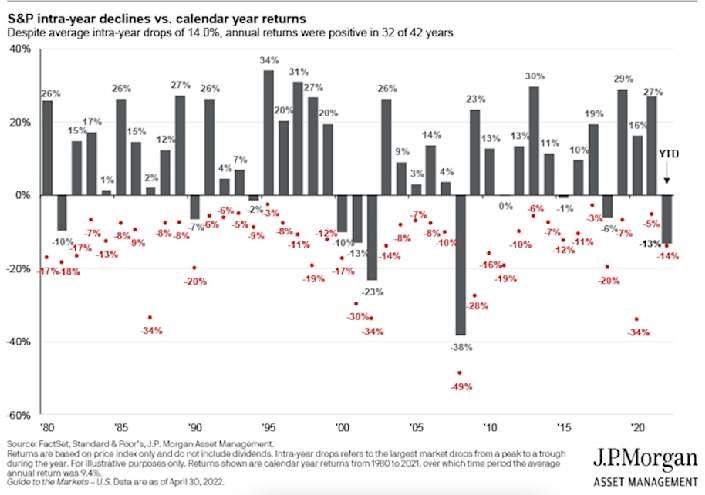

As Sam Ro noted for Yahoo Finance yesterday, this is a fairly average year. To wit:

"It's been an incredibly unpleasant year for stock market investors.

After setting a record closing high of 4,796 on January 3, the S&P 500 tumbled 13% to 4,170 on March 8. It then rallied to 4,631 on March 29, but then fell again hitting a closing low of 4,146 on Thursday, reflecting a max drawdown (i.e. the biggest intra-year sell-off) of 14%.

However, this year's moves are nothing out of the ordinary. Since 1950, the S&P has seen an average annual max drawdown of 14%."

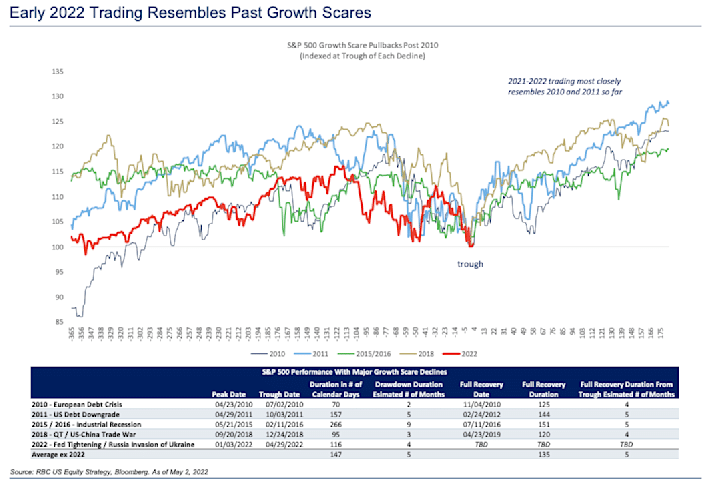

He quoted RBC Capital Markets on how markets reacted during four recent growth scares. RBC noted that the six-month returns ranged from 18.2% and 28.6% following market troughs. The 12-month returns ranged from 26.6% to 32.0%.

While it is easy to find a lot of reasons to be bearish, these data points help retain perspective and combat confirmation bias.

However, for now, the stock market rollercoaster continues.

- Lance Roberts

No comments:

Post a Comment