DEI Doctors and Nuclear Engineers

In recent newsletters, we’ve been critical of aspects of President Trump’s foreign policy.

But he does deserve significant credit here at home. We’ve already covered his important work in streamlining the permitting process for drilling and mining projects.

Today we’re going to discuss another area where the President has made good progress. Reversing the negative effects of DEI, and putting America back on track towards a merit-based system.

A few years back I remember seeing the chart below, and being absolutely blown away. I had no idea it had gotten this bad.

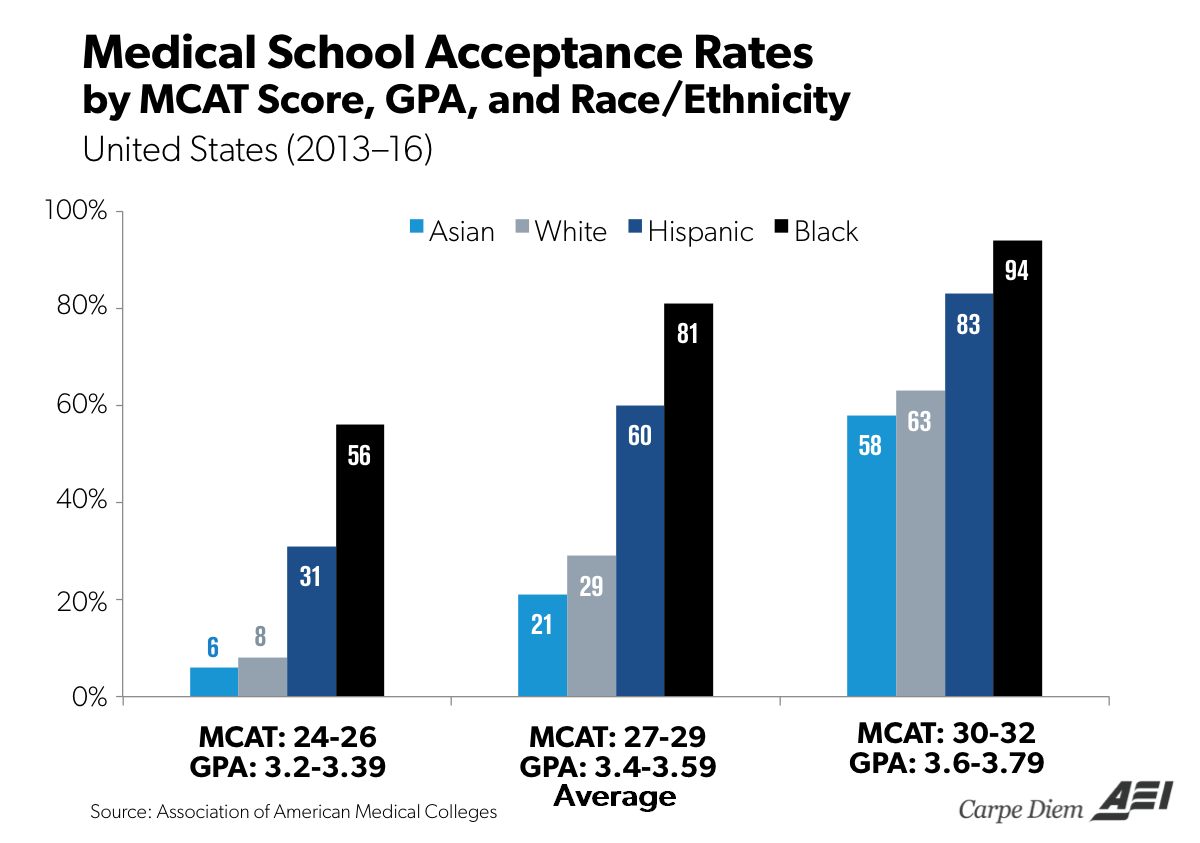

The chart shows the U.S. medical school acceptance rate by race. It is broken into groups by scores on the MCAT (med school acceptance test) and GPA.

Source: AEI

In the first group, we see that only 6% of Asians and 8% of White people who score 24-26 on their MCAT are accepted into med school. Meanwhile 31% of Hispanic and 56% of Black applicants with those same scores are admitted.

And even in the highest-scoring bracket, only 58% of Asians and 63% of Whites get in, while 83% and 94% of Hispanics and Blacks gain acceptance.

Is this the kind of society we want? One where race matters more than merit? Especially when it comes to life and death careers?

This is no small issue. It affects the very incentives that make our economy and society work. If we don’t fix this issue, and re-orient towards a merit-based system, the outlook is bleak.

DEI Nuclear Workers

Over in the U.K., DEI is also wreaking havoc.

For example, the country is attempting to build small modular nuclear reactors (SMRs) to meet growing power demand.

But DEI requirements are mucking up the process. From The Times:

Previously hailed as the fastest plan of its kind in the world, the bidding process to develop small modular reactors (SMR) took two years and saw firms face extra requirements to prove their “social value”.

Companies were told to fill out up to 350 pages solely dedicated to how they would give jobs to groups of disadvantaged people — including asylum seekers, who generally cannot work while their claim is being processed.

…Companies were asked how they would create jobs for those “who face barriers to employment”, which included “refugees, people who have recently immigrated or are seeking asylum”.

The British government is forcing companies building nuclear reactors to hire people “who face barriers to employment”?! These dolts never even considered how dangerous their little social experiment could prove to be.

Companies were also instructed to outline plans to maintain a 50% female workforce, which is completely unrealistic. Women are not as naturally drawn to industries like construction and nuclear as men are. These DEI campaigners refuse to recognize that there are inherent differences between the sexes and their differing interests in careers.

If there was a nuclear plant being built upwind of your house, would you want anyone but the most qualified and motivated people building it? Of course not.

And can you imagine hiring asylum seekers (refugees with little screening and questionable skills) to build a nuclear plant? It’s absolute madness.

Due to all this red tape, just the bidding process for a few SMRs took 2 years and cost £22 million.

Here in the U.S., nuclear firms were also committed to DEI goals before Trump came into office. Thankfully they have mostly closed their DEI offices since. As we enter this nuclear renaissance, I want absolutely zero DEI involved in the process.

I use the examples of medical and nuclear careers because they show how dangerous DEI can be. But realistically, this applies to the entire economy.

Trump’s Efforts to Fix It

DEI may have started out as a good-natured attempt to remove prejudice in hiring. But as it stands today, it’s a disaster.

A society that isn’t based on merit loses its moral compass. It becomes a nepotistic mess. Of course our society shouldn’t discriminate based on race, but these nutjobs have taken it way too far.

I don’t believe DEI is doing the people who are “benefitting” any favors, either. The incentive structures get all mixed up. If certain groups feel like they have a free pass, they’ll be less motivated to work hard and expect to get by anyway. So while DEI might “help” in the short-term, in the long run it creates a nightmare of incentive structures. And bad outcomes.

Thankfully DEI is one of the first items Trump addressed once in office. He instructed all government offices to dismantle their diversity, equity, and inclusion infrastructure.

He essentially required the same of any institution or company that gets significant funding from the government (which is most universities, non-profits, and companies).

This is a huge development. It will take time to show up, but the effects of re-instituting a merit-based system will be extremely positive.

There’s more work to be done, but this is a good start.

So whenever I get frustrated with something the Trump administration does, I have to remind myself that they’re doing important work in certain areas. And that is something to be thankful for.