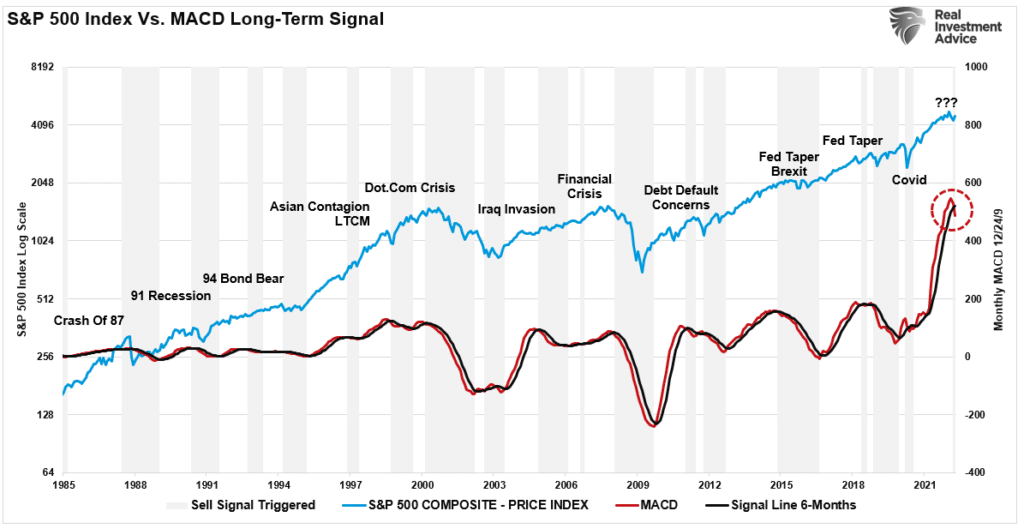

Lastly, from a purely technical perspective, the monthly moving average convergence divergence indicator (MACD) also rings a significant warning bell. The chart below measures the difference between the 12 and 24-month moving averages. When that line crosses below the 6-month signal line, such suggests the market is at risk.

Notably, after the massive infusions of capital into the financial markets following the pandemic, the MACD line surged to levels never before seen historically. Such suggests an eventual reversion will be similarly dramatic. The shaded grey bars show when a previous sell signal got triggered. While there are certainly some false signals along the way, it is worth noting that many of the sell signals are closely associated with more critical market-related events, corrections, and bear markets.

Failing To Plan

Does the current sell signal mean a bear market is lurking?

No. Given this indicator is based on monthly data, it can take quite some time for an event to play out. As such, it will get perceived the indicator is wrong this time. However, as noted above, if everything remains status quo, it likely won't be.

But, if the Fed reverses course, starts lowering rates, reintroducing QE, and repurchasing junk bonds, then such would like arrest any approaching downturn at least temporarily. Such is what history has taught us.

In Bullish Or Bearish, we provided some simple guidelines to follow:

- Tighten up stop-loss levels to current support levels for each position. (Provides identifiable exit points when the market reverses.)

- Hedge portfolios against significant market declines. (Non-correlated assets, short-market positions, index put options, bonds.)

- Take profits in positions that have been big winners (Rebalancing overbought or extended positions to capture gains but continue participating in the advance.)

- Sell laggards and losers. (If something isn't working in a market melt-up, it most likely won't work during a broad decline. Better to eliminate the risk early.)

- Raise cash and rebalance portfolios to target weightings. (Rebalancing risk regularly keeps hidden risks somewhat mitigated.)

Notice, nothing in there says, "sell everything and go to cash."

Given the weight of evidence currently at hand, it certainly doesn't hurt to plan and even take some actions to prepare for a storm if, or when, it comes.

If the environment changes, it's a simple process to reallocate aggressively to equities. By planning, the worst that can happen is underperformance if the bull market suddenly resumes.

But failing to plan entirely is the best way to fail completely if the lurking bear market awakens.

Lance Roberts

No comments:

Post a Comment