LEGAL DISCLAIMER Please note everything discussed at this site is a personal opinion of the author and may contain errors or omissions. NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT. It would be your sole responsibility for actions you undertake as a consequence of any analysis, opinion or advertisement on this site.

Total Pageviews

Friday, July 30, 2021

A precision of TA prediction

Thursday, July 29, 2021

Fauci Is Finished

By Trish Regan

After misleading the public for 17 months, Dr. Anthony Fauci may finally have to face the music...

This week, Senator Rand Paul criminally referred Fauci to the Department of Justice. At issue is whether "America's doctor" lied under oath to Congress.

Over the last year, Fauci repeatedly told Congress that the National Institutes of Health ("NIH") did not fund gain-of-function research into bat coronaviruses at the Wuhan Institute of Virology. Yet, as recently as last weekend, Fauci was on CNN saying that it would have been negligent not to fund this research.

Which leaves us asking... Which was it, Fauci? Did we fund the Wuhan lab as records suggest or did we not?

Fauci previously told Senator Paul in a hearing that the NIH "has not ever and does not now fund gain-of-function research in the U.S. Institute of Virology."

Last week, Senator Paul asked Fauci if he'd like to retract his earlier statement, adding: "As you are aware, it is a crime to lie to Congress."

Fauci refused, however, to retract the statement... saying he had never lied to Congress while adding, "You don't know what you're talking about, quite frankly. And I would like to say that officially."

Fauci's Flip-Flop

So why did he tell CNN it would have been negligent to not fund the research, while saying something different to Congress? I suspect this is Fauci proving his stripes as a political bureaucrat...

What is clear is that Anthony Fauci certainly knew more than he was ever willing to admit... And as a result, Americans have been left in the dark for well over a year as to the origins of COVID-19.

Why did Fauci insist the virus came from a wet market?

E-mails from Fauci's account as far back as February 2020 suggest he at least knew it was conceivable that the coronavirus had been leaked from the Wuhan Institute of Virology.

Yet he quite literally refused to tell the public that.

When then-President Donald Trump admitted to reporters in April 2020 that he had seen intelligence suggesting the virus came from the Wuhan lab, Trump was immediately reprehended for the comments that the mainstream media labeled as conspiratorial.

Fauci himself refuted the remarks by Trump in an interview with National Geographic magazine, saying all the scientific evidence pointed to the wet-market theory.

And yet, he knew better... He just didn't want the U.S. to know better.

Then, when President Biden took office, one of the first things he did was shut down the investigation into the Wuhan lab.

Why? Why wouldn't his team want to get to the bottom of what may have happened?

Allegedly, there were some folks in the State Department who didn't want it being known that the U.S. had helped fund the lab.

This is what you'd call a big, hot mess...

This May, the Wall Street Journal reported on some previously undisclosed U.S. intelligence that suggested yes, the virus could have come out of Wuhan and the Institute of Virology. According to the intelligence documents, three employees at the Wuhan Institute of Virology felt so ill with symptoms consistent with COVID-19 that they were hospitalized in November 2019.

Meanwhile, the World Health Organization ("WHO") has taken China's side in this and said there was no reason to further investigate the Wuhan lab (where they were studying bat coronaviruses), and until the WSJ report was issued, the Biden administration was quite willing to give China a pass.

Again, I'm left scratching my head... Why was Fauci, Biden, the State Department, the WHO, and everyone in the mainstream media carrying China's water? Even now, a bill in Congress that would have required all intelligence surrounding the origins of COVID be declassified was shot down last week by Democrats.

What gives?

Fauci's Affinity for Gain-of-Function Research

I've reported this before in American Consequences, and it's worth highlighting again: In 2012, Fauci wrote a paper in which he argued that conducting experiments on contagious viruses was worth it even if the work and experiments accidentally led to a pandemic.

Writing about gain-of-function experiments in the American Society for Microbiology magazine, Fauci said these experiments could manipulate viruses and make them much stronger... and that the research was necessary, even if it resulted in a worldwide pandemic:

Scientists working in this field might say, as indeed I have said, that the benefits of such experiments and the resulting knowledge outweigh the risks. The need to stay ahead of such a threat is a primary reason for performing an experiment that might appear to be risky.

"Risky." You can say that again... Millions are now dead from a virus that may have been created in a Chinese lab that we helped fund.

Is this why no one wants answers?

Perhaps... which is why it's up to us to keep demanding the truth. Senator Rand Paul is right to insist on it... and as Americans, we must keep searching for answers.

The Fauci Scapegoat

The mainstream media and the Left turned the good doctor into a poster boy of righteousness overnight. No matter how many times he contradicted himself, somehow his theories and advice were automatically taken as correct.

They hated President Trump so much that they were willing to look the other way on the obvious stuff... like the fact that a Chinese bio lab was in the same place that an infectious virus was first identified.

But Trump is no longer part of the picture... So with that in mind, I question whether the Left and the media will still rally to Fauci's defense. Indeed, it's quite possible that they may make Fauci a kind of scapegoat at this point... And he just might find himself in the crosshairs of an angry nation. Not that I have much sympathy...

Because if it's proven that Fauci was helping to fund the research that killed millions – and lied about it under oath to Congress – then he deserves to be called out for those mistakes.

Regardless of what happens, I'm still left asking:

1. Why didn't we know that the NIH was helping to fund this research in, of all places, China?

2. Why weren't we told earlier that there was a possibility the virus came from the lab?

The American public deserves to know what's going on... Without transparency trust in our system increasingly erodes. If people believe they are being lied to (and it sure seems we were), then increasingly Americans will fail to trust in our system.

And right now, the government needs its citizens to trust the system if it hopes to improve its vaccination levels.

Trish's Takeaway

Unfortunately, investors need to be prepared for "shutdown 2.0."

Travel restrictions are popping up again across the globe, and mask mandates are making a reappearance in many places after the WHO recently said vaccinated people should wear masks indoors again. (Our own Buck Sexton covered the latest "mask madness" yesterday)

As P.J. O'Rourke and I discuss in this week's podcast, politicians seem to enjoy the power trip of shutdowns... And the most dangerous thing for our economy right now would be a repeat of the 2020 lockdowns.

I remain skeptical as to whether shutdowns would translate into a sustained market sell-off... Although, I would expect some additional stock market volatility and even some down days.

But as always, the Fed stands in the wings – ready, willing, and able to print more money in an attempt to cushion the fall.

Meanwhile, the administration would likely seize the opportunity of another shutdown to send more stimulus checks and extend unemployment benefits. And so the cycle continues...

Wednesday, July 28, 2021

Why the next real correction is likely more severe

As I wrote last Friday, VIX traders were betting for high volatility by Wed (today) this week, as shown in the extremely high VIX call/put ratio. Well, they are right again and I'm happy to have this crystal ball that is more often than not correctly guiding me for the short term direction. Yesterday VIX jumped 15% at the intraday peak.

So far in the past year or so, the dip to the 50-day moving average (MA) line didn't always mark the absolute low of the move. But, in every case over the past year, buying at the 50-day MA proved profitable within a few weeks. But, there's something interesting happening now... pullbacks are being bought up much faster. It is very technical to explain this but in general, corrections in the stock market tend to unfold in three legs. There's the first move lower… Then there's the bounce... And then typically we get another decline to a lower low. If the lower low is associated with positive momentum, then the lower low provides the best buying opportunity. See the yellow highlighted arrows on the chart below show how that plays out.

But something changed starting in May. We got the dip, and we got the bounce. But the next decline formed a higher low. In other words, buyers were more eager than usual to step up. You can see the 3 blue arrows on the right side. Of course, nothing is wrong as long as traders can make money regardless of technicality and this trend may just continue for a while. But sooner or later, this Buy-The-First-Dip (BTFD) strategy will stop working as it is not a normal phenorman of trading. Instead, this is usually occurring near the end of a bullish trend. Here is the big warning, when the BTFD strategy stops working, it tends to lead to a more severe correction that will last for a while. I of course don't know when this will happen but I suspect this will be coming pretty soon, given various TA warning signs are flashing more and more lately.

Consider you are warned!!

Monday, July 26, 2021

The big whale wants more.....

Of course, New Jersey isn't the only state that's adding crypto stocks to their pension fund. California's pension fund has also been investing heavily in RIOT.

Saturday, July 24, 2021

A stupid and smart move

Taken from Racib.com

In this announcement, they list six specific reasons why mining companies should move to Russia.

- A high degree of centralization of the Russian energy system - about 90% of the total electricity is generated by large power plants;

- A large excess of electricity in the Russian Federation; depending on the specific region and the generating facility (even taking into account the high degree of wear and tear of the power plant equipment and power redundancy), it may amount to more than 50% of its installed electric capacity;

- Cold climate, which provides the possibility of organizing equipment cooling without the use of special refrigeration units (free cooling) and high energy efficiency of data centers;

- Excess of traditional fuel and energy resources;

- The specifics of socio-economic factors - a high level of professionalism of specialists;

- Large territories with a low density of settlements - the possibility of deploying large energy and infrastructure facilities.

Friday, July 23, 2021

About-face within days

Monday, July 19, 2021

Black Monday?

Friday, July 16, 2021

It is extremely bullish but I'm bearish

Thursday, July 15, 2021

The Fed: Too Big to Succeed

By Trish Regan

I wonder who's pumping Jerome Powell's gas...

Because it's clearly been a while since the Fed chairman pulled up to a pump himself...

Speaking to lawmakers in a congressional hearing last month, the Fed chairman doubled down on his view that there is no real inflation in the U.S. economy.

"I graduated from college in 1975," Powell told lawmakers. "I had a front-row seat," he said, referring to the devastating inflation that plagued the U.S. economy during the Carter years... "I don't expect anything like that to happen," he said, adding that the double-digit price increases of the 1970s would be "very, very unlikely."

Powell explained that recent inflation has everything to do with "this unique historical event that none of us has lived through before" and nothing to do with inflation spiraling out of control. And this is the reason he's watching employment measurements instead of inflation measurements to determine when we need to raise rates and when we need to scale back on his $120 billion per month bond-purchasing extravaganza.

You got to give Powell points for his consistency, if nothing else... He repeatedly keeps telling us that this inflation is just temporary.

It's amazing how wedded our central bankers can become to a particular viewpoint. It may be this conviction to a belief system (in this case "no inflation") that causes them to repeatedly fail the American public by over or underreacting in almost every economic challenge.

For example, former Fed Chairman Alan Greenspan was late to loosen rates ahead of the disaster that became the systemic financial crisis of 2008. This inaction exacerbated the problem. Overly generous liquidity in the prior years left interest rates too low for too long, creating an easy money environment that led to overly aggressive lending strategies. When the time came that the Fed needed to cut rates... it didn't have much room to lower them. So, it moved too cautiously...

And on the plus side, since this current mess began unfolding in March 2020, the Fed has done an excellent job stepping up to the plate in a major way. It lowered rates and began a liquidity program by purchasing bonds, thereby helping to keep rates low. In sum, the Fed – along with multiple rounds of coronavirus stimulus checks and generous unemployment packages – helped to mitigate a full-on economic crisis that could have, if left unchecked, devastated the economy for years to come.

A round of applause is in order... a standing ovation, even.

But now, it's time for everyone to sit down.

The coronavirus crisis in the U.S. has come and gone. We fought the war with COVID-19, and we won. The economy has reopened and "help wanted" signs are on just about every street corner.

So, why is the Fed still printing money via bond-repurchasing programs and low rates?

It's a fair question and one Powell can't quite answer... Granted, recent Fed minutes suggest they're finally at least willing to discuss tapering off the bond purchases.

But for the most part, Powell and company believe that we need new metrics like employment to gauge the health of the economy.

Let's take him at his word. Let's assume he's right and employment is the only way to truly measure whether the U.S. economy is "back in action." If so, then, even by those metrics... the economy is looking quite healthy.

Last month, we added 850,000 jobs to the American economy and the unemployment rate came in at a healthy 5.9%. Keep in mind that this is despite the lengths that the administration is taking to effectively ensure that those who are unemployed need not go back to work until at least September, when the benefits are set to expire.

The growth of 850,000 jobs in the latest month should be the kind of improvement needed to encourage the Fed to get back into the tightening game before it's too late.

Because, when it's too late... well, it's just too late. We saw that with Greenspan – and I don't know about you, but I'm not in the mood for a repeat of 2008.

Meanwhile, we're seeing real, hard evidence of actual inflationary pressures that you'd think would convince Powell and his team of Fed governors of the need to focus on inflation.

At present, the U.S. economy is facing higher food, higher energy, and higher housing prices. And the prices of most commodities are going up, up, and away...

Food prices are up 2.2% year over year and are expected to move higher. General Mills (GIS), the company that produces giant food brands like Betty Crocker and Cheerios, recently sounded the alarm, telling investors it anticipates inflation of roughly 7% this fiscal year... along with higher input costs including labor and logistics.

Consumer prices on most goods are up 5% annually, according to the most recent read on the Consumer Price Index, and still climbing. (The read on the "core rate", which strips out food and energy is up 3.8%, its sharpest increase in nearly three decades.)

Oil, as I've been predicting, is at $75 per barrel and expected to keep rising.

And this has an effect on prices for everything else. The price of coffee beans, for example, recently escalated because of the shipping costs associated with transporting the beans to their end markets. At the start of June, the futures benchmark in New York for the high-end arabica coffee bean hit a four-and-a-half-year high of almost $1.70 a pound, up almost 70% from a year before.

Yet, despite this reality, the Fed seems quite determined to downplay inflation.

This inflation is just "transitory," Powell tells us. And again, Powell is so not worried that he says he's not even reading the inflation tea leaves, just the employment data.

Is he burying his head in the sand like an ostrich? It certainly seems so.

The reality is this: Inflation is seeping into our economy at such a rate that it would be an economic miracle if the masterminds at the Fed turn out to be correct in calling it transitory.

And Powell isn't the messiah.

The realist in all of us should remember that the Fed has failed, over and over again, to get this right. Instead, it has a tendency to both under and overreact.

In this case, the Fed is underreacting to inflationary pressures. Its refusal to move on both its rates and its aggressive bond-buying programs will have long-lasting effects... courtesy of... (drumroll please) 1970s style inflation.

Consumer and producer prices are all higher, and there are more than 9 million jobs currently open... imagine that!

Is This All Just Lip Service?

Powell and company's dedication to the no-inflation story has turned the old Wall Street bromide of "don't fight the Fed" into "don't trust the Fed."

Take everything you hear from the Federal Reserve with a grain a salt... an inflated one at that.

These academics, thanks to political pressures, have gotten into the poor habit of telling investors exactly what they think investors want to hear.

Think about it... Just a few months ago, it was "We're not raising till 2024." (Who actually thought that was even conceivable?)

Then, when the economic data improved, it was... "We're not raising until the end of 2023."

And then we heard from one Federal Reserve governor talk of 2022.

And now, some Fed governors, including Mary Daly of San Francisco, are pushing to taper in 2021.

So, which is it, guys?

I would bet money the Fed has no idea. But they've got this story of inflation not being a problem, and so far, they're sticking to it.

So, as investors, we need to remain nimble and ready. If the Fed does hike rates in the near future (as a normal, rational person might assume they would, given the positive economic indicators and inflationary reads), then the economy and markets may suffer the consequences.

If they don't raise – and increasingly, the smart money is making that assumption – then the party lives on... until it ends. Badly.

Remember the 1970s inflation? The stock market was a mess. It lost nearly 50% over a 20-month period, and for close to a decade few people wanted anything to do with stocks...

We need more responsible rhetoric from the Fed and even some near-term tapering with a promise to look at all the data in case it needs to move on interest rates. And I believe the market would welcome it.

Is it too much to ask that the Fed review all the data?

That's exactly what Powell should have told Congress in his most recent hearing. He should have said he would remain vigilant and watch all the signals and data points – including employment numbers, producer prices, and consumer prices.

When Janet Yellen was Fed chair, she was good about promising to read all data in real time. So what happened?

Some think that Powell's job might be on the line... and that he's speaking to an audience of one – his former colleague at the Fed, now secretary of the U.S. Treasury, Janet Yellen.

His term is coming up, and some think that she may want to replace him. And, why not? He was "Trump's guy"... liked by former Treasury Secretary Steve Mnuchin, and Powell effectively replaced Yellen herself. As such, she may feel more comfortable putting her own guy, or gal, into the spot. Lael Brainard, a friend of Yellen's, could easily fit the job and might be a preferable and friendly alternative for Yellen.

(Keep in mind, the Yellen we've seen as Treasury secretary is far more aggressive in her desire to tax the world than we ever saw at the Fed... so much so, that she's responsible for the 15% worldwide-tax proposal.)

So, internal politics may also be playing into Powell's positioning – a lousy thought, but nonetheless a potential reality as we try to understand the Fed's backwards thinking.

The bottom line is this... inflation is coming. And at some point, the Fed will need to react.

When that happens, you'll want to be prepared... Capture the momentum on the upside by being invested in markets as they move higher. But you should diversify into some hard assets (gold or real estate). When investors lose confidence in the stock market, they put their capital into these kinds of assets. And you should keep a little cash on hand to be ready to buy some stocks when the pullback in the market happens.

Remember, don't trust the Fed...

Make your own judgments, knowing that sooner or later, the Fed will have to react if only to taper its bond buying, and that – in the long run – it will be healthy for the markets and the economy as a whole.

Wednesday, July 14, 2021

A functional flying car is finally here…

The tech world has been talking about flying cars for decades. And many prototypes have come and gone over the years. The problem is, nothing has ever been very practical before. Nobody could figure out how to crack the code.

Until now. Check this out:

Klein Vision's Flying Car

Source: Engadget

This is footage from a recent 35-minute inter-city flight in Slovakia. This car can reach an altitude of over 8,000 feet. And it can carry two passengers weighing up to about 440 pounds (about 200 kilograms).

Yet it looks like a sports car. It runs on a 160 horsepower BMW engine that takes normal gasoline. And it can reach speeds of 172 kilometers per hour.

And get this – the wings and the tail fold in when the car is on the ground. That enables it to function as an actual car as well. That includes parking in normal parking spots.

So this is by far the most promising flying car prototype we've ever seen. It has already completed 142 successful flights and landings.

And the story behind the car is just as impressive.

The inventor is a professor named Stefan Klein. And he's been working on his flying car design for more than 30 years now. This is the third prototype, and Klein finally believes it is ready for prime time.

Sunday, July 11, 2021

Expect to earn 14.5% per year after inflation over the long term

Last Friday before opening, I was telling my groups that I didn't believe the market would make new highs without heading back again first. Of course I was wrong as new highs were made again by closing! Sure the price action remains very strong and bullish but, this is a big BUT, the underlying technicality continues to deteriorate, and fast!! I'm still very much convinced this bullishness won't be sustainable for long and we will see a sizable, probably a surprisingly big correction in the near future. With this in mind, I'm doing more short side trades for those crazily overbought stocks in the short term but start to be trending down, e.g. AMZN and LABU. I'm also taking advantage of the extremely low VIX to buy longer term puts for the next couple of months. Although the market can ignore the gravity for now, it will be pulled back by the gravity sooner or later. It is just a matter of when, not if.....

Now I have seen an interesting survey result that I think it would be interesting to many of you folks:

French investment bank Natixis recently issued the 2021 edition of its annual Global Survey of Individual Investors...

The company surveyed 8,550 investors in 24 countries. Each respondent had minimum investable assets of $100,000. Based on the results, Natixis said the gap between individual and professional investors' expectations for long-term investment returns has widened "dramatically"...

Individual investors who were surveyed expect to make inflation-adjusted returns of 14.5% per year over the long term. Meanwhile, professionals expect to make 5.3% per year. In other words, individual investors expect a 174% greater result (14.5% compared with 5.3%) than professionals. That's 53 percentage points above last year's expectations.

The real point isn't the specific numbers or whether they'll come true. It's the extreme difference between individuals and professionals' expectations – how optimistic individuals all over the world are right now. (Remember, Natixis surveyed investors in 24 countries.) Both groups are likely to be wrong. But one group is very obviously much more aware of the risks than the other and has tempered its expectations accordingly. The other hasn't.

It reminds us of an anecdote from the dot-com era.....

A couple went to a financial adviser in the late stages of the dot-com bubble. The adviser was bullish and excitedly told the couple that they could expect to make 20% per year in the stock market if they bought the funds he recommended. The couple was disappointed, though... And they replied, "No, we want to make 100% a year."

The dot-com bubble fueled irrational expectations. Likewise, expecting 14.5% per year after inflation over the long term, when equities are trading at their highest valuations in recorded history, is far too optimistic.

Needless to say, I'm on the side of the professional expectations for a miniscule average return for the next 5-10 years. I think they have a good basis for such a downbeat hope: inflation is headed much higher and liquidity is headed much lower!

The most recent PCE reading was 3.9% in May... nearly double the Fed's stated goal of 2% inflation over the long run. The Fed says this is only temporary, and that it's nothing to worry about. REALLY? Just look at our money supply. The U.S. "M2" money supply (includING cash, checking and savings accounts, money-market accounts, and mutual funds – is up 33% since the end of 2019). And the more liquid "M1" money supply (i.e. coins and currency in circulation plus checking accounts) is up 378% since the end of 2019.

|

I'd think any rational human with normal common sense should also know that this game can't go on forever... We're fast approaching a tipping point where it will be "game over" for the Fed. Once the Fed realizes that today's high inflation isn't going away anytime soon, the printing party will end abruptly. It is important to know that the Fed can only control the very short term interest rate but the market will determine the longer term rates. As such, even if the Fed doesn't act, the free market will. Consumers don't have much power to combat rising prices – but creditors do...and they will demand higher interest rates if hyperinflation is in sight!! Here are a few obvious consequences of higher interests:

- Higher interest rates make stocks less valuable. Many investors will sell them in favor of safer, higher-yielding fixed-income securities.

- Higher interest rates are also a problem for another reason... They cost companies more to service their debt.

Investors already fear rising inflation and climbing interest rates. A wave of bankruptcies – which is already underway, by the way – will create even more fear in the markets. As that happens, investors will dump risky, overleveraged stocks. And they'll dump corporate bonds... causing bond prices to plummet and interest rates to go even higher. The chain reaction will continue... With more companies defaulting on their debt, banks will tighten credit. And that will lead to even more bankruptcies.

So fasten your seatbelt as we're on the verge of the next credit crisis.

Of course I'm not talking about an epic crisis in the next few months but there is an increasing chance that this may start to emerge towards the end of the year or some time next year. Just watch the volatility. As the moment comes near, we will start to see crazy volatility for a period of time before waterfall types of crashes suddenly hit the market seemingly out of the blue! Just remember, before we saw the prolonged over 50% decline when the dot.com bubble burst in 2000, the market had experienced 7-8 times of correction in the size of 10% or more while it was still moving up relentlessly towards the end of the 90s. I bet we are in such a period right now!!

Thursday, July 8, 2021

Alchemy of Melt-Up/Melt-Down

If you don't realize yet, stock valuations are the highest they've been since the dot-com bubble. Using the Shiller P/E Ratio, a more realistic measurement based on the average price-to-earnings ratio of S&P 500 stocks, the PE is close to 40 now. As you can see below throughout the history of over a century, it is higher than Black Monday in 1987 and Black Tuesday in 1929.

Of course, higher valuation does not mean the market must crash soon. Nevertheless, this is just one warning signal that we could be due for a fall in stocks. Or let's put that way: we can safely say that every major market crash will start with an overly priced valuation. Sooner or later, the market will find its means to revere to. Whether the next bear market comes in two weeks or two years, it'll be wise and essential to be prepared!

Below I'm sharing a good writeup my friend sent me, which presents a good picture how the market Melt-Up is formed, and inevitably followed by a Melt-Down.

********************************************************************************

- During June, retail investors put the most money to work in stocks since 2014.

- At the same time, institutional investors are building cash positions.

- This is another signal we could be entering the last stages of the "Melt Up."

The stock market "Melt Down" may be drawing closer...

It feels like the S&P 500 Index is going up every day. Since making a new closing high back in mid-June, it has added another 2.3% on a total return basis (dividends included). That would be a great return for a single month, let alone two weeks.

Yet, considering the 96.1% increase for the index since the bottom on March 23, 2020, it's making institutional investors nervous. So they're raising high levels of cash.

But all of this money isn't participating in the current rally. It's likely all this cash will be forced to seek returns.

That tells us we could be entering the late-stage Melt Up rally, where investor behavior becomes irrational before the consequent "Melt Down"...

UBS's Equity Derivatives team recently noted that institutional investors have added to their cash positions. The team said this has been taking place for the better part of this year. And the amount is significant. According to the firm, the total cash cushion has swelled to roughly $400 billion.

Money markets are telling a similar story. Since the beginning of this year, those assets have jumped from $4.3 trillion to more than $4.5 trillion. That's after a drop of $500 billion over the prior six months. And at the same time, the Federal Reserve's reverse repurchase facility has swelled to nearly $1 trillion.

Typically, institutions look for a 3% to 5% pullback before putting money to work. But if one doesn't materialize, they start to get antsy. Inevitably, that leads to that cash pile slowly trickling out into the market at first. But before long, as others notice a pullback is or isn't materializing, the investing turns into a flood.

At the same time, retail investors continued to pile into the market last month. As they keep pushing the markets to new gains, it makes it even harder for portfolio managers – who are paid based on performance – to sit out the run.

According to data from market research firm VandaTrack, individual investors plowed $28 billion into stocks in June. That was the largest single-month inflow into stocks for the retail investor crowd since 2014, based on VandaTrack's data.

Those weren't the only data showing retail investor bullishness. A separate report from Sundial Research said that 70% of individual investors see stocks rising over the next quarter, according to the Wall Street Journal. That's compared to just 44% of investment "professionals," the WSJ said.

This bullishness has pulled millions of retail investors into the market. Free trading service Robinhood has seen its users surge to 18 million at the end of March 2021 (up from 12.5 million a year earlier).

And Fidelity added 4.1 million new accounts in the first quarter, according to a report from CNBC. That's a 160% jump in new accounts added from the same quarter in 2020. About 40% of these accounts (1.6 million) are for individuals under the age of 35, representing a 222% jump, CNBC said.

After all that, U.S. households now hold the highest percentage of their wealth in stocks. It was reported that, as of April, 41% of households' financial assets were allocated to stocks. Again, that's higher than the dot-com peak of 37%.

As we've noted in recent weeks, retail investor bullishness usually signals that the end of the "Melt Up" is near. It is often the case that this is the crowd that we tend to see near the peak of a Melt Up. It's the last group to arrive to the party. That's also why the final inning of the Melt Up can lead to some of the biggest gains of the entire bull market.

This would align with the "Greater Fool Theory." That's where a feeding frenzy starts, driving investors into stocks until there's no one left to buy.

In the near term, this should point to steady support for the S&P 500, Nasdaq Composite, and Russell 2000 indexes, in addition to the Dow Jones Industrial Average. If these big money investors are waiting for a pullback, it usually means it will be short-lived. And it implies continued gains over the summer.

That means there's no time like the present to make sure you have a game plan for adversity. Because if we're in the last stage of the Melt Up, it would point to another rally in the markets. And if it's followed by a similar type of sell-off, the time to prepare is when the market in rally mode... not when it's dropping.

Wednesday, July 7, 2021

History is About to Repeat Itself

Yesterday I asked a question critical to the markets…

That question?

Will the Fed allow the stock market to become a massive bubble on par with, if not greater than, the Tech Bubble of the late '90s?

To answer that question, we need to assess just who is currently running the Fed.

His name is Jerome Powell, and he idolizes former Fed Chair Alan Greenspan.

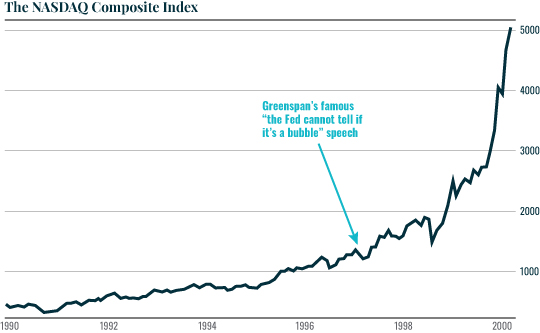

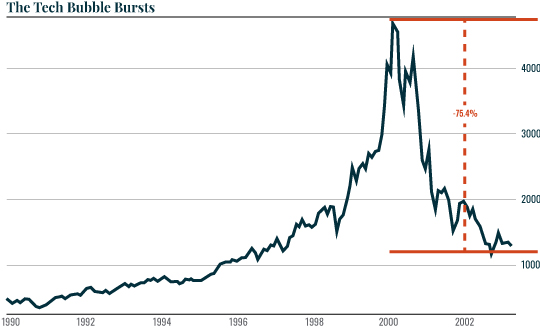

Greenspan is the former Fed Chair who famously argued that the Fed cannot predict stock market bubbles.

Suffice to say, Powell's admiration of Greenspan opens the door to a repeat of the insanity Greenspan's action caused. (I'll show you that in a second.)

This all became abundantly clear when Powell made his first speech at Jackson Hole.

If you're unfamiliar with the Fed's Jackson Hole meeting, it takes place once a year in August in Jackson Hole, Wyoming.

There, Fed officials meet with central bankers and policymakers from around the world to present their views of what is happening in the economy and financial markets.

Think of it as a glorified Ted talk for the most powerful money-related policymakers in the world. And typically, the Fed uses this forum to unveil key changes to its policies and views of the world.

With that in mind, Jerome Powell used his first-ever speech as Chairman of the Federal Reserve at Jackson Hole to lionize Alan Greenspan.

The following quote is quite revealing. And looking back, this speech was a hint of things to come.

The FOMC thus avoided the Great-Inflation-era mistake of overemphasizing imprecise estimates of the stars. Under Chairman Greenspan's leadership, the Committee converged on a risk-management strategy that can be distilled into a simple request: Let's wait one more meeting; if there are clearer signs of inflation, we will commence tightening. Meeting after meeting, the Committee held off on rate increases while believing that signs of rising inflation would soon appear. And meeting after meeting, inflation gradually declined.

–Source: Federal Reserve

In simple terms, Powell admires the fact that Alan Greenspan refused to raise interest rates despite clear warnings of froth in the financial system.

What Does This Portend for the Markets?

In this context, consider that Powell is currently arguing that the Fed believes the current bout of hot inflation in the U.S. is "transitory" and does not need to be dealt with.

Put another way, under Powell's supervision, the Fed is refusing to hike interest rates or taper its $120 billion per month Quantitative Easing (QE) program anytime soon because it believes inflation won't be around for long.

Sounds a lot like what Powell admired about Alan Greenspan doesn't it? And what happened under Greenspan's watch during this period that Jerome Powell admires so much?

First this…

Followed by this...

Graham Summers

Sunday, July 4, 2021

Will history repeat a 17% decline in Jul?

Starting on July 22, 2011, the stock market went on a steep skid — falling nearly 17% in 17 days. The government did not default... but something equally "unthinkable" happened along the way: The bond-rating arm of Standard & Poor's downgraded U.S. government debt from a pristine AAA rating to AA+.

This was what happened 10 years ago, so it is history. But will history repeat itself now? Well, we have reason to believe something similar is in the cards this summer. I will share more when the developments start to emerge.

Right now, traders are facing a conudrum where the market price actions are persistently bullish but the underlying technicality is increasingly bearish. So it is not easy to trade purely based on TA as it will fool you more often than not. But it does not mean this will continue forever! After all, sanity will come back to the earth sooner or later. Actually the current divergent phenomenon often occurs during the dawn prior to a major decline. No one knows for sure when the turning point will come but the risk is increasingly higher now.

For today, let me just share a simple technical indicator that is predicting a major decline eerily consistent with the timeframe of the historical crash in 2011!

"Currently, complacency has reached more extreme levels. As noted last week, the 15-day moving average of VIX, on an inverted scale, suggests a correction is likely. By this measure, the correction should begin somewhere around July 21st – August 10th."