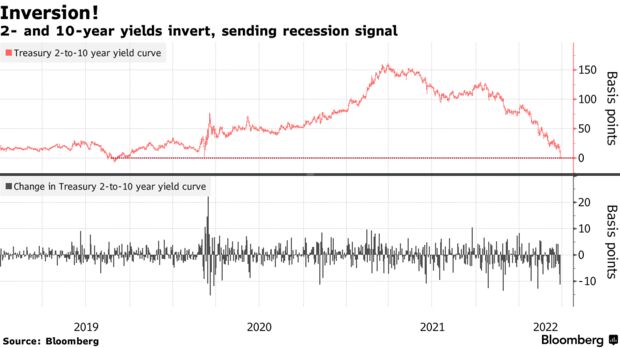

Closely watched yield curve inverts, flashing recession signal! This is what was reported by Bloomberg.

The U.S. two-year yield briefly exceeded the 10-year Tuesday for the first time since 2019, inverting yet another segment of the Treasury curve and reinforcing the view that Federal Reserve rate increases may cause a recession.

The inversion occurred as two-year yields rose while 10-year yields declined, crossing at a level of about 2.39%. Prior to 2019, when the curve inverted in August during a U.S. trade spat with China, the last persistent inversion of the Treasury curve occurred in 2006-2007.

Short-term yields that are higher than long-term yields are abnormal, and they signal that high levels of short-term yields are unlikely to be sustained as growth slows. The inversion of the two- to 10-year segment of the Treasury curve is the latest in a series beginning in October, when 20-year yields topped 30-year yields. The widely watched gap between five years and 30 years also turned upside down this week, something that hasn't happened since 2006.

"Historically, a recession has not happened without an inversion," said Ben Emons, global macro strategist with Medley Global Advisors LLC. "So likely, it will be a predictor of a future recession. Timing, however, is unknown. It could take up to two years."

No comments:

Post a Comment