Financial Times article notes: 'Tech wreck' looks more like another dot-com bubble bursting. Excerpt:

At what point does the slump in U.S. technology stocks stop being dismissed as a mere "tech wreck" primarily centered on the most speculative companies and become considered a fully-fledged dot-com crash 2.0?

The combination of increasingly hawkish central banks and Russia's invasion of Ukraine has been toxic for equity markets this year. The MSCI All-Country World index is now down 12% in 2022. However, as is often the case, headline indices miss a more fascinating story underneath.

The pain has been primarily focused in U.S. technology stocks. Despite a tepid bounce over the past week, the Nasdaq Composite index has already fallen nearly 20% in 2022. In dollar terms, the tech-heavy market has now lost well over $5 trillion in value since its November peak – more than the Nasdaq's dollar losses through the entire dot-com bubble unwinding in 2000-02.

Yes, the index is vastly bigger these days, but the scale of wealth destruction – and how painful it has been for many investors – is real and arguably under-appreciated, as the relative resilience of Big Tech is obscuring the extent of the damage.

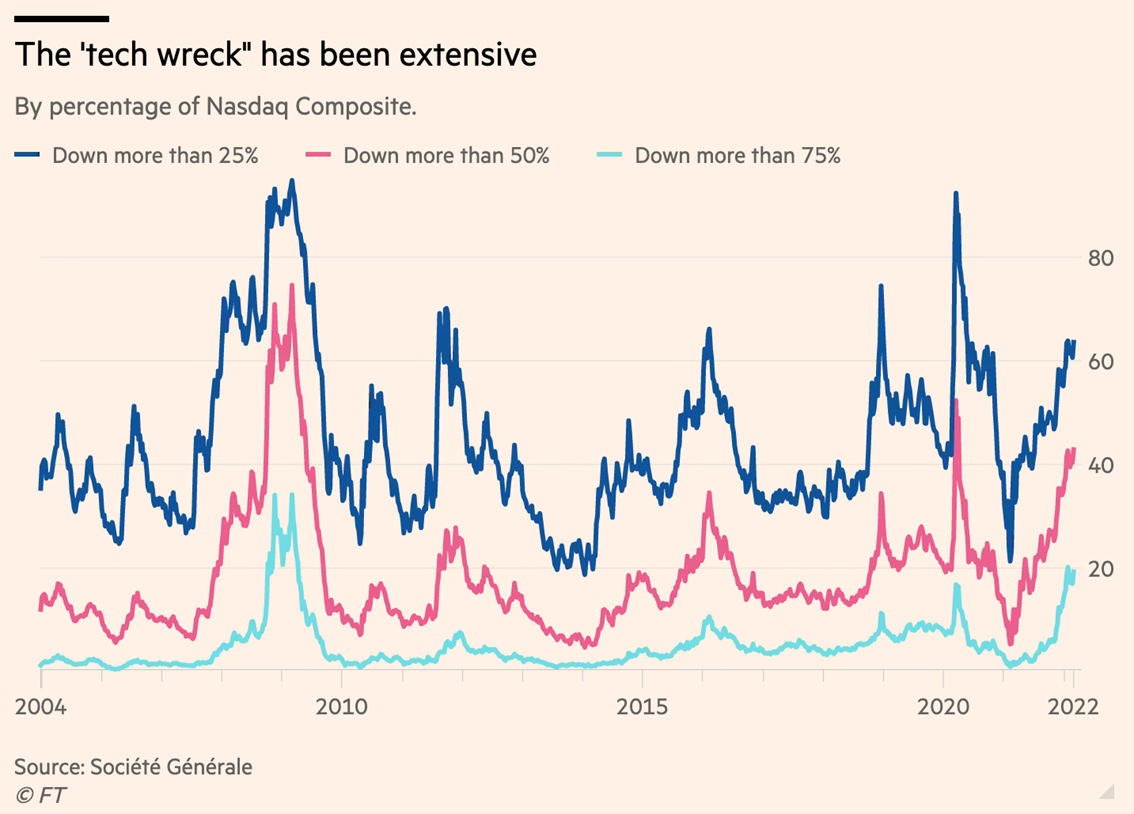

Almost two-thirds of the Nasdaq's 3,000 plus members have fallen by at least 25% from their 52-week highs, according to numbers from Société Générale's Andrew Lapthorne. Almost 43% have lost more than half their value, and nearly a fifth have tumbled over 75% – the worst such ratio since the financial crisis. The $5.15 trillion that has evaporated from the Nasdaq in recent weeks is like the entire U.K. stock market going "poof".

No comments:

Post a Comment