Despite new highs in many of the major U.S. equity indexes, the old school NYSE Advance/Decline Line hadn't made a fresh high for over two months.

It's worse on the Nasdaq.

On Monday, the Nasdaq Composite closed within 1% of a 52-week high, and yet two long-term measures of breadth on that exchange fell to very low levels. The McClellan Summation Index closed below -350, and the New High / New Low Ratio was below 30%. Those are the worst figures in history, dating back to 1986, for a day when the Composite was so near a high.

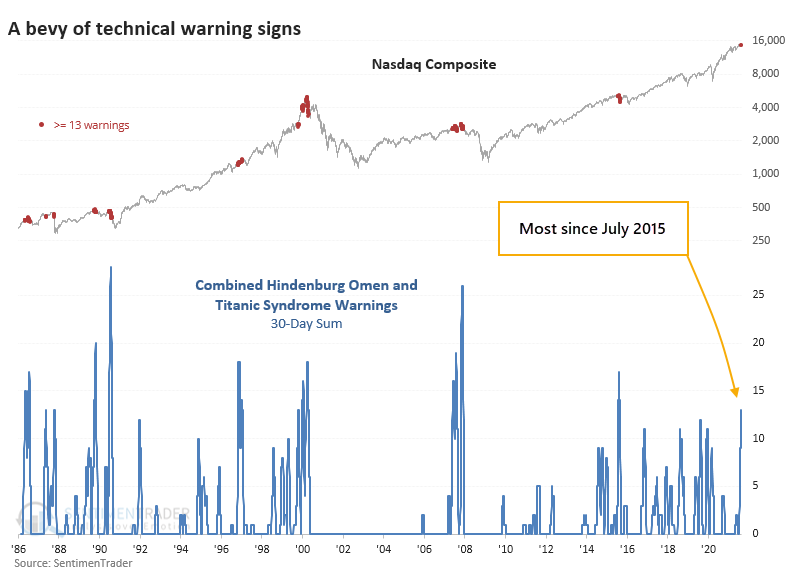

This internal tumult has been triggering some technical warning signs, such as the Hindenburg Omen and Titanic Syndrome for the Nasdaq exchange.

Over the past 30 sessions, a combined 13 signals have been triggered, the most in six years.

When there has been such a cluster of signals with the Composite within spitting distance of a new high, trouble was brewing most of the time. The Nasdaq escaped any damage in 1996, 1999 (for a while), and 2016 but otherwise witnessed high volatility and negative returns.

After the speculative blow-off in late January - early February of this year, we've been on the lookout for major deterioration under the surface of the indexes. There have been periodic bouts of that since then, and the indexes have almost immediately recovered. We'll have to see if this is yet another episode.

No comments:

Post a Comment