murphy also wrote for FEE. "People need to think through the full consequences of a policy, because often it will lead to a cure worse than the disease."

And elections are no exception. If the American people let Joe Biden have his way with our economy, there will be unintended consequences—that could cost you your job.

Saturday, July 11, 2020

What big money is doing?

This is what Lance Roberts said: "Over the last quarter, the "Death of Fundamentals" has become apparent as investors ignore earnings to chase market momentum. However, throughout history, such large divergences between fundamentals and price have resulted in low future returns."

I totally agree and I also think this time is unlikely to be different.

Here is just one fundamental piece about the current situation how the economy has been hit... and hard! As we know, travelling is a big part of our daily life that impacts a lot of economic activities supporting the GDP. In the past 3 months or so, the US travels have been cut monumentally, from nearly a total halt to still 80% down by now. Extrapolation from this, I guess we can guess what the earnings will be looking like in the coming season coming soon.

The S&P is trading at a PE of 23, probably the most expensive level at least as far as I know. No wonder we are entering the era of "Death of Fundamentals"! No question, the pushup of the stock market must be driven by the big money if it wants to sustain and continues. No surprise that we do see the influx of Big Money into stocks in the past 4 months, which has led to the subsequent historical rally.

However, we start to see a slow down of the big money influx to the market (see below the yellow line). Similar early this year when BM was pushing up the market relentlessly, it started to slow down quietly starting in Feb while the market continued to be hot and euphoric. And we know what happened soon after that. Now we start to see the same setup that the Big Money is quietly retreating from the market but the market cannot care less and continue to pump up. Will the Mar plunge repeat this time? No one can tell as of now but at least be careful if you have the habit of chasing! FYI three sectors show a slowdown in big buying: discretionary, financials, and technology.

Friday, July 10, 2020

Where is the gravity?

First, just some fun about the upcoming election. While it is certainly a political issue, its impact on investment is enormous. Watch your portfolio if Biden wins. A 50% tank is not unexpected!! 💀💀 Mark my words😏🤓 Actually I'm not the solo singer on this. Here is what other same-minds have also seen: "There's a problem. It's all after-tax. That's unfortunate but at the end of the day, the money you put in your pocket is after-tax. You need to put more money in your pocket. It [the Biden plan] means that stocks — all things being equal — would be lower by 25% than they are today. It may not work that way. That is at least the theory," explained SMH Group CEO George Ball . This is just an estimate based on Biden's harmful tax plan but he will have a lot more comprehensive plans that will for sure significantly damage the US economy!

Now, here's the NASDAQ Summation Index...

Friday, July 3, 2020

Make America Miserable Again

The Establishment Strikes Back

By Buck Sexton

Dear reader,

If you turn on the TV or open up your newspaper, you'll find practically nothing about the fiercely contested presidential race just five months away. At least at first glance...

The stories appear to be focused on an array of topics that aren't about electoral politics. And yet most of what we see is presented with a clear theme: America is doing poorly.

There's the renewed media obsession with COVID-19, for example. The few weeks of relative quiet is all over now. Predictably, the Democrat-dominated media took a brief hiatus from the "social distancing" mantra so that tens of thousands of protestors (and rioters) wouldn't be the target of public shaming.

There was a convenient absence of public health professionals on cable news networks or social media calling out protestors for their mass gatherings. Who needs social distancing when you have social justice?

Among conservatives and independent-minded voters, this partisan hypocrisy was noted – causing a tremendous loss of faith in the so-called "objective experts" who are now demanding another lockdown.

National media is also focused on the nationwide protests... which so often turn into riots. Nonetheless, they are described as "mostly peaceful" even when journalists can clearly see a burning building and violent mobs. At first, the movement was all about the killing of George Floyd and police brutality. Then it rapidly transitioned into demands for police budget cuts or even total police defunding. Now it's a Marxist movement seeking to erase and rewrite American history through toppling and destroying statues.

Nobody really knows what these protestors will be enraged about next week. It doesn't really matter. Journalists certainly don't plan to get to the bottom of any of it. The point of all this rabble rousing and street activism is not to address systemic inequality or the history of American oppression and racism. This is all about power politics and the upcoming election, plain and simple.

Call it the "Make America Miserable Again" plan.

These mobs have taken to the streets as part of a mass mobilization of the Democrat party.... whether shouting in cops' faces, looting stores, or burning down buildings. And they are running a widespread and well-coordinated campaign against President Donald Trump – they're just not doing it in the most traditional way. Think of it as asymmetrical political warfare.

This is not a standard presidential battle between two men...

Presidential candidate Joe Biden is effectively a ghost, refusing to leave his basement in Delaware unless he dons an ominous black face mask and dark sunglasses. He seems to forget where he is and mumbles a bizarre gaffe almost daily.

Few believe Biden is going to inspire a movement. But that's not the plan...

All Biden has to do is fog a mirror. The establishment will take care of the rest.

That's because all of 2020 is a referendum on Trump. If the mood of the country is positive and hopeful this November, he's probably going to be the president for four more years. The country doesn't have to be perfect... It just has to be moving in the right direction.

What Trump was doing before the pandemic was working. All he has to do now is convince enough voters that he has a plan to bring back the economy of January 2020.

On the other hand, Democrats and the establishment ruling class will seek to stop this "right direction" feeling at all costs. We are seeing that effort right now.

The more they can get the American people to focus on a pandemic, civil unrest, and mounting economic anxiety from the shutdowns – the tougher it will be for Trump to focus on his voters and go on the offensive against his opponent. The national news media is pulling out all the stops to make sure that there is an overwhelming narrative of national fatigue and frustration that has set in by November. All of this will play to Biden and the Democrats' advantage...

Fair or not, the American people expect the party in power to deliver.

Trump is the guy in the White House with the biggest job in the world, and voters in the swing states aren't going to respond well to anything that sounds like, "It wasn't my fault, it was the virus and the dirty-fighting Democrats" – no matter how true that may be.

Trump doesn't have to beat Biden... He has to beat the ruling class that is still in a state of shock and rage from 2016. Back then, they laughed at him and assumed they could force him out with the absurd Russia collusion hoax. Now, they're willing to tank the whole country as long as it finishes off Trump's reelection.

Remember that as you watch and read all these stories about a nation in crisis. If we simply refuse to undergo lockdown again and enforce some law and order in the streets, America will bounce back pretty quickly. The biggest obstacle to our recovery is not from a virus or an anti-cop narrative... but is the coordinated, stop at nothing effort of many powerful individuals and their interests that view America as mere collateral damage in their maniacal anti-Trump campaign.

Thursday, July 2, 2020

Trigger to the March panic

No doubt, stocks will be watching, which brings us to our call of the day, which discusses what could drive some big highs and lows for the S&P 500 SPX, +0.50% in weeks to come.

"As we look ahead, the biggest risk to markets is the return of panic, as we saw into the March 23 bottom where money was simply trying to get out. The only way panic at that magnitude returns is if the % positive number of cases continues to trend higher off the lows, which is very possible into the fall," writes Adam Kobeissi, founder and editor in chief of the Kobeissi Letter, an investment newsletter.

Kobeissi said that percentage of U.S. cases is currently hovering at 6%, from a low of 4.5%, according to Johns Hopkins University. If that figure starts inching higher, he expects the S&P will start to pull back. Note, U.S. cases topped 50,000 for the first time on Wednesday.

Over the short-to-medium term, he said the path of least resistance for stocks appears to be higher, with the technical picture suggesting a move to 3,150, which marks the high from June 15 to June 23, and a break above that would send the index to 3,275.

But from there, the index could pull back to a low of around 3,000 that was seen this week, partly due to simmering COVID-19 concerns. "It is important to note that 'higher lows' have formed SIX times since March 23, and the 2965-3000 support range marks the last two 'higher lows.' A break below 2,965 opens for significant downside, and we would expect to see 2,730 within a few trading sessions," Kobeissi said.