Yesterday I asked a question critical to the markets…

That question?

Will the Fed allow the stock market to become a massive bubble on par with, if not greater than, the Tech Bubble of the late '90s?

To answer that question, we need to assess just who is currently running the Fed.

His name is Jerome Powell, and he idolizes former Fed Chair Alan Greenspan.

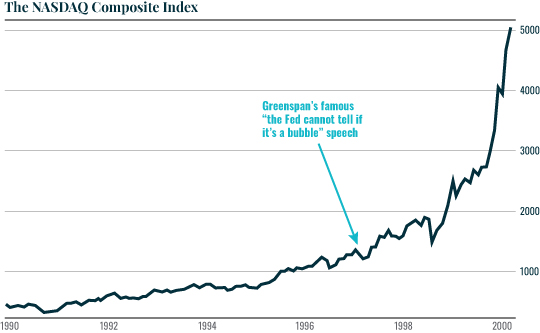

Greenspan is the former Fed Chair who famously argued that the Fed cannot predict stock market bubbles.

Suffice to say, Powell's admiration of Greenspan opens the door to a repeat of the insanity Greenspan's action caused. (I'll show you that in a second.)

This all became abundantly clear when Powell made his first speech at Jackson Hole.

If you're unfamiliar with the Fed's Jackson Hole meeting, it takes place once a year in August in Jackson Hole, Wyoming.

There, Fed officials meet with central bankers and policymakers from around the world to present their views of what is happening in the economy and financial markets.

Think of it as a glorified Ted talk for the most powerful money-related policymakers in the world. And typically, the Fed uses this forum to unveil key changes to its policies and views of the world.

With that in mind, Jerome Powell used his first-ever speech as Chairman of the Federal Reserve at Jackson Hole to lionize Alan Greenspan.

The following quote is quite revealing. And looking back, this speech was a hint of things to come.

The FOMC thus avoided the Great-Inflation-era mistake of overemphasizing imprecise estimates of the stars. Under Chairman Greenspan's leadership, the Committee converged on a risk-management strategy that can be distilled into a simple request: Let's wait one more meeting; if there are clearer signs of inflation, we will commence tightening. Meeting after meeting, the Committee held off on rate increases while believing that signs of rising inflation would soon appear. And meeting after meeting, inflation gradually declined.

–Source: Federal Reserve

In simple terms, Powell admires the fact that Alan Greenspan refused to raise interest rates despite clear warnings of froth in the financial system.

What Does This Portend for the Markets?

In this context, consider that Powell is currently arguing that the Fed believes the current bout of hot inflation in the U.S. is "transitory" and does not need to be dealt with.

Put another way, under Powell's supervision, the Fed is refusing to hike interest rates or taper its $120 billion per month Quantitative Easing (QE) program anytime soon because it believes inflation won't be around for long.

Sounds a lot like what Powell admired about Alan Greenspan doesn't it? And what happened under Greenspan's watch during this period that Jerome Powell admires so much?

First this…

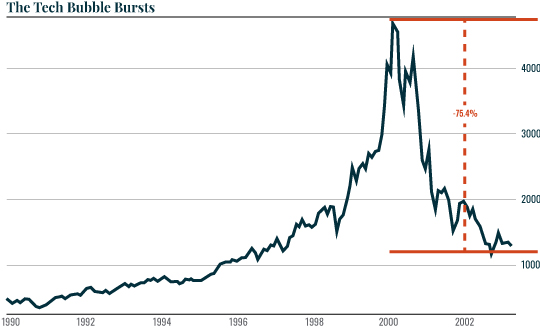

Followed by this...

Graham Summers

No comments:

Post a Comment