With a fake president in power by stealing ballots and worse, a guy with mental disability without knowing what is going on in the world, what can we expect from him and those around him? Good luck for those who stupidly believe him.....😜

Why Is the U.S. Taking Orders From the Taliban?

By Trish Regan

Just when you thought you'd heard it all...

On Tuesday, word leaked that the head of the CIA, William Burns, traveled to Afghanistan to meet in secret with the de-facto head of the Taliban, Abdul Ghani Baradar.

Let that sink in... The CIA's director had a clandestine meeting with the head of the Taliban. And he came back empty-handed!

Within hours of the story being (deliberately) leaked to the mainstream media, President Joe Biden participated in a call with G7 leaders in which he said he couldn't budge from the August 31 deadline to get all troops out of Afghanistan – regardless of how many Americans are left behind.

Since when did we take orders from the Taliban?

And why isn't anyone telling the Taliban that they, in fact, didn't honor their side of the agreement? The Taliban was not to take over the cities and country until after August 31 – but as soon as the U.S. communicated that it was withdrawing from the country, it was game over.

The Taliban swiftly took the country, and U.S. officials – including the president – were left scratching their heads.

Perhaps it's another example of U.S. leaders losing their edge... They want so badly to believe in their own particular vision of the world that they fail to understand all sides and end up developing poor plans. They can't think through the permutations of all that might happen because they're too blinded by their own political viewpoints.

Can Uncle Joe Survive This?

I realize Biden wanted out ahead of the 9/11 anniversary... Heck, everyone wanted out. No one wants forever wars.

But it wasn't in this country's best interest to get out in the way that we did. With better planning, this could have been handled more appropriately.

Meanwhile, we're now in a situation in which our allies are all rightly furious at us... Despite pleas from Britain, France, and other NATO allies to keep troops in Kabul, Biden said on Tuesday that the U.S. intends to withdraw completely from Afghanistan by the end of the month, as planned.

Even members of President Biden's own party are trying to distance themselves from him amid the latest events, including Vice President Kamala Harris.

Couple this with the reality that the Dems may not even be able to get their $1 trillion spending plan for infrastructure through, since Nancy Pelosi won't approve it without the other $3.5 trillion for social programs included... and you have the makings of an inept Jimmy-Carter-style presidency.

Now people are asking, can President Joe Biden survive this?

Chances are, he will. I hate to break it to those that wish he'd resign or be removed from office... but that's not going to happen. Yes, I realize there are a growing number of people who want him impeached over this. And while he could see a political attempt for such a thing, the likelihood that impeaching him sees the light of day in the Senate is non-existent.

For the Senate to convict a president and force him out of office, especially in a divided Senate, is a tall order... as it should be.

So the impeachment chatter is just more politicking... The reality is, elections have consequences. And the fact that Biden is currently the president of the United States has consequences – economically (as we've seen in the constant inflationary pressures) and politically on the world stage.

Trish's Takeaway

Ultimately, we need to work harder and smarter to protect our country's reputation at home and abroad.

We need to be more thoughtful in our approach to foreign policy... knowing that we still have a responsibility to the globe as the world's reserve currency.

Former Congressman and three-time presidential candidate Dr. Ron Paul just joined me on my American Consequences podcast, and his response would probably be "Good riddance! We never should have been the world's reserve currency to begin with!" (You can listen to more of what we talked about by accessing the episode here.)

Dr. Paul's point aside, I would argue that we have benefited tremendously from having that status, and I'd like to keep it... Being the world's reserve currency, after all, is partly what's helped support our country in times of real stress.

Consider this: When the pandemic hit, where did everyone invest their money? The United States of America.

When things globally start looking dicey, the entire world comes back to the U.S. to keep their money safe.

However, after the latest overseas catastrophe, the question now is... is it sustainable? Can the U.S. remain the world's reserve currency? At what point might our allies say, "Hey guys, it's been nice, but..."

At this point, I wouldn't blame our allies for seeking new ways to stabilize the world... And I wouldn't blame them for abandoning the U.S. dollar in the process.

Granted, countries around the world have their own big issues to deal with... Stocks in China have finally started to recover this week amid the Chinese Communist Party's privacy rules on tech companies. But many may be nervous to invest there knowing that the Communist Party could wipe out your investment tomorrow.

As for Europe, well... things may be bad in the U.S., but they're a whole other level of bad in Europe. I would start with the reality that the E.U. was destined for failure if nothing for the simple reality that people don't even speak the same language.

You cannot have a centralized government responsible for the currency if it's not also responsible for everything else. This will ultimately prevent the Europeans from dominating the world. (Well, that and a bunch more things that we'll save for another day.)

So – for now – we get a pass here in the U.S.

But President Biden... the CIA... and the State Department should not squander the equity that we have built as the world's reserve currency. We're still in charge, which means we don't just "walk away" from our responsibilities. And this includes the thousands of Americans still on the ground seeking a way out of Afghanistan. We cannot leave them behind.

Tomorrow, we'll get a read of the Federal Reserve on its plans for the future as it meets for its Economic Policy Symposium. (I covered this go-to event in our recent August magazine. If you missed it, you can read it here.)

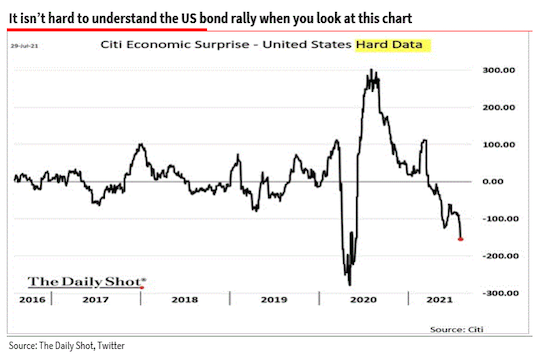

So far, the Fed has chosen to completely ignore inflation in favor of focusing on unemployment. But with unemployment now at just 5.4%, there is reason to double down on inflation.

In light of all that has just transpired, and the frustrations our allies now feel, stabilizing the currency could help us bide our time.

Eventually, I predict the world will find a new system of tender, one that is digital and enables the world to depend less on the United States. But there's no reason for us to hasten this process.

There's no excuse for the ineptitude of U.S. leaders on the Afghanistan issue... But let's not compound it with more incompetence from the Federal Reserve.

The events of the last several weeks do not inspire additional confidence in the U.S. dollar.

Let's hope that's only temporary.