The market has got a rough two weeks, losing nearly 5% from its recent peak. Magnitude-wise it is really nothing but psychology-wise, we have seen enough pain and outcrys. After all, September is typically the worst month of a year in general based on the long term average. It seems the market wanted to reemphasize this fact by shooting up more than 1% immediately after we turned into October. The big question is whether or not this rally can hold and sustain. While today is the first time we saw a sustained gain through the last hour of the day in the past two weeks, which is usually a bullish sign, I'm not yet convinced that the worst has necessarily passed for this correction. Technically we are still nearly 100 points below the major resistance for S&P. Without a decisive breakthrough, we may still get back down to test the 200 DMA around 4137ish, or another 5% below the current level. One major risk factor right now is the stupid debt ceiling fight that is still ongoing. The deadline is Oct 18 per Yellen. I don't think the politicians at each side will easily let the fight pass. So be prepared for more volatility. But in the very near term or the next few days, we may see a bullishMore attempt to try to challenge the 50 DMA around 4440ish. More pain and volatility will probably come towards the mid of the month. After all, we may likely see a more bullish season towards the year end.

Outside of the US market, we have seen bloodshed crashes in the Chinese market but it seems it has reached its max pessimism by now. There is a sign that the smart money is gearing up to buy. It is certainly risky but maybe with a great reward in the end. See below a sentiment report about the Chinese tech stocks.

Chinese Tech Is Washed Out and Smart Money Is Buying (by SentimenTrader)

Few markets have suffered more of a barrage of uncertainty and negativity this summer than Chinese stocks. Technology-related issues have been hit particularly hard from all sides.

Based on the last 15 years of history, they've reached a point of maximum pessimism.

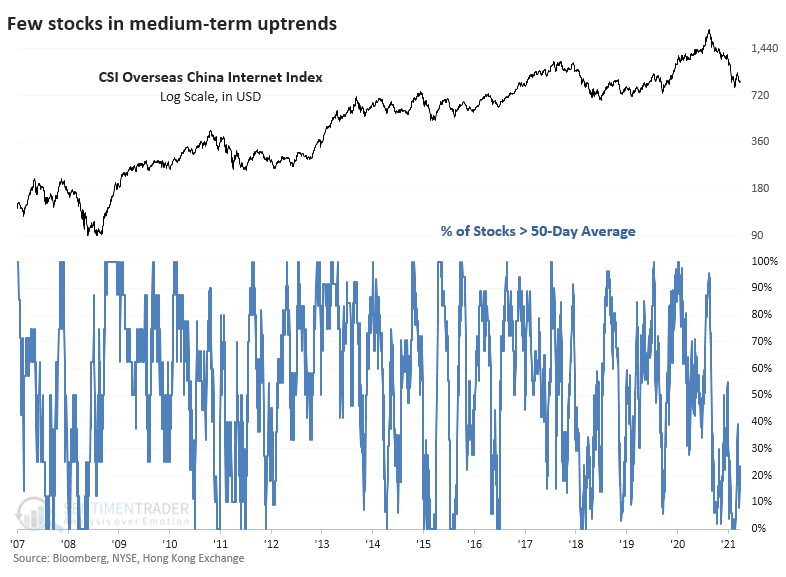

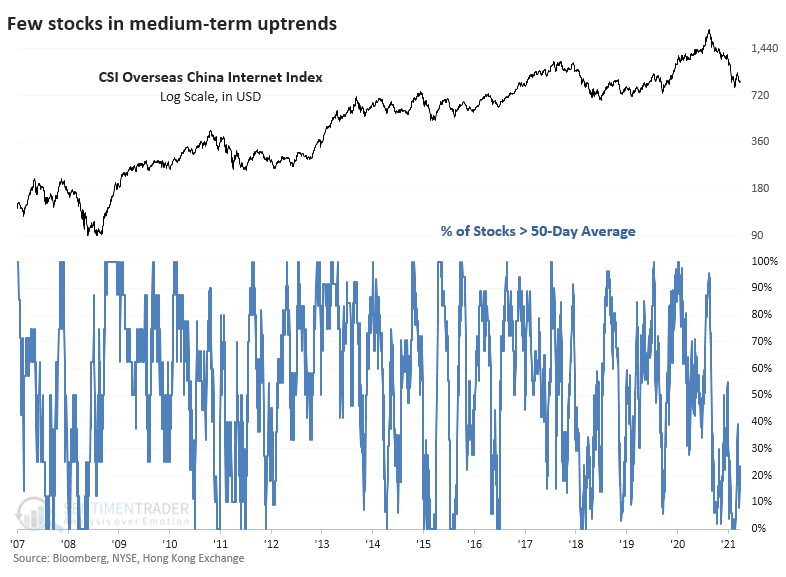

The most popular domestic fund for trading Chinese internet stocks is KWEB, based on the CSI Overseas China Internet Index. The index has just over 50 member stocks, and it's hard to find an uptrend among them.

During mid-August, precisely 0% of these stocks were trading above their 50-day moving averages. That spiked to around 40% during a relief bounce and has since slid back under 10% as recently as last week.

It's an even uglier picture when looking at the percentage of these stocks in long-term uptrends. In recent days, only 4% of them have closed above their 200-day moving averages, ranking among the very worst readings in available history.

The plunge in late July caused more than 50% of Chinese 'net stocks to fall to a 52-week low, only the third time in 15 years that so many have done so at the same time. Many are gyrating around those low prices, and on any given day, between 10% - 25% of stocks have been setting fresh 52-week lows.

No comments:

Post a Comment