This week, the market has got a wild gyration, just like a rollercoaster. It seems the market has moved a lot but if you look into it more carefully, the market is not really moving a lot but just within a wide range between its support and resistance. So buying at support and selling at resistance is a good trading strategy in the current setting. For today with the market tanking towards its support around 4400ish with VIX showing a lot higher put futures than calls for next week and the week after, I think the chance is high that we will see a rally in the next week or two. Armed with the TA trends and VIX indicator, I'm sharing a lot of ideas in my Family based on an option trading strategy that will allow me to bet with a small risk to bet for a 3-5 times potential return for a wide margin of error. For example, SPY closed at 440. We opened an option spread due next week that can make money as long as SPY is trading within a range of 444 to 456 with the max profit if it closes at 450 next Wed. With just a few hundreds, we bet for a potential gain of several thousands. That's the kind of risk reward ratio I'm interested in at the moment in this very fluid market🤓 We have harvested quite a few nice gains by the strategy in the past few weeks, betting up or down depending on the momentum trend. 😇

******************************************************************************

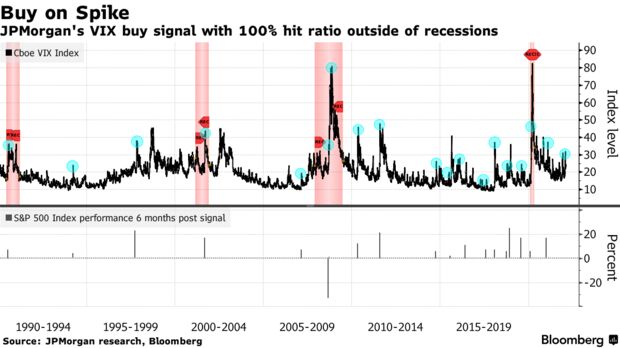

JPMorgan Chase & Co. strategists have identified what they say is a near bulletproof indicator to strengthen their argument that stock markets are poised to rally.

The buy signal is triggered when the Cboe Volatility Index (VIX) rises by more than 50% of its 1-month moving average, which it last did Jan. 25, according to the strategists led by Mislav Matejka. The indicator has proven 100% accurate outside of recessions over the last three decades.

"We believe that equities still offer upside, and that the cycle is far from over," the London-based strategists wrote in a Feb. 7 note. In addition to the VIX signal they look for more gains in earnings, a bottoming in Chinese activity and say investor sentiment has become too negative of late.

Data show the VIX signal has been triggered 21 times since 1990, with the S&P 500 Index gaining an average 9% in the six months afterwards. Prior to January, the last time the indicator flashed was in November, since when stocks have fallen globally. Markets have remained choppy this week.

No comments:

Post a Comment