The Apple stock got hit quite hard last few days. I guess I was too early again. But for Apple I'm not a trader; rather a long-term investor. As long as its value is good, I'm fine to be a bit earlier. I will buy more if it drops further. Actually by the way I'm buying Apple I will not lose a penny until it drops to $500. At $576 at the moment, I don't think it will get to that level but I could be wrong of course.

As I predicted, gold is indeed coming down as well. With a $37 decline yesterday to $1678, gold is very close to its 200 day moving average at around $1650-1660 area. As I said, this is a strong support level and I think is a good entry point. However, I have learned over years that I should never be too confident about what I believe in. While I believe gold is likely bounce back from this support level, there is always a chance that it may not hold up there and may further go down. Whenever possible, I want to set up a position in such a way that my loss could be minimized. So what is the strategy to hedge against this possible short-term over correction for gold?

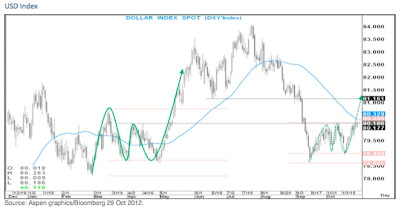

About 2 months ago in Sep, I said US$ was likely bottomed and would appreciate. See below that this is exactly what has happened. The US$ index has been range-bounded roughly between 79.0 -80.1 in the past 2 months. But it appears it has just broken through the upper bound. This will likely push US$ up to 81-84. I think this is one major reason why gold has declined so much lately, because a strong US$ will push down gold price at least in a short-term. Eventually though, gold will not be bounded by the US$ and will continue to go up substantially in its huge bull run, since gold has become more and more a currency, not a metal.

So when US$ goes up, what is the next obvious victim? I hope you can guess: yes, it is Euro. I think Euro has run its upward course already by now. Likely it will start to decline from the current level of $1.29. I won't be surprised to see Euro plunge to below $1.20 this time. I have talked about EUO many times in the past, which is a 2 x leverage ETF against Euro. In other words, when Euro drops 1%, EUO should go up 2%. You may notice interestingly below that EUO was also range bounded between 19-20 in the past 2 months and has just broken through the upper bound over 20 now. If indeed US$ appreciates in the next few months, Euro will decline and EUO will go up in parallel.

No comments:

Post a Comment