Legendary investor Stan Druckenmiller, founder of the Duquesne Family Office, gave two speeches recently at the USC Marshall School of Business and the Sohn Investment Conference.

In them, he laid out his concerns about the future of the United States and the stock market.

Here's a transcript of his remarks and a copy of his slides at USC on May 1. Excerpt:

The fiscal recklessness of the last decade has been like watching a horror movie unfold... here in the U.S., the only thing that Hillary Clinton, Biden and Trump can agree on is that entitlements should not be touched. And waiting only makes the problem worse as interest payments keep building... This is a nightmare for future economic growth, investment and productivity, and, of course you, the future taxpayer.

It is time that we let go of the false pretense that cutting entitlements is a choice. It is not. Either we cut them today or we will have to cut them much more tomorrow.

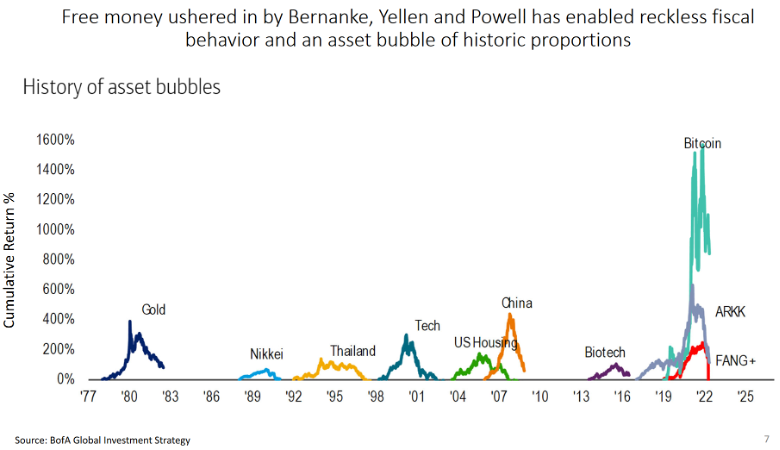

As if the irresponsible fiscal behavior wasn't enough, around 15 years ago the Fed simultaneously decided to start courting with asset bubbles... This Fed policy has enabled risky behavior from investors, banks and the government... it has driven unprecedented bubbles in both breadth and magnitude.

The tech frenzy, the crypto craze, SPACs, the search for yield by investors and also by regional banks (!). While it has truly been an "everything bubble", nothing symbolized it more than Doge Coin, which started as a joke and reached a market cap of 80bn.

This is the last of his seven slides:

|

He continues:

As I have repeatedly said, central banks should be in the business of balancing rather than fueling asset prices or risky behavior... It is hard to overstate the myopic absurdity of the current policy and the predicament we find ourselves in.

He concludes:

To conclude, I greatly admire your generation's focus on the long‐term implications of climate change and your willingness to take action. I urge you to also take action against the bipartisan myopic abuse of our "seed corn" at the expense of future investment and growth. American exceptionalism and innovation have been on display my entire career.

We led the PC revolution, we led the development of the internet, the move to mobile and cloud, and blockchain and are leading in Generative AI. Indeed, the cover story of the Economist two weeks ago, Riding High, documented the astonishing success of American capitalism over the last 30 years.

Further delay in addressing the fiscal gap threatens a future of us not "riding high" but rather sinking into malaise, decay, and the end of the American Dream. It will embolden autocracies in places like China and Russia. And tragically risks a lack of wealth to make sufficient investments to address existential crises like climate change; and a lack of growth to afford programs for the least well‐off among us.

Here's the 62-minute video of the interview Druckenmiller did at the Sohn Investment Conference on May 9. There isn't a transcript, but the main takeaway was that his advice to investors was to prepare for a significant market pullback – he said he's market neutral, 30% long and 30% short – and wait for the incredible buying opportunities that will be available at the bottom.

No comments:

Post a Comment