Below is the note I got from SentimenTrader. For anyone who has any Chinese stocks, the past few weeks have been quite miserable for sure. I'm one of those, although my position is quite small, just to test the water a few weeks ago. As a contrarian, I'd think now maybe a good time again to test another water to bet for a quick rebound for Chinese stocks? Not meant for any long term investment but just for short term trading purposes. That's what I'm thinking right now. 😎

Fear that debt troubles with China's Evergrande would spread globally was the most common excuse for Monday's slide. Using it as a reason for drops in the U.S. is questionable, but the closer you get geographically, the more sense it makes.

Stocks in Hong Kong certainly have been feeling that pressure, thanks in part to a plunge in property developers and related companies.

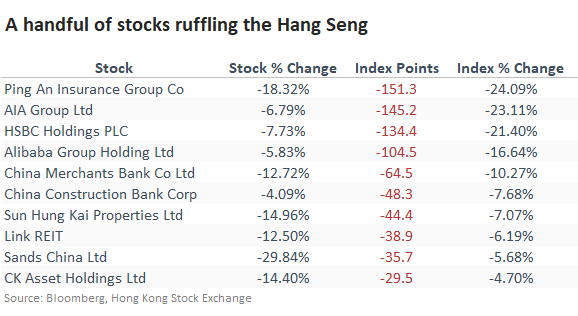

According to Bloomberg calculations, the five stocks with the most significant losses accounted for 600 of the Hang Seng's 628-point loss over the past month.

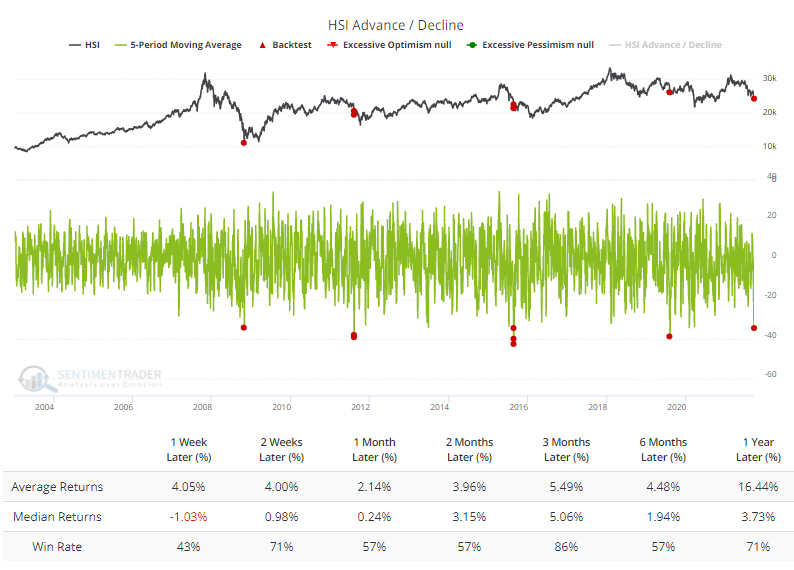

Over 5 days into Monday, an average of more than 34 stocks in the index declined versus advanced, one of the most extreme readings in nearly 20 years. The Backtest Engine shows mostly positive returns after the others. The index continued to slide for a couple more months in August 2011, then reversed those losses in the months ahead.

In prior years, we've looked at a breadth composite when a particular market looks like it's suffering panic-level selling pressure (like Mexico and South Korea in 2019). This composite includes breadth metrics that have a good record at highlighting overwhelming internal selling pressure.

When we look at that composite for the Hang Seng, we can see that it is nearing panic-level conditions that have indicated washout selling pressure over the past 20 years.

No comments:

Post a Comment