If you have put some money into oil in the past few months, you would certainly be very happy as oil has mounted an enormous moonshot to a level not seen for years! Sure it is very bullish and longer term, we will probably see even higher oil down the road with an inevitable recovery of the economy following the pandemic. But the million dollar question is whether we will see a continuation of higher oil in the near future? I don't think so and I have taken off my profit from XLE lately and actually am betting for a downside trend for the short term. The sentiment analysis below supports my view.

What Happens When Oil Prices Show Historic Momentum (by Sentimentrader)

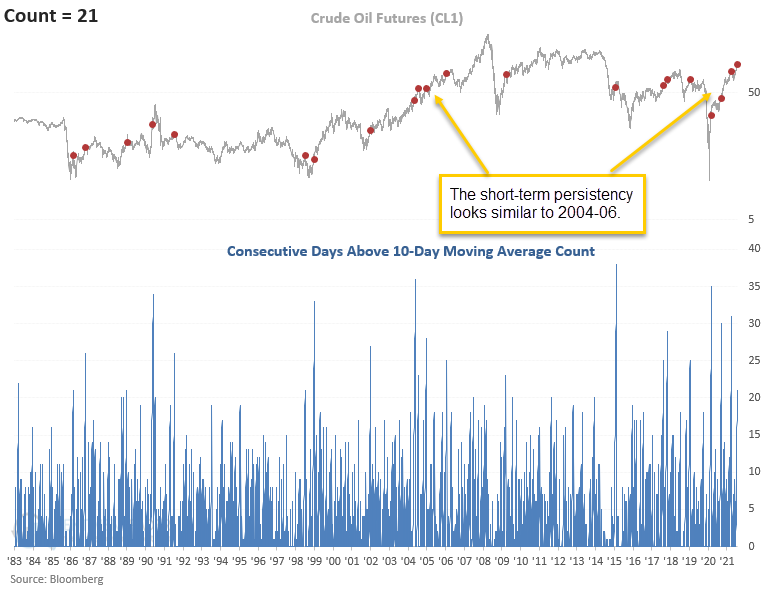

Oil prices have been on a historic run.

Whatever your opinion is about the reasons for its rise, the implications for consumers, or the likelihood of the rally continuing, we should appreciate just how much momentum has entered the market.

Crude oil has now closed above its 10-day moving average for 21 consecutive days, a full month. The chart below shows that the streak has surpassed 21 days four times since May 2020. The commodity's ability to hold above its short-term moving average looks similar to the period between 2004-06, the last secular bull market environment for oil.

After similar streaks above its moving average, short to intermediate-term forward returns in oil were weak when compared to historical averages. Even during secular bull markets, corrections should be expected when conditions get stretched.

Out of 20 signals since 1983, only 7 showed a positive return over the next month, and the average drawdown of -4.7% was above the average maximum gain.

No comments:

Post a Comment