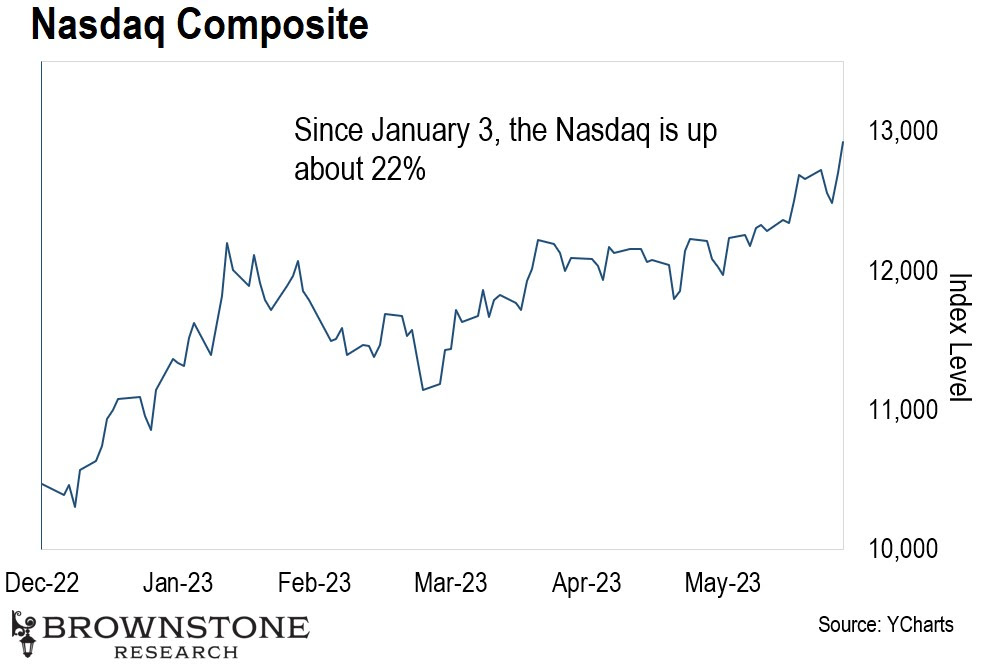

The Nasdaq Is Quite Deceiving |

It’s market periods like the one we’re seeing now that can make it difficult to reconcile what’s happening. A perfect example is the market action in the Nasdaq year to date. It looks spectacular, right? Since January 3, the broad tech/biotech-heavy index is currently up about 22%. It must be a bull market… right? But the index is quite deceiving because of its constitution. Rarely mentioned, but always true, is the fact that just eight companies make up 27% of the total market capitalization of the Nasdaq composite index. None of us should be surprised which companies those are:

Maybe we need a new acronym? MANTAMAN! What’s remarkable is that these eight companies have been responsible for almost the entire 22% gain of the Nasdaq since the beginning of the year. Heck, NVIDIA alone added $219 billion of market cap yesterday alone. But if we strip these companies out of the index, the Nasdaq would have basically gone nowhere. We can see this clearly in another chart of the Russell 2000. This is the small-cap index that is constituted by the smallest publicly traded companies in the Russell 3000 index, and is a broad proxy for the overall small-cap market. As we can see above, the index compared to the beginning of the year has been absolutely flat. It enjoyed an early rise in the first few weeks of the year and returned back quickly by mid-March. How can we reconcile what’s going on? One chart looks like a bull market, and another looks like the market is going nowhere. Unfortunately, there is no breath at all to the current run in the Nasdaq index. In fact, I would argue that this is a terrible set up. Large institutional capital and hedge funds are chasing eight blue chip tech companies, seven of which have heavy exposure to artificial intelligence. The only exception being Netflix, but to be fair, Netflix does use a lot of machine learning in its matching algorithms for programming. The other seven however are directly tied to the exponential advancements in natural language processing and generative AI. They’re piling on and they’re paying crazy prices to do so. This won’t last. A perfect example is NVIDIA which is now trading at an enterprise value to sales of 35. NVIDIA has long been one of my favorite companies, I pounded the table for my subscribers to buy in 2016 when it was trading at just $24. It has risen thousands of percent since that time; but I wouldn’t touch it at a 35 EV/Sales. The stock is going to collapse. Any institutional capital buying at these levels is looking at short term momentum trades, not investing. This is a dangerous time in the markets right now. Hedge funds and institutional traders are just playing the momentum game, sucking retail investors into the market, and they’ll happily sell their entire positions on a moment’s notice when the momentum stops. Please be careful out there and don’t get fooled by what’s going on. It may make for good fodder on CNBC, but this is not a good sign. Jeff Brown |

No comments:

Post a Comment